Attorney-Approved Business Bill of Sale Form

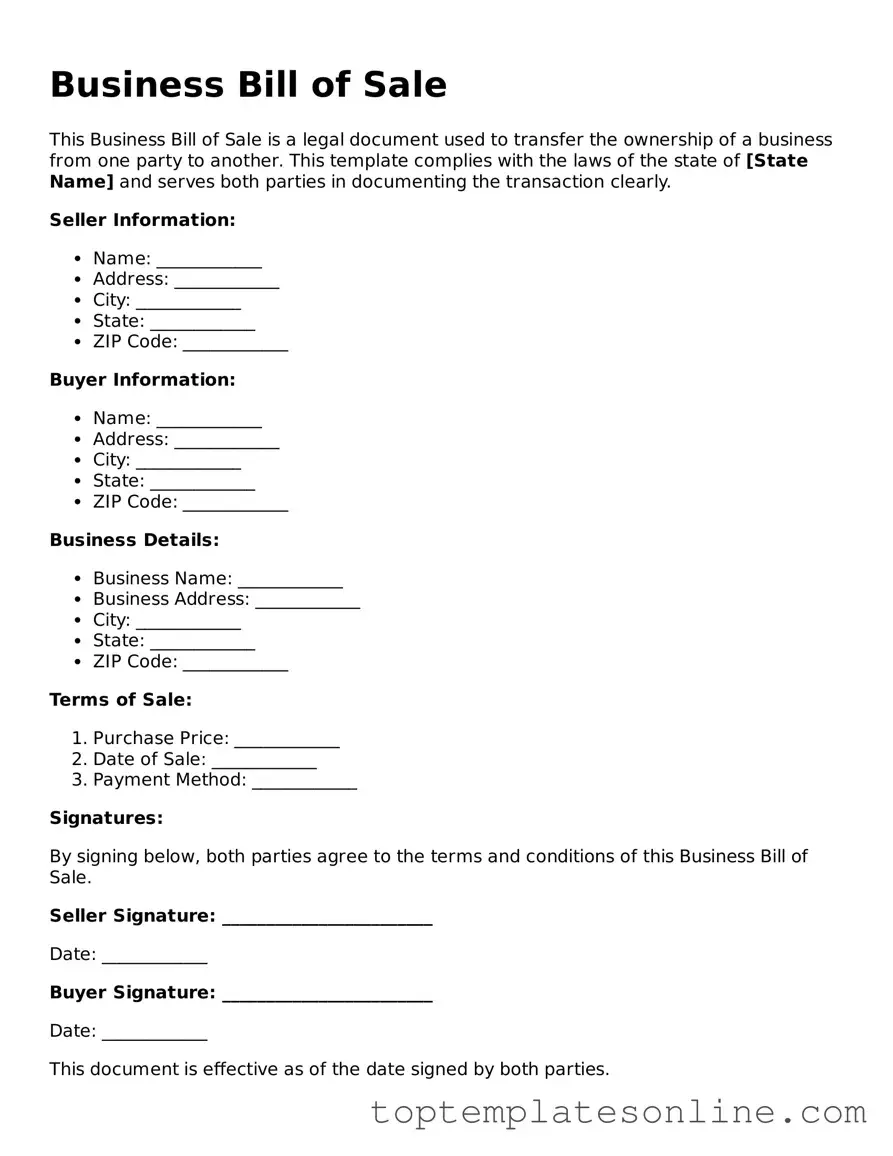

The Business Bill of Sale form serves as a critical document in the transfer of ownership for a business or its assets, ensuring that both the seller and buyer are protected during the transaction. This form outlines essential details such as the names and addresses of both parties, a clear description of the business or assets being sold, and the agreed-upon purchase price. By documenting the terms of the sale, it helps to mitigate potential disputes that may arise post-transaction. Additionally, the form may include representations and warranties from the seller regarding the condition and legality of the business, further safeguarding the buyer's interests. Signatures from both parties are required to validate the agreement, making it a legally binding document. Understanding the components and implications of the Business Bill of Sale is vital for anyone involved in the sale or purchase of a business, as it lays the groundwork for a smooth transition of ownership and ensures compliance with relevant laws and regulations.

Find More Types of Business Bill of Sale Templates

Golf Cart Title - The form can help buyers verify the legitimacy of the transaction.

For those seeking a reliable method to document their transactions, utilizing an effective Arizona bill of sale can be invaluable in safeguarding both parties' interests. To learn more, visit our guide on the comprehensive Arizona bill of sale form.

Jet Ski Bill of Sale Template - Allows the buyer to verify the legitimacy of the purchase.

Equipment Bill of Sale - Completing this form may help streamline the process of future equipment transactions.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. This can lead to confusion or disputes later on. Ensure that every section is completed accurately.

-

Incorrect Dates: People often overlook the importance of accurate dates. Entering the wrong date can affect the legality of the sale. Always double-check that the date of the transaction is correct.

-

Missing Signatures: A Business Bill of Sale requires signatures from both the buyer and the seller. Forgetting to sign or having one party neglect to sign can render the document invalid.

-

Vague Descriptions: Providing a vague description of the business or assets being sold can lead to misunderstandings. Be as specific as possible about what is included in the sale.

-

Not Keeping Copies: After filling out the form, some individuals forget to keep a copy for their records. Retaining a copy is essential for future reference and proof of the transaction.

Guide to Writing Business Bill of Sale

Once you have the Business Bill of Sale form in front of you, it’s time to provide the necessary details to ensure a smooth transaction. This document serves as a record of the sale of a business and includes important information about the parties involved, the business being sold, and the terms of the sale. Follow the steps below to complete the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Fill in the name of the seller. This should be the individual or entity selling the business.

- Next, write the seller's address. Include the street address, city, state, and ZIP code.

- Now, enter the name of the buyer. This is the individual or entity purchasing the business.

- Provide the buyer's address, including the street address, city, state, and ZIP code.

- Describe the business being sold. Include the business name, type, and any relevant details that identify it.

- Specify the purchase price. Clearly state the amount agreed upon for the sale of the business.

- Indicate the payment method. Whether it’s cash, check, or another form, make sure to clarify how the buyer will pay.

- Include any additional terms or conditions of the sale. This could cover warranties, liabilities, or any agreements made between the parties.

- Finally, both the seller and buyer should sign and date the form to validate the transaction.

After completing these steps, keep a copy for your records. This document is crucial for both parties, as it provides proof of the transaction and outlines the agreed-upon terms. Ensure that all information is accurate and legible to avoid any disputes in the future.

Documents used along the form

When engaging in the sale of a business, several important documents complement the Business Bill of Sale. Each of these forms plays a crucial role in ensuring that the transaction is clear, legal, and beneficial for all parties involved. Below is a list of commonly used documents that accompany the Business Bill of Sale.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, payment terms, and any contingencies. It serves as a binding contract between the buyer and seller.

- Asset List: An asset list details all the tangible and intangible assets included in the sale, such as equipment, inventory, trademarks, and customer lists. This helps both parties understand what is being transferred.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared during negotiations. It ensures that confidential business details remain private and are not disclosed to third parties.

- Transfer of Ownership Documents: These documents formally transfer ownership of the business from the seller to the buyer. They may include stock certificates or membership interest assignments, depending on the business structure.

- Tax Clearance Certificate: This certificate confirms that the business has paid all necessary taxes up to the date of sale. It protects the buyer from inheriting any tax liabilities associated with the business.

- Bill of Sale Template: Utilizing a Texas Forms Online template can simplify the process of creating a Bill of Sale, ensuring all necessary details are included for a legally binding transaction.

- Employee Agreements: If the business has employees, agreements regarding their employment status, benefits, and severance may be necessary. This ensures a smooth transition and clarifies the responsibilities of both parties.

In summary, while the Business Bill of Sale is a vital component of a business transaction, these accompanying documents help create a comprehensive framework for the sale. They provide clarity, protect interests, and facilitate a successful transfer of ownership.