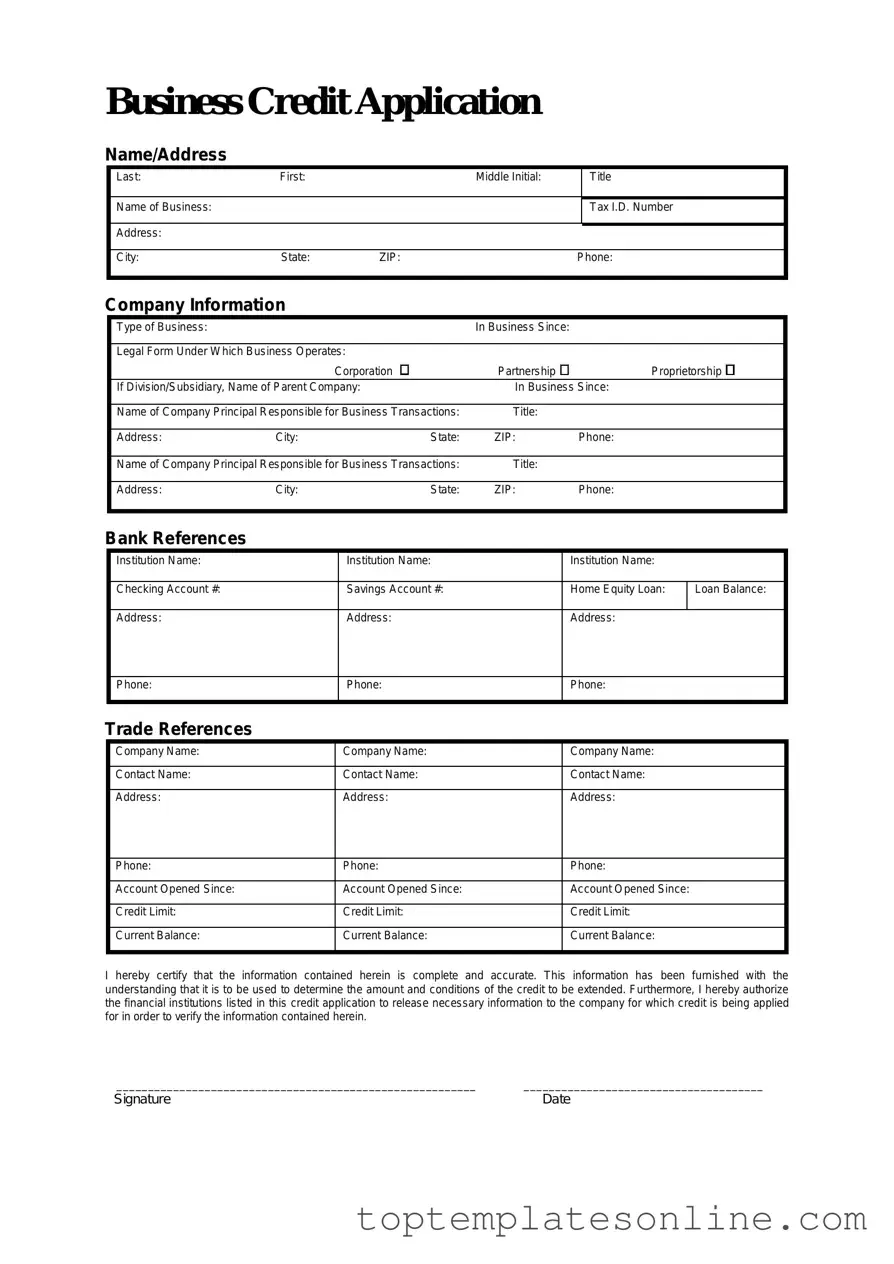

Fillable Business Credit Application Form

When seeking to establish a business relationship with suppliers or lenders, the Business Credit Application form plays a crucial role in the process. This document serves as a comprehensive tool for businesses to communicate their financial stability and creditworthiness. Typically, the form requires essential information such as the business name, address, and contact details, as well as the type of business entity, whether it's a corporation, partnership, or sole proprietorship. Additionally, applicants must provide details about their ownership structure, including the names of owners or partners and their respective ownership percentages. Financial information is another key aspect, often including annual revenue, banking references, and existing credit relationships. The form may also ask for trade references to help assess the applicant’s payment history and reliability. By filling out this application, businesses not only present their credentials but also set the stage for potential credit terms that can foster growth and expansion.

Common PDF Templates

Puppy Health Guarantee Template - No procedures or treatment should proceed without the seller’s agreement on the puppy's health.

How to Make a Rental Lease Agreement - Clarity around effective dates helps both parties track important timelines within the lease.

The New York Hold Harmless Agreement form is a legal document designed to protect one party from liability for any injuries or damages that may occur during a specific activity or event. By signing this form, individuals agree to assume the risk and release the other party from responsibility. This agreement is commonly used in various contexts, including events, construction projects, and recreational activities. For those looking for a template, check out NY Templates for a comprehensive option.

Invoice Forms Pdf - Keep your clients informed with accurate and timely invoices.

Common mistakes

-

Incomplete Information: Many applicants fail to provide all the necessary details. Missing information can lead to delays or outright denial of credit. Ensure that every section of the application is filled out completely.

-

Inaccurate Data: Providing incorrect information, such as wrong addresses or misreported financial figures, can harm your credibility. Double-check all entries for accuracy before submitting the application.

-

Failure to Understand Terms: Some individuals do not take the time to read and understand the terms and conditions associated with the credit application. This oversight can lead to unexpected obligations or fees. Review the terms carefully to avoid surprises later.

-

Neglecting Supporting Documents: Often, applicants overlook the importance of including necessary supporting documents, such as financial statements or tax returns. These documents provide lenders with a clearer picture of your business's financial health. Always include relevant documentation to strengthen your application.

Guide to Writing Business Credit Application

Once you have the Business Credit Application form, you will need to complete it accurately to ensure a smooth processing of your application. Follow these steps carefully to provide all necessary information.

- Start with the Business Information section. Fill in the legal name of your business, the type of business entity, and the business address.

- Provide Contact Information. Include the name of the primary contact person, their phone number, and email address.

- Complete the Business Details section. Enter the date your business was established, the number of employees, and the nature of your business.

- In the Financial Information section, list your business’s annual revenue and any other financial data requested.

- Fill out the Credit References section. Provide the names and contact information for at least three suppliers or creditors who can vouch for your creditworthiness.

- Review all the information you provided for accuracy. Ensure that there are no typos or missing details.

- Sign and date the application at the bottom of the form. This signature indicates that all information is true and complete.

- Submit the form according to the instructions provided, whether electronically or by mail.

Documents used along the form

When applying for business credit, several forms and documents often accompany the Business Credit Application. Each of these documents serves a specific purpose in evaluating the creditworthiness of the business and ensuring a smooth application process. Below is a list of commonly used forms and their brief descriptions.

- Personal Guarantee: This document holds the business owner personally responsible for the debt if the business fails to pay. It provides additional security for lenders.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. They provide a snapshot of the business's financial health and performance over a specific period.

- Tax Returns: Recent tax returns help lenders verify the business's income and ensure that it is reporting accurately to the IRS.

- Business Plan: A comprehensive outline of the business's goals, strategies, and financial projections. It demonstrates to lenders how the business plans to succeed and repay its debts.

- Bank Statements: Recent bank statements provide insight into the business's cash flow and spending habits, helping lenders assess financial stability.

- Trade References: Contact information for suppliers or vendors that can vouch for the business's creditworthiness and payment history.

- Ownership Documents: This may include articles of incorporation, operating agreements, or partnership agreements that establish the legal structure of the business.

- Business License: A copy of the business license shows that the business is legally registered and allowed to operate in its jurisdiction.

- Motor Vehicle Bill of Sale: It is essential to have a Motor Vehicle Bill of Sale form completed when transferring ownership of a vehicle to ensure a legal and documented transaction.

- Insurance Certificates: Proof of insurance coverage, such as liability or workers' compensation, reassures lenders that the business is protected against potential risks.

Gathering these documents can streamline the credit application process and enhance the chances of approval. Each piece of information contributes to a complete picture of the business's financial standing and operational legitimacy.