Fillable Adp Pay Stub Form

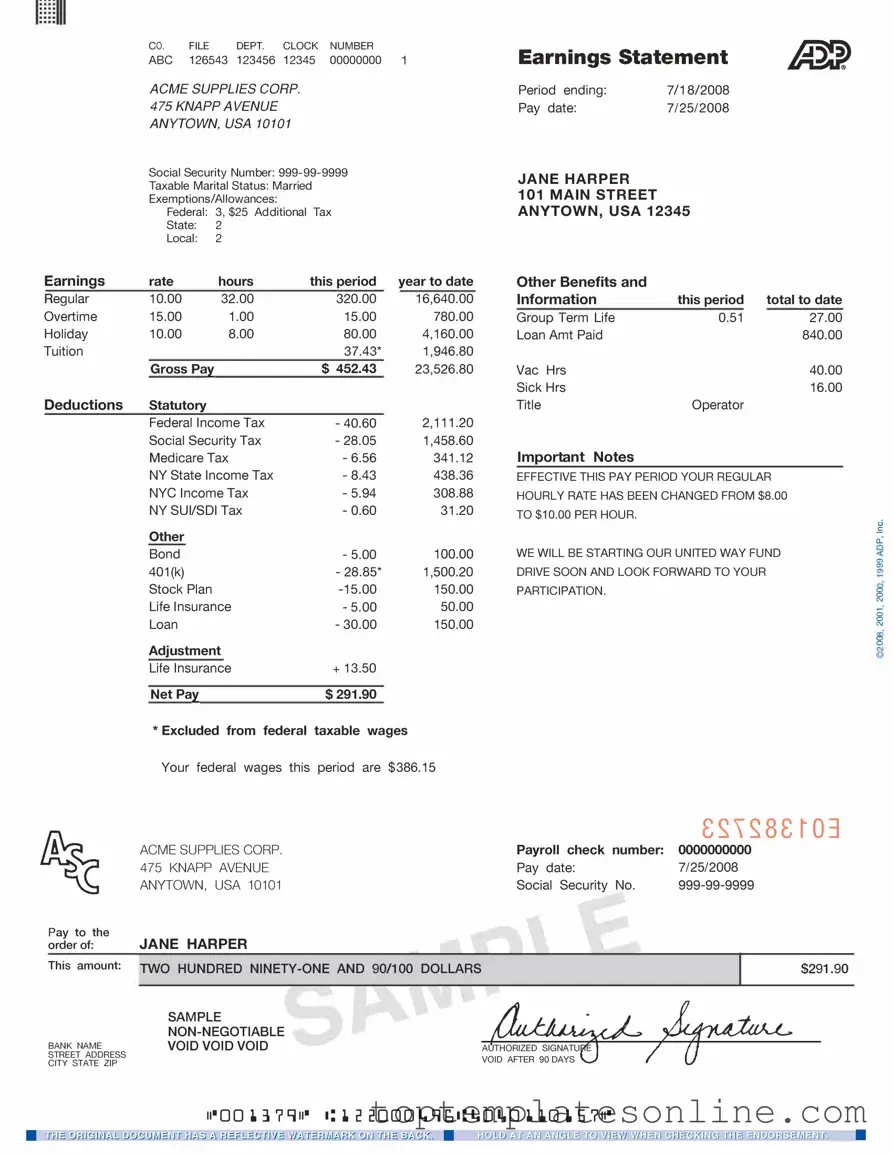

Understanding your paycheck is essential for managing your finances, and the ADP Pay Stub form plays a crucial role in this process. This document provides a detailed breakdown of your earnings, deductions, and taxes, allowing you to see exactly how much you take home after all adjustments. Typically, the pay stub includes your gross pay, which is the total amount earned before any deductions, as well as net pay, the amount you actually receive. Additionally, it outlines various deductions such as federal and state taxes, Social Security contributions, and retirement plan contributions. Each section is designed to give you clarity on where your money goes, helping you make informed financial decisions. With a clear understanding of the ADP Pay Stub form, employees can easily track their income and ensure that they are being compensated accurately for their work.

Common PDF Templates

Car Repair Estimate Template - Include how you heard about the repair shop for context.

Employee Incident Report - This document will be reviewed by management for safety improvement.

A Bill of Sale is a legal document that records the transfer of ownership of an item from one party to another. This form serves as a receipt, offering protection and clarification for both the seller and the buyer regarding the transaction. For those looking to complete a sale and establish clear ownership, filling out a Bill of Sale is essential; get started by accessing the Bill of Sale form today.

Texas Temporary Tag - The form is specifically designed to address the needs of vehicle owners during transitional periods.

Common mistakes

-

Incorrect Personal Information: Filling in the wrong name, address, or Social Security number can lead to significant issues. Always double-check these details.

-

Missing Pay Period Dates: Not specifying the correct start and end dates for the pay period may cause confusion regarding payment timing.

-

Inaccurate Hours Worked: Reporting the wrong number of hours can result in underpayment or overpayment. It's essential to keep accurate records.

-

Failure to Include Overtime: If applicable, neglecting to include overtime hours can lead to a lower paycheck than expected. Be sure to calculate these hours correctly.

-

Ignoring Deductions: Not accounting for deductions such as taxes, insurance, or retirement contributions can lead to unexpected changes in net pay.

-

Using Incorrect Pay Rate: Entering the wrong hourly or salary rate will affect the total pay. Verify the pay rate before submission.

-

Neglecting to Review the Form: Skipping a final review can result in overlooked mistakes. Always take a moment to check the entire form before submitting.

-

Not Keeping a Copy: Failing to save a copy of the completed form can create problems later. Retaining a record is always a wise choice.

Guide to Writing Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that ensures you have accurate records of your earnings and deductions. Follow these steps carefully to complete the form correctly.

- Begin by entering your employee information. This includes your name, employee ID, and department.

- Next, fill in the pay period dates. Specify the start and end dates for the pay period you are reporting.

- Indicate your gross pay. This is the total amount earned before any deductions are applied.

- List any deductions that apply to your pay. Common deductions include taxes, health insurance, and retirement contributions.

- After that, calculate your net pay. This is the amount you take home after all deductions have been made.

- Lastly, review all entered information for accuracy. Make any necessary corrections before finalizing the form.

Once you have completed these steps, you will have a clear understanding of your earnings for the specified pay period. Ensure that you keep a copy of the filled form for your records.

Documents used along the form

The ADP Pay Stub form is an essential document for employees, providing a detailed breakdown of earnings, deductions, and net pay for a specific pay period. Along with this form, several other documents may be used to support payroll processes and employee understanding of their compensation. Below are four common forms that often accompany the ADP Pay Stub.

- W-2 Form: This form is issued annually and summarizes an employee's total earnings and tax withholdings for the year. It is crucial for filing personal income tax returns.

- Direct Deposit Authorization Form: Employees use this document to authorize their employer to deposit their paychecks directly into their bank accounts. It streamlines the payment process and ensures timely access to funds.

- Asurion F-017-08 MEN Form: This important document aids in managing claims and warranty services for electronic devices, enhancing customer support and compensation processes. More details can be found at Fast PDF Templates.

- Time Sheet: A time sheet records the hours worked by an employee during a specific pay period. This document helps ensure accurate calculations of pay based on hours worked, overtime, and leave taken.

- Employee Benefits Summary: This document outlines the benefits offered by the employer, including health insurance, retirement plans, and other perks. It helps employees understand their total compensation package beyond just salary.

These documents, when used alongside the ADP Pay Stub, contribute to a clearer understanding of compensation, tax responsibilities, and employee benefits. Together, they create a comprehensive view of an employee's financial relationship with their employer.