Fillable Citibank Direct Deposit Form

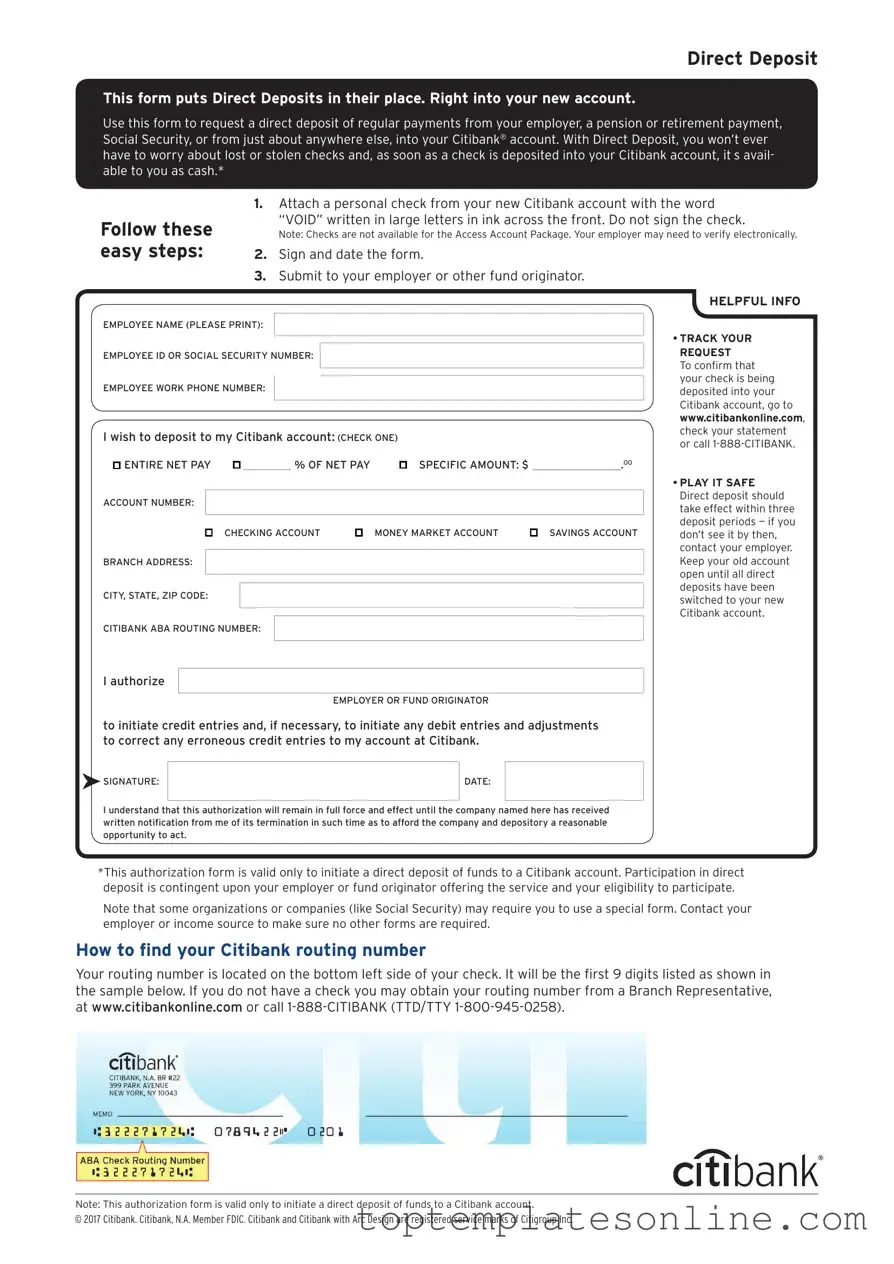

Direct deposit has become a cornerstone of modern banking, offering convenience and efficiency for both employees and employers. The Citibank Direct Deposit form is a crucial tool in this process, allowing individuals to authorize the electronic transfer of funds directly into their bank accounts. This form typically requires essential information such as the account holder's name, account number, and routing number, ensuring accurate and secure transactions. It also often includes options for designating multiple accounts, enabling users to split their deposits among different accounts if desired. By completing this form, customers can streamline their payroll processes, receive government benefits, or manage other recurring payments with ease. Understanding how to fill out and submit the Citibank Direct Deposit form can lead to a smoother banking experience, eliminating the need for paper checks and reducing the risk of lost or delayed payments.

Common PDF Templates

Miscarriage Symptoms - The mother can express her preferences concerning the handling of fetal remains.

Trader Joe's Application - Offering a diverse range of high-quality products at great prices.

When preparing a New York Durable Power of Attorney, it is crucial to utilize reliable resources to ensure the document meets all legal requirements. For those in need of a structured template, NY Templates offers comprehensive options that can aid in completing this important legal form accurately, thereby protecting the principal's interests effectively.

What Is I-9 Form - Employees often feel relief from having their employment verified through this form.

Common mistakes

-

Not double-checking the account number. A single digit mistake can lead to funds being deposited into the wrong account.

-

Forgetting to include the routing number. This number is essential for directing the funds to the correct bank.

-

Using an old or closed account. Make sure the account is active and able to receive deposits.

-

Neglecting to sign the form. Without a signature, the bank may not process the request.

-

Failing to indicate the type of account (checking or savings). This information is necessary for proper processing.

-

Not providing contact information. In case of issues, the bank needs a way to reach you.

-

Leaving out the employer's information. This can delay the processing of your direct deposit.

-

Not keeping a copy of the completed form. Having a record can help resolve any future discrepancies.

Guide to Writing Citibank Direct Deposit

Completing the Citibank Direct Deposit form is an essential step for ensuring that your payments are deposited directly into your bank account. This process streamlines your finances and provides peace of mind regarding your funds. Follow these steps carefully to fill out the form accurately.

- Begin by obtaining the Citibank Direct Deposit form. You can find it online or request a physical copy from your employer.

- In the first section, enter your personal information. This typically includes your full name, address, and contact number.

- Next, provide your Social Security number or Tax Identification Number. Ensure that this information is accurate to avoid any issues with your deposit.

- Locate the section for bank account details. Here, you will need to input your Citibank account number and the routing number. You can find these numbers on your checks or by logging into your online banking account.

- Indicate the type of account you are using for direct deposit. Usually, this will be either a checking or savings account.

- Review the form for any errors or missing information. It is crucial to double-check that all details are correct to prevent delays in processing.

- Finally, sign and date the form. Your signature is necessary to authorize the direct deposit arrangement.

Once you have completed the form, submit it to your employer or the designated department responsible for processing payroll. They will handle the necessary steps to set up your direct deposit, allowing you to receive your payments seamlessly.

Documents used along the form

When setting up direct deposit with Citibank, several forms and documents may be required to ensure a smooth process. These documents help verify your identity, confirm your banking information, and facilitate the deposit of your funds. Below is a list of commonly used forms that may accompany the Citibank Direct Deposit form.

- Bank Account Verification Letter: This letter confirms your account details and is typically issued by your bank. It provides assurance that the account information you provide is accurate.

- W-4 Form: This form is used to determine the amount of federal income tax withholding from your paycheck. Completing this form accurately ensures that the correct amount is withheld.

- Employment Verification Form: This document verifies your employment status and may be required by your employer to process the direct deposit request.

- Social Security Card: Providing a copy of your Social Security card can help confirm your identity and ensure that your earnings are reported correctly to the IRS.

- Identification Documents: A government-issued ID, such as a driver's license or passport, may be needed to verify your identity when setting up direct deposit.

- Power of Attorney Form: To authorize someone to act on your behalf, download our comprehensive Power of Attorney form resource for clarity on decisions regarding financial and healthcare matters.

- Pay Stub: A recent pay stub can provide proof of employment and income, which may be necessary for some employers during the direct deposit setup process.

- Direct Deposit Authorization Form: This form grants permission for your employer or payer to deposit funds directly into your bank account. It typically includes your account details and signature.

- Employer's Direct Deposit Policy: This document outlines the employer's procedures and policies regarding direct deposit, including timelines and any requirements for employees.

- Change of Address Form: If you have recently moved, this form ensures that your employer has your current address for tax purposes and other communications.

Gathering these documents can help streamline the direct deposit setup process with Citibank. It is essential to ensure that all information is accurate and up to date to avoid any delays in receiving your funds. If you have any questions about these forms or the process, consider reaching out to your employer or Citibank for assistance.