Fillable Cash Drawer Count Sheet Form

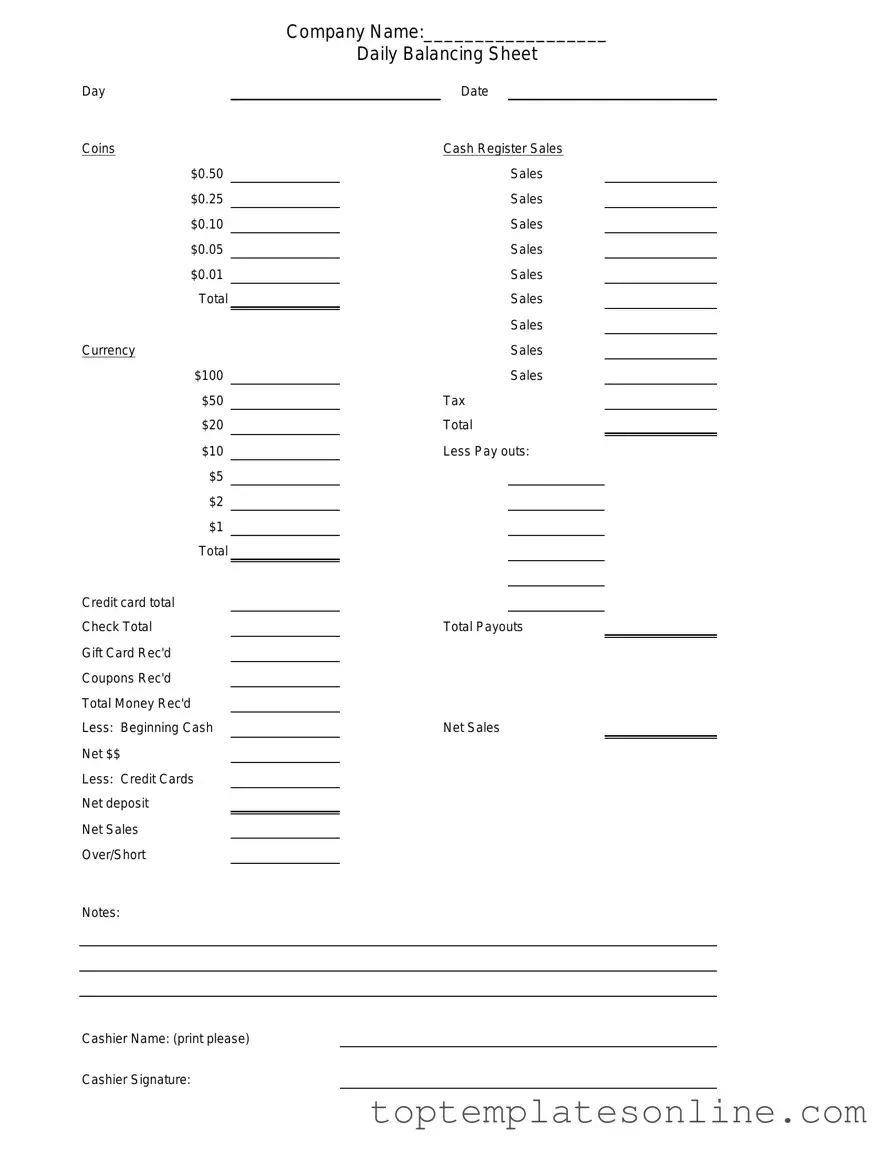

Managing cash in a retail environment requires precision and accountability. The Cash Drawer Count Sheet form plays a crucial role in this process, serving as a tool for tracking the cash flow within a business. This form typically includes sections for recording the initial cash amount in the drawer, daily sales, cash received from various transactions, and the final cash count at the end of a shift. By documenting these figures, businesses can ensure accuracy in their financial reporting and minimize discrepancies. Additionally, the form aids in identifying trends in cash handling and can highlight areas for improvement. With a clear structure, the Cash Drawer Count Sheet simplifies the process of cash management, providing both employees and management with a reliable record of cash transactions. Using this form regularly can enhance overall operational efficiency and foster a culture of accountability within the workplace.

Common PDF Templates

Adp Paystub - Users can compare pay stubs from different periods to track income changes.

For those looking to create a Bill of Sale, it is important to utilize reliable resources to guide you through the process, and one such resource is NY Templates, which offers templates that simplify the documentation required for ownership transfer.

Melaleuca Membership Cost - This form is not valid without your signature, so sign it to ensure processing.

USCIS Form I-864 - This form may require additional documentation if the sponsor’s financial situation is complex.

Common mistakes

-

Inaccurate Counting: One of the most common mistakes is failing to count the cash accurately. This can lead to discrepancies between the actual amount and what is recorded on the form.

-

Omitting Change: Some individuals forget to include the change in the drawer. This oversight can result in an incomplete cash count.

-

Not Recording Denominations: Failing to specify the denominations of bills and coins can create confusion. It is essential to document each type clearly.

-

Neglecting to Verify Previous Count: Skipping the verification of the previous count can lead to repeated errors. Always check the last recorded amount before starting the new count.

-

Rushing the Process: Many people rush through the counting process. Taking time to ensure accuracy is crucial to avoid mistakes.

-

Failing to Sign the Sheet: Not signing the Cash Drawer Count Sheet can create accountability issues. Always ensure that the form is signed by the person completing the count.

Guide to Writing Cash Drawer Count Sheet

When preparing to fill out the Cash Drawer Count Sheet form, it's important to ensure that you have all necessary materials at hand. This includes cash, coins, and any relevant receipts. After completing the form, you will have a clear record of your cash drawer, which helps in maintaining accurate financial records and preparing for audits.

- Start by writing the date at the top of the form.

- In the designated section, enter your name or the name of the person responsible for the cash drawer.

- List the denominations of cash you have in the drawer. This typically includes $100, $50, $20, $10, $5, and $1 bills.

- Count the number of bills in each denomination and write that number next to the corresponding denomination.

- Calculate the total amount for each denomination by multiplying the number of bills by the bill value.

- Sum all the totals to get the overall cash amount in the drawer.

- Record any coins in the same manner, noting their denominations and quantities.

- Calculate the total amount of coins as well and add this to the overall cash amount.

- Double-check your calculations to ensure accuracy.

- Sign and date the form to verify that the count is complete and accurate.

Documents used along the form

The Cash Drawer Count Sheet form is essential for tracking cash flow and ensuring accurate financial reporting. However, several other documents complement this form to provide a comprehensive view of cash management. Below is a list of related forms and documents that are often used alongside the Cash Drawer Count Sheet.

- Daily Sales Report: This document summarizes total sales for the day, including cash, credit, and other payment types. It helps in reconciling cash counts with sales figures.

- Deposit Slip: Used to record the amount of cash being deposited into the bank. This slip ensures that the cash counted matches what is actually deposited.

- Cash Handling Policy: A guideline document outlining procedures for handling cash, including security measures and employee responsibilities. It ensures consistency and reduces theft risk.

- Petty Cash Log: This log tracks small cash expenditures. It helps maintain accountability for minor expenses that do not go through the main cash drawer.

- End-of-Day Reconciliation Report: A report that compares cash on hand to sales and other records at the end of the day. It identifies discrepancies and ensures accuracy.

- Change Fund Sheet: This document records the amount of cash kept on hand for making change during transactions. It helps ensure that the cash drawer is adequately funded.

- Non-disclosure Agreement (NDA): It is crucial for businesses to protect sensitive information, ensuring that proprietary details remain confidential. For a template, you can refer to https://newyorkform.com/free-non-disclosure-agreement-template/.

- Employee Cash Register Report: Each employee may fill out this report at the end of their shift, detailing their cash sales and any discrepancies. It aids in tracking individual performance and accountability.

- Audit Trail Report: This report tracks all cash transactions and adjustments made within a specified period. It is crucial for internal audits and financial reviews.

Using these documents in conjunction with the Cash Drawer Count Sheet enhances financial accuracy and accountability. Proper management of cash-related forms can help prevent errors and fraud, ensuring smooth operations in any business.