Fillable Broker Price Opinion Form

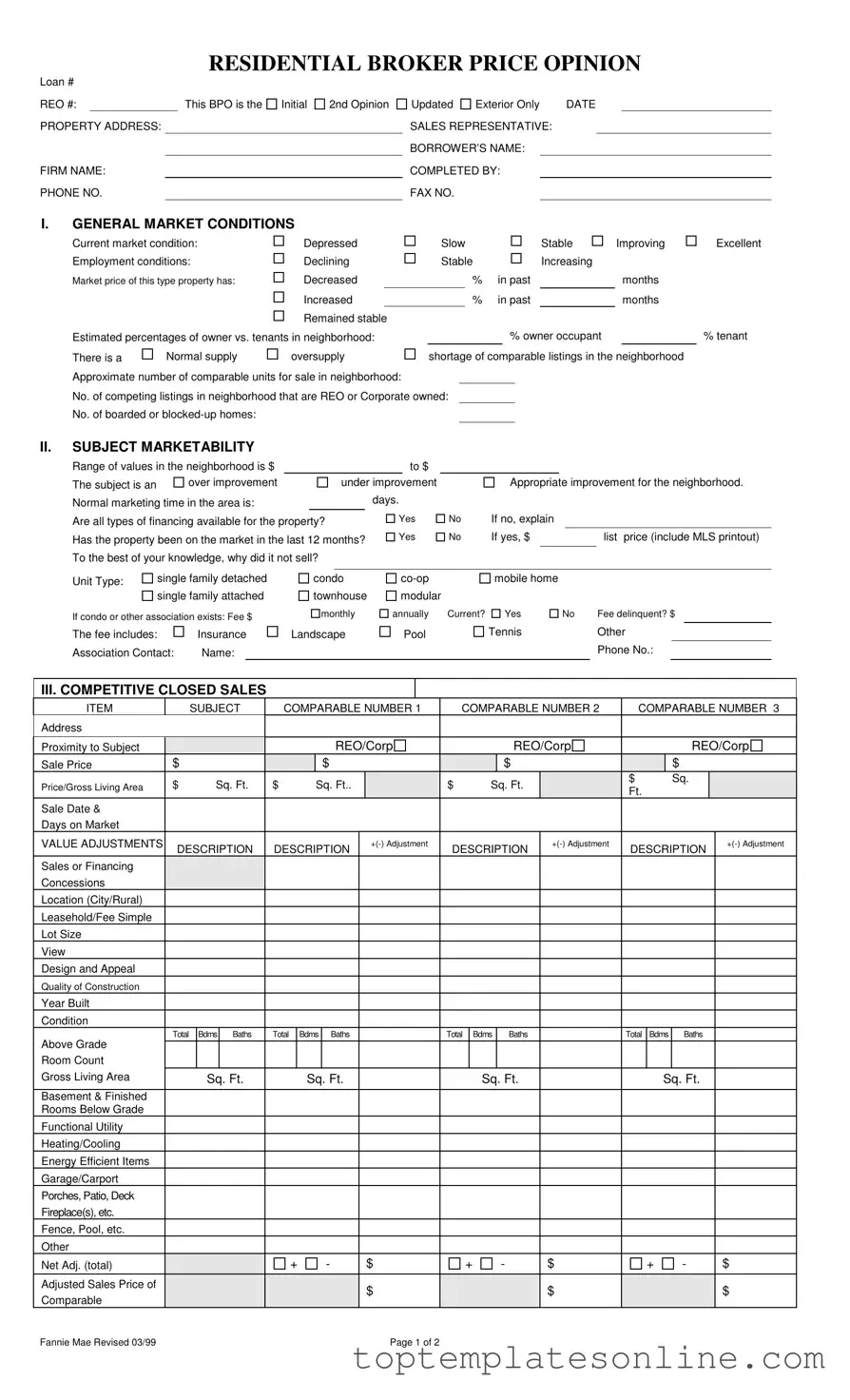

The Broker Price Opinion (BPO) form serves as a crucial tool in the real estate industry, particularly when assessing the value of residential properties. This comprehensive document is used by real estate professionals to provide an estimated market value based on various factors, including current market conditions, property characteristics, and competitive sales data. Within the BPO, evaluators analyze the general market environment—whether it’s stable, improving, or declining—and consider employment conditions in the area. They also take into account the percentage of owner-occupants versus tenants, as well as the supply of comparable listings. The form includes sections dedicated to the subject property's marketability, outlining its potential value range and marketing strategy. Additionally, it highlights necessary repairs to bring the property to a marketable condition, ensuring that all relevant details are captured. By comparing the subject property to similar recent sales and active listings, the BPO provides a well-rounded view of the property’s worth, making it an essential resource for lenders, investors, and real estate agents alike.

Common PDF Templates

Trader Joe's Application - We pride ourselves on exceptional customer service and community involvement.

In New York, landlords must ensure that they follow the proper legal procedures when issuing a Notice to Quit, which can help to mitigate misunderstandings and ensure compliance with local laws. For those seeking a template to execute this process correctly, they can refer to a valuable resource found at newyorkform.com/free-notice-to-quit-template/.

Chickfila Careers - Must be comfortable multitasking in a busy setting.

What Is a Proposal in Construction - Clearly state your project goals using this structured format.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to confusion and inaccuracies. Each section of the form serves a purpose. Missing details may result in an incomplete assessment.

-

Ignoring Market Conditions: Not accurately reflecting current market conditions can skew the valuation. Whether the market is improving, stable, or declining affects the property's worth significantly.

-

Inaccurate Comparables: Selecting the wrong comparable properties can misrepresent the subject property's value. It’s essential to choose comps that are truly similar in size, location, and condition.

-

Overlooking Repair Needs: Not itemizing necessary repairs can mislead potential buyers. Clearly stating what needs fixing helps set realistic expectations and can influence the property’s marketability.

-

Neglecting Financing Options: Failing to indicate whether all types of financing are available can limit buyer interest. This information is crucial for prospective buyers and should be clearly stated.

Guide to Writing Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. Each section of the form is designed to capture essential information about the property and the market conditions. Following these steps will help ensure that the form is completed accurately and comprehensively.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, and PHONE NO..

- Indicate if this BPO is an Initial, 2nd Opinion, or Updated and if it is for Exterior Only.

- Record the DATE, SALES REPRESENTATIVE, BORROWER’S NAME, and COMPLETED BY.

- Provide the FAX NO. if applicable.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition and employment conditions. Select the appropriate options for market price changes and occupancy statistics.

- Estimate the number of comparable listings in the neighborhood and any boarded or blocked-up homes.

- In the SUBJECT MARKETABILITY section, indicate the range of values, marketing time, and financing availability. Note whether the property has been on the market in the last 12 months and provide the list price if applicable.

- Identify the Unit Type and any applicable association fees, ensuring to check the current status of those fees.

- Move to the COMPETITIVE CLOSED SALES section. Fill in details for up to three comparable properties, including addresses, sale prices, and adjustments needed.

- In the MARKETING STRATEGY section, indicate the condition of the property and the most likely buyer type.

- List all necessary repairs in the REPAIRS section, checking those that are recommended for successful marketing.

- In the COMPETITIVE LISTINGS section, provide details for comparable listings, including list prices and adjustments.

- Determine the MARKET VALUE based on the competitive closed sales and suggest a list price.

- Finally, include any COMMENTS regarding specific concerns or positives about the property and sign and date the form.

Documents used along the form

The Broker Price Opinion (BPO) form is often accompanied by various other documents that provide additional context and support for the valuation of a property. Below is a list of commonly used forms and documents that may accompany the BPO.

- Comparative Market Analysis (CMA): This document analyzes similar properties in the area that have recently sold, are currently on the market, or were taken off the market. It helps to establish a fair market value by comparing the subject property with others.

- Property Condition Report: This report details the current condition of the property, including any repairs needed. It can help assess the potential costs and impact on the property's value.

- Listing Agreement: This is a contract between the property owner and a real estate agent that outlines the terms of the property listing. It includes the listing price and duration of the agreement.

- Sales Contract: This document outlines the terms of a sale between the buyer and seller. It includes the purchase price, contingencies, and closing date, providing a framework for the transaction.

- Title Report: A title report confirms the legal ownership of the property and identifies any liens or encumbrances. This is crucial for ensuring that the property can be sold without legal issues.

- Appraisal Report: An appraisal provides an independent assessment of the property's value, typically conducted by a licensed appraiser. This report can be used to support the BPO findings.

- Inspection Report: This document details the findings of a professional property inspection. It highlights any issues that may affect the property's value or require repairs.

- Operating Agreement: This document is essential for LLCs in Florida, as it outlines management structure and responsibilities among members, ensuring clarity and preventing misunderstandings. For more information, visit Florida Forms.

- Market Analysis Report: This report provides an overview of the real estate market trends in the area, including supply and demand dynamics, pricing trends, and economic indicators that may influence property values.

These documents work together to create a comprehensive picture of the property's value and marketability. They assist real estate professionals in making informed decisions regarding pricing, marketing strategies, and negotiations.