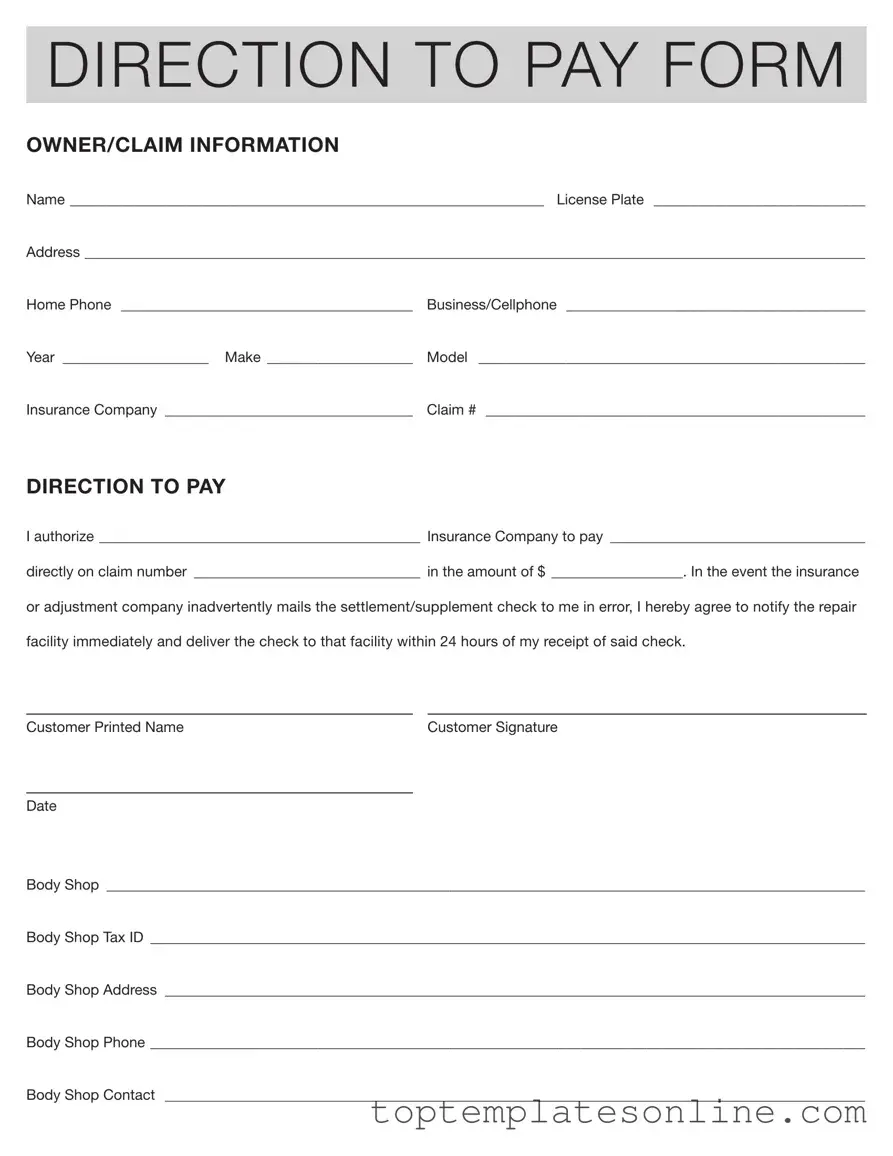

Fillable Authorization And Direction Pay Form

The Authorization and Direction Pay form is an important document used in the insurance claims process. It allows a policyholder to direct their insurance company to pay a specific repair facility directly for services rendered. This form collects essential information, such as the owner's name, address, and vehicle details, including the license plate number, make, model, and year of the vehicle. Additionally, it requires the insurance company’s name and the claim number associated with the repair. By signing this form, the policyholder authorizes the insurance company to issue payment directly to the designated body shop, streamlining the process and ensuring that repairs can begin without delay. The form also includes a provision that requires the policyholder to return any incorrectly issued checks to the repair facility within 24 hours, reinforcing the importance of clear communication between all parties involved. This form is a vital tool for anyone navigating the often complex world of insurance claims and vehicle repairs.

Common PDF Templates

Dd Form 2656 March 2022 Pdf - The DD 2656 may be updated if the retiree's financial circumstances change.

For those looking to navigate the requirements of the Statement of Fact Texas form, it's crucial to gather all necessary information beforehand, ensuring accuracy and adherence to Texas regulations. To assist you further, you can find the form online at https://texasformspdf.com/, which provides a streamlined process for submission.

View P60 Online - The P45 is pivotal in ensuring a smooth transition for the employee's tax affairs.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not filling out all the required fields. Ensure that every section, including your name, address, and claim number, is complete. Missing information can delay the processing of your claim.

-

Incorrect Insurance Company Name: Double-check the name of the insurance company. Writing the wrong name can lead to confusion and may result in the payment being sent to the wrong party.

-

Failure to Sign: Forgetting to sign the form is a frequent oversight. Your signature is essential as it indicates your authorization for the payment. Without it, the form may be considered invalid.

-

Not Specifying the Payment Amount: Leaving the payment amount blank can cause significant delays. Clearly state the amount you are expecting to receive to ensure the payment process moves smoothly.

-

Ignoring the Delivery Instructions: Some people overlook the instruction about notifying the repair facility if a check is sent to them. Following this step is crucial to avoid any complications with the payment process.

Guide to Writing Authorization And Direction Pay

Once you have gathered all necessary information, you can proceed to fill out the Authorization And Direction Pay form. This form is essential for directing payment from your insurance company to the repair facility. Follow these steps carefully to ensure accurate completion.

- Begin by entering your name in the designated field at the top of the form.

- Fill in the license plate number of your vehicle.

- Provide your complete address, including street, city, state, and zip code.

- Enter your home phone number, followed by your business or cellphone number.

- Indicate the year of your vehicle.

- Specify the make of your vehicle.

- Write down the model of your vehicle.

- List the name of your insurance company.

- Input your claim number in the appropriate space.

- In the "DIRECTION TO PAY" section, write the name of the insurance company that you authorize to make the payment.

- Clearly state the name of the repair facility that will receive the payment.

- Fill in the claim number again in the specified area.

- Write the amount to be paid directly to the repair facility.

- Understand that if a check is mailed to you by mistake, you must notify the repair facility immediately and deliver the check within 24 hours.

- Print your name in the "Customer Printed Name" section.

- Sign the form in the "Customer Signature" field.

- Date the form appropriately.

- Provide the name of the body shop in the designated area.

- Enter the body shop's tax ID number.

- Fill in the complete address of the body shop.

- Include the body shop's phone number.

- Finally, write the name of the contact person at the body shop.

Documents used along the form

The Authorization and Direction to Pay form is often used in conjunction with several other documents. Each of these forms serves a specific purpose in the claims process. Below is a list of commonly associated documents.

- Claim Submission Form: This document provides detailed information about the claim being filed. It includes specifics such as the incident date, the parties involved, and a description of the damages. This form initiates the claims process with the insurance company.

- Repair Estimate: A repair estimate outlines the anticipated costs associated with repairing the vehicle. This document is typically prepared by the body shop and is submitted to the insurance company for approval before any work begins.

- Proof of Loss: This form is a statement provided by the policyholder that details the loss incurred. It may include receipts, photographs, and other evidence to support the claim. This document helps the insurance company assess the validity of the claim.

- Release of Liability: This document protects the insurance company from future claims related to the incident. By signing this form, the claimant agrees not to pursue further legal action regarding the matter once the settlement is paid.

- Assignment of Benefits: This form allows the policyholder to assign their insurance benefits directly to a third party, such as a repair shop. This ensures that the repair facility can receive payment directly from the insurance company for the services rendered.

- Power of Attorney for a Child: This legal document allows a parent or guardian to designate someone to make decisions for their child when they cannot be present. Understanding its importance is essential, as outlined in Florida Forms.

- Insurance Policy Declaration Page: This document summarizes the key details of the insurance policy, including coverage limits, deductibles, and the insured parties. It is essential for verifying the coverage applicable to the claim.

Each of these documents plays a crucial role in the claims process, ensuring that all parties involved have the necessary information to proceed efficiently. Proper completion and submission of these forms can help facilitate timely resolution of claims.