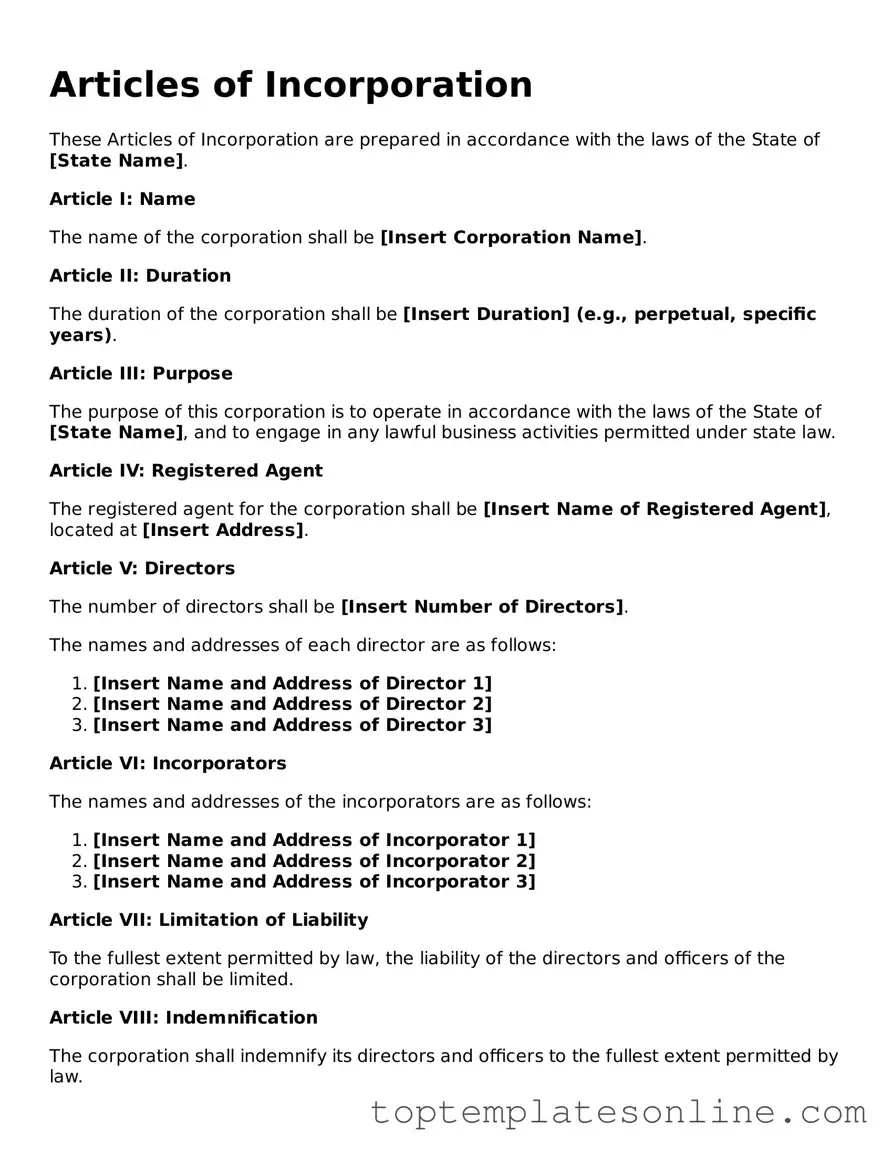

Attorney-Approved Articles of Incorporation Form

The Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the United States. This form lays the groundwork for your business by outlining essential details such as the corporation's name, its purpose, and the address of its registered office. You'll also need to include information about the initial directors and the number of shares the corporation is authorized to issue. Additionally, the form often requires the name and address of the incorporator, the individual responsible for filing the document. Understanding these components is vital, as they not only define the structure of your corporation but also ensure compliance with state laws. Completing the Articles of Incorporation accurately can help you avoid legal pitfalls and set your business on a solid foundation for future growth.

State-specific Information for Articles of Incorporation Documents

Common Templates

Hold Harmless Agreement Insurance - Individuals may be asked to sign this document before engaging in high-risk activities, such as sports.

A Florida Non-disclosure Agreement (NDA) is a legally binding contract designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping confidential information private, ensuring that proprietary details remain secure. For more detailed information about this form, individuals should consult resources like Florida Forms, which can provide valuable insights for anyone looking to safeguard their intellectual property or trade secrets in the state of Florida.

Army Pubs Da 31 - All signatories should understand their roles in the approval process.

Common mistakes

-

Failing to include the correct name of the corporation. The name must be unique and comply with state regulations.

-

Not specifying the purpose of the corporation clearly. A vague description can lead to confusion or legal issues later.

-

Omitting the registered agent's information. This person or business must be designated to receive legal documents on behalf of the corporation.

-

Incorrectly stating the number of shares the corporation is authorized to issue. This can affect ownership and investment opportunities.

-

Neglecting to include the principal office address. A physical address is necessary for official correspondence.

-

Not providing the names and addresses of the initial directors. This information is essential for establishing the corporation's governance.

-

Failing to sign the document. The Articles of Incorporation must be signed by the incorporator(s) to be valid.

-

Using improper formatting or structure. Adhering to the state's required format is crucial for acceptance.

-

Overlooking state-specific requirements. Each state may have unique rules that need to be followed.

-

Not reviewing the completed form for accuracy. Errors can delay processing and create complications.

Guide to Writing Articles of Incorporation

After gathering the necessary information, you are ready to fill out the Articles of Incorporation form. This form is essential for officially establishing your business as a corporation. Once completed, you will submit it to the appropriate state agency, usually the Secretary of State's office, along with any required fees.

- Begin by entering the name of your corporation. Make sure it is unique and complies with your state's naming rules.

- Provide the principal office address. This is where your corporation will conduct its main activities.

- List the purpose of your corporation. Be clear and concise about what your business will do.

- Include the number of shares your corporation is authorized to issue. Specify if there are different classes of shares.

- Identify the registered agent. This is the person or business designated to receive legal documents on behalf of the corporation.

- Provide the address of the registered agent. This must be a physical address, not a P.O. Box.

- Include the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that the person filling it out is authorized to do so.

- Check for any additional requirements specific to your state, such as additional signatures or documents.

- Submit the completed form along with the required filing fee to the appropriate state agency.

Documents used along the form

When forming a corporation, the Articles of Incorporation serve as a foundational document. However, several other forms and documents are often necessary to complete the incorporation process. Each of these documents plays a crucial role in establishing and maintaining the legal status of the corporation.

- Bylaws: These are the internal rules that govern how the corporation operates. Bylaws outline the roles of directors and officers, procedures for meetings, and other important operational guidelines.

- Initial Board of Directors Resolution: This document records the decisions made by the initial board of directors. It often includes the appointment of officers and the adoption of bylaws.

- Registered Agent Consent Form: This form confirms that the registered agent, who is responsible for receiving legal documents on behalf of the corporation, has agreed to serve in this capacity.

- Employer Identification Number (EIN) Application: Often referred to as Form SS-4, this application is submitted to the IRS to obtain an EIN, which is necessary for tax purposes and hiring employees.

- State Business License Application: Depending on the state, a corporation may need to apply for a business license to operate legally. This document varies by jurisdiction and type of business.

- Dirt Bike Bill of Sale Form: For a smooth transfer of ownership, refer to the detailed Dirt Bike Bill of Sale form requirements to ensure all terms are clearly documented.

- Annual Report: Many states require corporations to file an annual report. This document updates the state on the corporation's activities, financial status, and any changes in its structure or management.

These documents collectively support the formation and operation of a corporation, ensuring compliance with state laws and regulations. Understanding each one is essential for anyone looking to establish a successful business entity.