Attorney-Approved Business Purchase and Sale Agreement Form

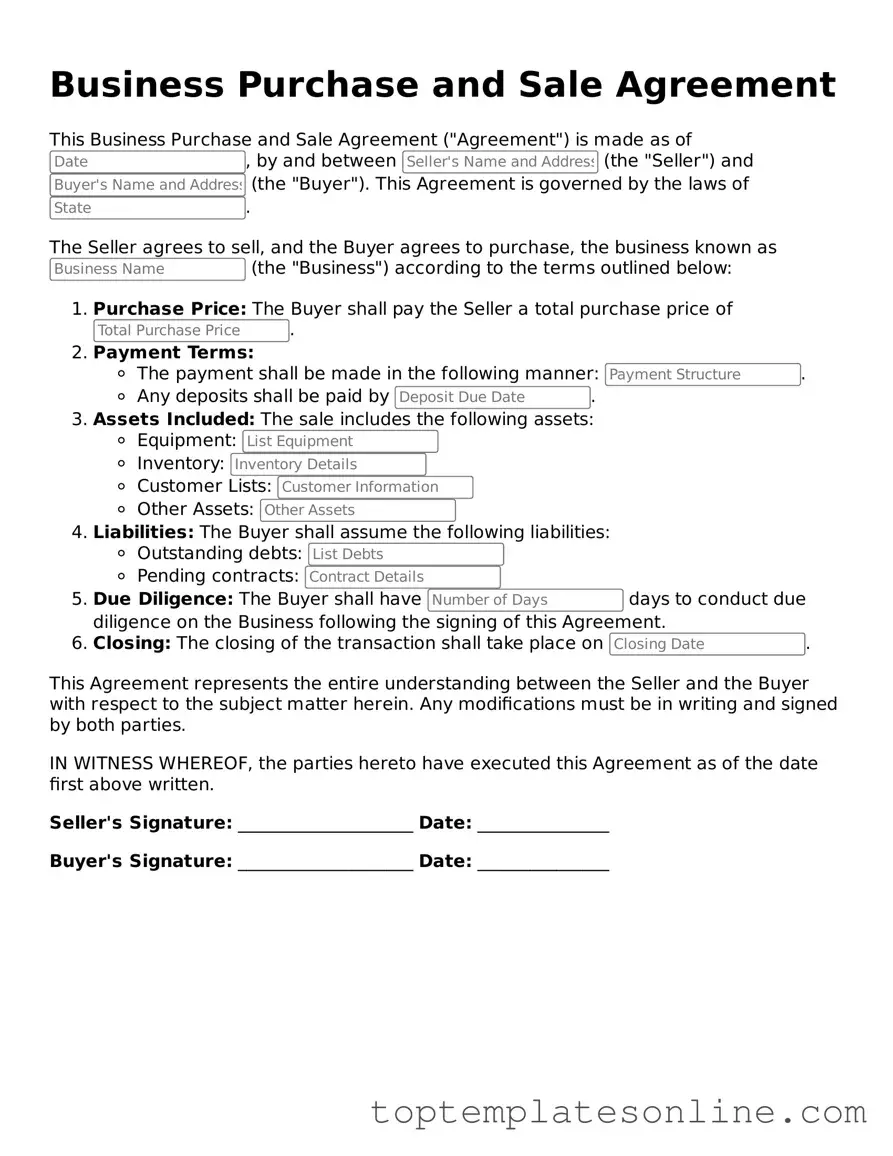

The Business Purchase and Sale Agreement form serves as a critical document in the transfer of ownership of a business. It outlines the terms and conditions agreed upon by the buyer and seller, ensuring that both parties have a clear understanding of their rights and obligations. Key aspects of the agreement include the purchase price, payment terms, and a detailed description of the business being sold. Additionally, the form addresses contingencies, such as financing and due diligence, which may impact the transaction. Representations and warranties from both parties are also included, providing assurances about the business's condition and legal standing. Furthermore, the agreement often covers post-sale obligations, such as non-compete clauses and transition assistance, which can help facilitate a smoother handover. By clearly delineating these elements, the Business Purchase and Sale Agreement form plays a vital role in protecting the interests of both the buyer and seller, ultimately contributing to a successful business transaction.

Common Templates

What Is a Health Care Directive - This form addresses decisions about life-sustaining treatment if you are unable to communicate.

For those looking to navigate the process of transferring ownership of a watercraft, obtaining a New York Boat Bill of Sale form is crucial; you can find a helpful resource at NY Templates. This legal document aids both the buyer and seller by providing a comprehensive record of the transaction, ensuring all pertinent details are accurately captured.

Furniture Bill of Sale - Helps prevent disputes by documenting the sale conditions.

Common mistakes

-

Not Clearly Defining the Business Assets: Buyers and sellers often overlook the importance of clearly listing all assets included in the sale. This can lead to misunderstandings later on.

-

Ignoring Liabilities: Failing to address existing liabilities can be a costly mistake. It's crucial to specify any debts or obligations that the buyer will assume as part of the sale.

-

Vague Terms of Payment: Some people leave the payment terms too ambiguous. Clearly stating how much will be paid, when, and how can prevent disputes.

-

Neglecting Contingencies: Not including contingencies, such as financing or inspection, can create problems. These clauses protect both parties and ensure the sale can proceed under certain conditions.

-

Overlooking Confidentiality Agreements: Many forget to incorporate confidentiality clauses. Protecting sensitive business information is vital during and after the sale process.

-

Failing to Consult Professionals: Some individuals attempt to fill out the agreement without professional guidance. Engaging a lawyer or business advisor can provide valuable insights and avoid pitfalls.

-

Not Considering Future Liabilities: It's essential to think about potential future liabilities that could arise after the sale. Addressing these in the agreement can safeguard both parties.

-

Inadequate Signatures: All required signatures must be obtained. Missing a signature can invalidate the agreement, leading to legal complications.

-

Rushing the Process: Taking time to carefully review the agreement is crucial. Rushing can lead to mistakes that could have long-term consequences.

Guide to Writing Business Purchase and Sale Agreement

Completing the Business Purchase and Sale Agreement form is an essential step in finalizing a business transaction. This form outlines the terms and conditions agreed upon by both the buyer and the seller. Follow these steps to ensure accurate and thorough completion of the form.

- Identify the Parties: Clearly state the names and addresses of both the buyer and the seller at the beginning of the form.

- Describe the Business: Provide a detailed description of the business being sold, including its name, location, and any relevant identification numbers.

- Specify the Purchase Price: Enter the agreed-upon purchase price for the business. Include any terms regarding deposits or payment schedules.

- Outline Terms and Conditions: List any specific terms and conditions that apply to the sale, such as contingencies or warranties.

- Include Closing Date: Indicate the anticipated closing date for the transaction, ensuring both parties agree on this timeline.

- Signatures: Both the buyer and seller must sign and date the form to make it legally binding.

Once the form is filled out, review it carefully for accuracy. Both parties should retain a copy for their records. It is advisable to consult with a legal expert to ensure all aspects of the agreement are properly addressed.

Documents used along the form

When engaging in the process of buying or selling a business, several important documents often accompany the Business Purchase and Sale Agreement. Each of these forms serves a specific purpose, ensuring that both parties are protected and that the transaction proceeds smoothly. Below is a list of commonly used documents in this context.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It typically includes key terms of the deal and serves as a starting point for negotiations.

- Confidentiality Agreement: Also known as a non-disclosure agreement, this document protects sensitive information shared during the negotiation process. It ensures that both parties keep proprietary information confidential.

- Due Diligence Checklist: This is a comprehensive list that guides the buyer in reviewing the seller’s business. It includes financial records, legal documents, and operational details to assess the value and risks associated with the purchase.

- Asset Purchase Agreement: If the transaction involves purchasing specific assets rather than the entire business entity, this document details the assets being sold and the terms of the sale.

- Bill of Sale: This document serves as proof of the transfer of ownership of specific assets. It is essential for recording the sale and ensuring that the buyer receives clear title to the assets.

- Non-Compete Agreement: Often included in business sales, this document restricts the seller from starting a competing business for a specified period and within a defined geographical area.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, adjustments, and any fees. It is typically reviewed and signed at the closing of the sale.

- Vehicle Release of Liability: To protect yourself in a vehicle sale, consider using the comprehensive Vehicle Release of Liability form to ensure all future claims are addressed.

- Financing Agreement: If the buyer is financing the purchase through a loan or other means, this document outlines the terms of the financing arrangement, including repayment terms and interest rates.

Understanding these documents is crucial for anyone involved in a business transaction. Each plays a vital role in ensuring clarity, protecting interests, and facilitating a successful transfer of ownership. Being well-prepared with the right forms can make the process more efficient and less stressful.