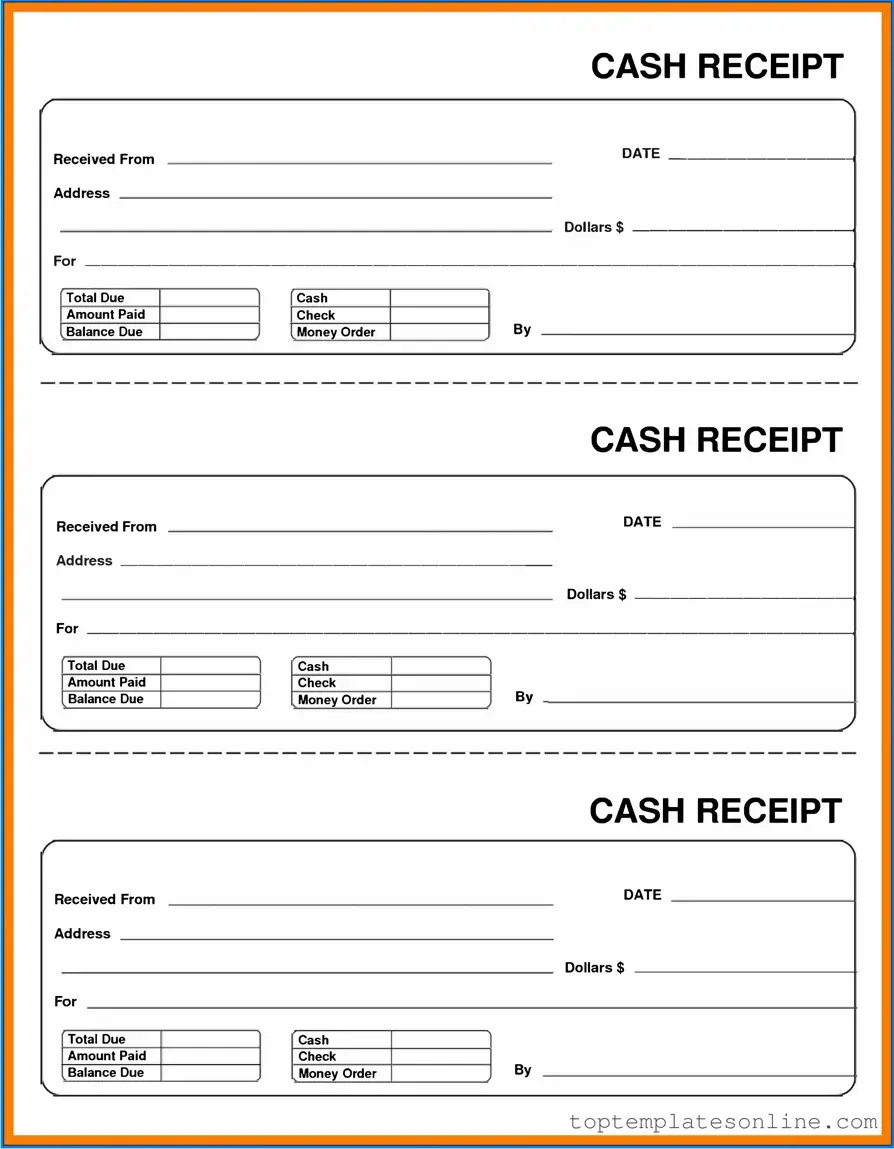

Fillable Cash Receipt Form

The Cash Receipt form is an essential document used in various financial transactions, ensuring that both parties involved have a clear record of cash exchanges. This form typically includes key details such as the date of the transaction, the amount received, and the payer's information. It may also feature a description of the goods or services provided, as well as the signature of the person receiving the cash. By documenting these elements, the Cash Receipt form serves to protect both the payer and the payee, providing a reliable reference for future inquiries or audits. Additionally, businesses often use this form to maintain accurate accounting records, making it easier to track income and manage finances effectively. Understanding the importance of this form can lead to better financial practices and enhanced transparency in monetary dealings.

Common PDF Templates

Doctor Release Form to Return to Work - Completion of the Work Release form is a requirement for approval of work outside the facility.

For those looking to create a Bill of Sale, it is essential to utilize reliable resources that guide you through the process, one such resource is NY Templates, which provides templates tailored for New York transactions, enhancing the overall clarity and legality of the document.

Acord Form - It is a standardized way to gather important claims information.

Common mistakes

-

Failing to include the date of the transaction. This is crucial for record-keeping and tracking payments.

-

Not specifying the amount received clearly. Ensure that the amount is written in both numbers and words to avoid confusion.

-

Leaving out the payer's information. It is important to include the name and contact details of the individual or organization making the payment.

-

Using an incorrect payment method. Clearly indicate whether the payment was made by cash, check, credit card, or another method.

-

Not providing a description of the transaction. A brief note about what the payment is for helps in understanding the context of the receipt.

-

Forgetting to include the receipt number. This unique identifier is essential for tracking and referencing the transaction in the future.

-

Neglecting to obtain a signature from the payer. A signature serves as proof of the transaction and confirms that the payment has been received.

-

Not recording the name of the person issuing the receipt. This adds accountability and helps in case of any disputes.

-

Failing to keep a copy of the receipt for records. Retaining a duplicate is important for both the payer and the organization.

-

Using illegible handwriting or unclear formatting. It is important to fill out the form neatly to ensure that all information is easily readable.

Guide to Writing Cash Receipt

Once you have the Cash Receipt form in front of you, it’s time to fill it out accurately. This form plays a crucial role in tracking financial transactions. Completing it correctly ensures that all parties have a clear record of the cash received.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY for clarity.

- Next, write the name of the individual or organization from whom the cash is received. Ensure the spelling is correct.

- In the designated space, specify the amount of cash received. Double-check the number for accuracy.

- Provide a brief description of the purpose of the cash receipt. This could include details like the service rendered or the invoice number.

- Include any relevant reference numbers if applicable, such as an invoice or transaction number.

- Finally, sign and date the form at the bottom. This confirms the receipt of cash.

After completing these steps, ensure that you keep a copy for your records. This will help maintain an accurate financial history for future reference.

Documents used along the form

The Cash Receipt form is an essential document used to record cash transactions. Alongside this form, various other documents are often utilized to ensure accurate financial tracking and compliance. Below is a list of related forms and documents that may accompany the Cash Receipt form.

- Invoice: This document details the goods or services provided and the amount owed. It serves as a request for payment from the customer.

- Payment Voucher: A payment voucher is used to authorize and document a payment, often including details about the transaction and the recipient.

- Deposit Slip: This form is used when depositing cash or checks into a bank account. It provides a record of the deposit for both the depositor and the bank.

- Sales Receipt: A sales receipt confirms the sale of goods or services and provides the buyer with proof of purchase. It typically includes transaction details and payment information.

- Credit Memo: This document is issued to reduce the amount owed by a customer, often due to returns or discounts. It serves as a formal acknowledgment of the adjustment.

- Motorcycle Bill of Sale Form: For those engaged in motorcycle transactions, the valuable Motorcycle Bill of Sale documentation guide ensures all ownership details are properly recorded.

- Bank Statement: A bank statement summarizes all transactions in a bank account over a specific period. It is crucial for reconciling cash receipts with bank deposits.

- Expense Report: An expense report outlines the expenses incurred by an employee or department. It is often submitted for reimbursement and can help track cash flow.

Each of these documents plays a vital role in maintaining accurate financial records. Proper management of these forms can enhance accountability and streamline financial processes.