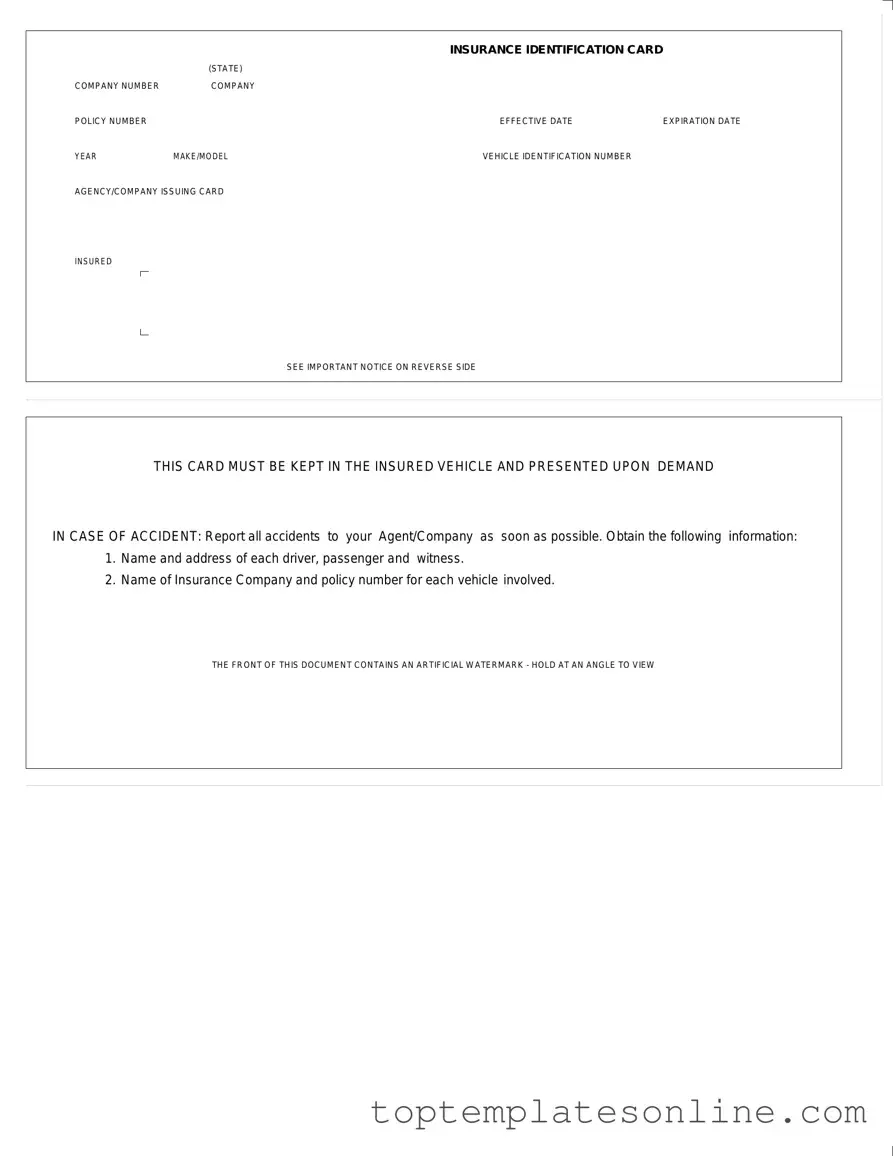

Fillable Auto Insurance Card Form

When it comes to driving legally and safely on the roads, having your Auto Insurance Card is essential. This card serves as proof of your insurance coverage and contains important information that you need to be aware of. Key details include your insurance company’s name, the policy number, and the effective and expiration dates of your coverage. Additionally, the card specifies the make and model of your vehicle, as well as the Vehicle Identification Number (VIN), which uniquely identifies your car. It’s important to note that this card must be kept in your vehicle at all times and presented upon request, especially in the event of an accident. In such cases, you are required to report the incident to your insurance agent or company promptly, and gather necessary information from all parties involved, including names and addresses of drivers, passengers, and witnesses. The card also features a watermark for authenticity, which can be seen when held at an angle. Understanding these aspects of the Auto Insurance Card can help ensure that you are prepared and compliant while on the road.

Common PDF Templates

Florida Family Law Financial Affidavit Short Form - The form is a crucial part of many Florida family court cases.

Obtaining a crucial Power of Attorney form is vital for individuals seeking to ensure their legal and financial decisions are handled by a trusted representative. This document empowers someone to act on your behalf, particularly in important matters such as healthcare and financial transactions, allowing for peace of mind during challenging times.

Aphis 7001 - Verify that your pet is free from diseases that could spread to humans.

Scrivener's Affidavit California - It strengthens the credibility of the written record presented in court.

Common mistakes

-

Failing to include the insurance company number. This number is crucial for identifying your insurance provider.

-

Omitting the policy number. Without this number, it can be difficult to verify your coverage.

-

Not specifying the effective date and expiration date of the policy. These dates indicate the validity of your insurance.

-

Incorrectly entering the year, make, and model of the vehicle. This information must match your vehicle registration.

-

Leaving out the vehicle identification number (VIN). This unique number helps identify your specific vehicle.

-

Not including the name of the agency or company issuing the card. This helps in verifying your insurance.

-

Ignoring the instructions about keeping the card in the vehicle. It must be readily available in case of an accident.

-

Failing to report accidents to your agent or company promptly. This can complicate claims and coverage.

-

Not obtaining necessary information from all parties involved in an accident. This includes names and addresses of drivers, passengers, and witnesses.

Guide to Writing Auto Insurance Card

Once you have the Auto Insurance Card form in front of you, it’s time to fill it out. This process is straightforward, and it ensures that you have all the necessary information at hand. Follow these steps carefully to complete the form accurately.

- Start by entering the Insurance Identification Card (State) at the top of the form.

- Fill in the Company Number provided by your insurance provider.

- Next, write down your Company Policy Number.

- Indicate the Effective Date of your policy.

- Enter the Expiration Date of your policy.

- Provide the Year of your vehicle.

- Write the Make/Model of your vehicle.

- Fill in the Vehicle Identification Number (VIN).

- List the Agency/Company Issuing Card.

- Review all entries to ensure accuracy before saving the document.

After completing the form, keep it in your vehicle. You may need to present it if you’re involved in an accident. Remember to report any accidents to your insurance agent as soon as possible, and gather necessary information from all parties involved.

Documents used along the form

When dealing with auto insurance, several important documents complement the Auto Insurance Card. Each of these documents serves a specific purpose in ensuring that drivers are informed and protected. Below is a list of commonly used forms and documents associated with auto insurance.

- Insurance Policy Document: This comprehensive document outlines the terms and conditions of your auto insurance coverage. It details the types of coverage included, limits, deductibles, and any exclusions that may apply.

- General Power of Attorney Form: This form allows individuals to designate another person to manage their affairs when they are unable to do so. It is essential for financial and legal matters, and you can find a useful template for this form at NY Templates.

- Claim Form: This form is used to report an accident or incident to your insurance company. It typically requires details about the accident, including the date, time, and circumstances, as well as information about all parties involved.

- Proof of Insurance Letter: This letter serves as an official confirmation from your insurance company that you have an active policy. It can be presented to law enforcement or other parties when proof of insurance is required.

- Vehicle Registration: This document is issued by the state and confirms that your vehicle is legally registered. It includes important information such as the vehicle identification number (VIN), make, model, and the name of the registered owner.

- Accident Report: This report is typically filed with law enforcement following an accident. It provides an official account of the incident, including details about the vehicles involved and any citations issued.

- Endorsement Forms: These forms are used to make changes to your existing policy. They can include updates to coverage limits, changes in vehicle information, or the addition of new drivers.

Understanding these documents can help you navigate the complexities of auto insurance more effectively. Keeping them organized and readily accessible will ensure that you are prepared in case of an accident or any inquiries from your insurance provider.