Attorney-Approved Closing Date Extension Addendum Form Form

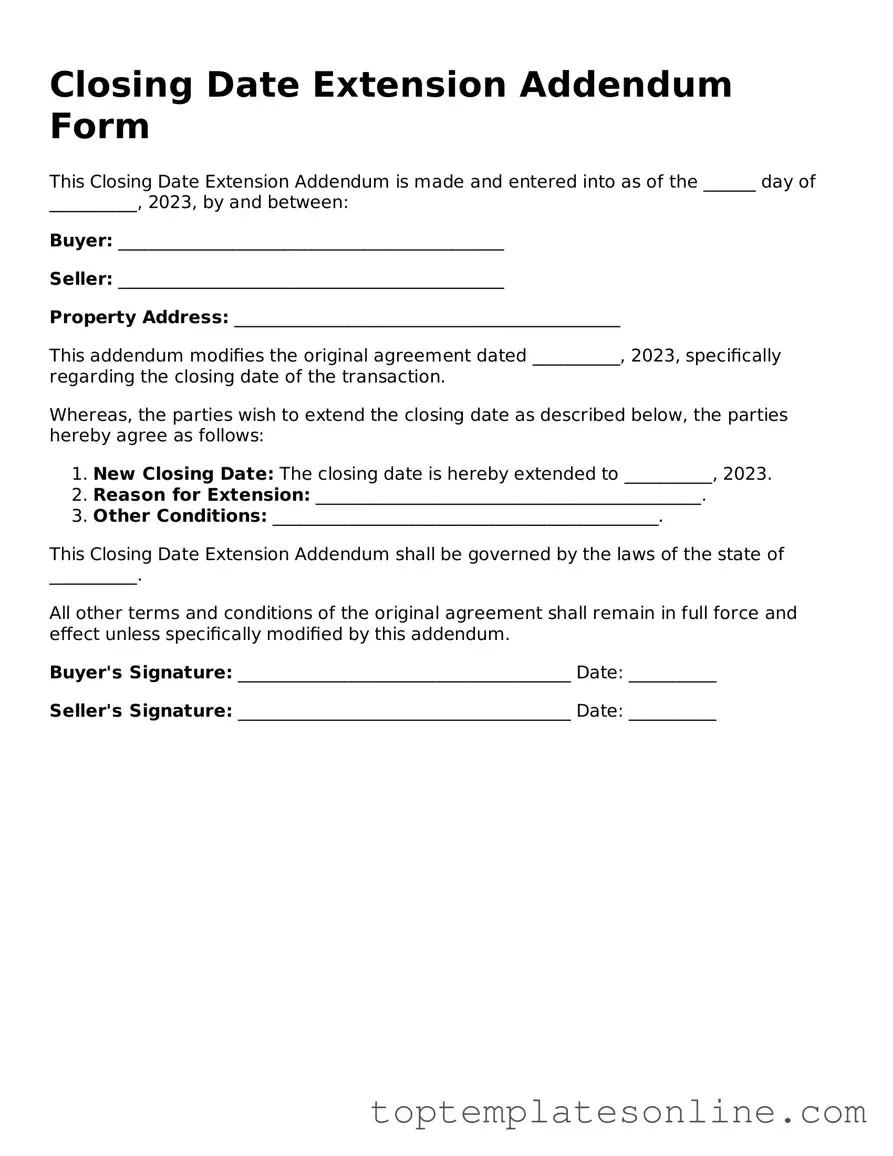

The Closing Date Extension Addendum Form serves as a crucial tool in real estate transactions, particularly when unforeseen circumstances arise that necessitate a change in the timeline for closing. This form allows parties involved—typically buyers and sellers—to formally agree on extending the closing date, ensuring that both sides remain aligned and protected during the process. It outlines essential details such as the original closing date, the new proposed date, and any conditions that may accompany this extension. By utilizing this addendum, parties can mitigate potential disputes and misunderstandings, fostering a cooperative atmosphere as they navigate the complexities of real estate deals. Furthermore, this form not only provides clarity but also serves as a written record of the agreement, which can be invaluable should any issues arise later. Understanding its components and implications can empower individuals to make informed decisions, ultimately leading to smoother transactions and successful outcomes.

Common Templates

Free Printable Affidavit of Identity - It's particularly useful for someone whose name has changed due to marriage or divorce.

To facilitate a smooth transfer of ownership, it is essential to utilize a Vehicle Release of Liability form, which can be found at smarttemplates.net/fillable-vehicle-release-of-liability. This document plays a vital role in ensuring both the seller and buyer are protected, as it formally indicates that the seller relinquishes any future liability associated with the vehicle.

Dnr Do Not Resuscitate - A Do Not Resuscitate Order (DNR) is a legal document that specifies a person's wishes regarding emergency medical procedures.

Common mistakes

-

Failing to specify the new closing date: One common mistake is not clearly indicating the new closing date. This can lead to confusion and potential disputes.

-

Not signing the addendum: Both parties must sign the addendum for it to be valid. Omitting a signature can render the document unenforceable.

-

Neglecting to date the form: Forgetting to include the date of the extension can create ambiguity regarding when the new terms take effect.

-

Using vague language: Ambiguity can lead to misunderstandings. It’s essential to use clear and precise language when describing the terms of the extension.

-

Failing to notify all parties involved: All parties must be informed of the extension. Failure to do so can result in one party being unaware of the changes.

-

Not considering the implications of the extension: Extensions may affect other contractual obligations. It’s important to consider how the new closing date impacts related agreements.

-

Ignoring local regulations: Each state may have specific requirements regarding closing date extensions. Not adhering to these can invalidate the addendum.

-

Overlooking the need for additional documentation: Sometimes, an extension may require additional paperwork. Failing to provide necessary documents can complicate the process.

-

Assuming verbal agreements are sufficient: Relying on verbal agreements instead of documenting the extension can lead to misunderstandings and disputes later on.

Guide to Writing Closing Date Extension Addendum Form

After obtaining the Closing Date Extension Addendum Form, you'll need to fill it out accurately to ensure the extension is properly documented. Follow these steps to complete the form correctly.

- Begin by entering the date of the original closing.

- Next, write down the new proposed closing date.

- Fill in the names of all parties involved in the transaction.

- Include the property address to clearly identify the location of the transaction.

- Sign and date the form at the bottom. Each party should do this.

- Make copies of the completed form for all parties involved.

Once the form is filled out and signed, it should be distributed to all relevant parties. This ensures everyone is aware of the new closing date and can plan accordingly.

Documents used along the form

When engaging in real estate transactions, various documents may accompany the Closing Date Extension Addendum Form. Each of these forms serves a specific purpose, ensuring that all parties involved have a clear understanding of their rights and obligations. Below is a list of commonly used forms that may be relevant in such scenarios.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, property details, and the responsibilities of both the buyer and seller.

- Disclosure Statements: These statements inform the buyer of any known issues with the property, such as structural problems or environmental hazards, ensuring transparency in the transaction.

- Motor Vehicle Power of Attorney: This form is crucial for appointing someone to handle vehicle transactions on your behalf, especially when you are unable to manage them yourself. For more information, visit Florida Forms.

- Loan Commitment Letter: Issued by the lender, this letter confirms that the buyer has been approved for a loan, detailing the amount and terms of the financing.

- Title Insurance Policy: This policy protects the buyer and lender against any claims or disputes over the property’s title, providing peace of mind regarding ownership rights.

- Closing Disclosure: This document outlines all final financial details of the transaction, including loan terms, closing costs, and the total amount due at closing.

- Bill of Sale: This document transfers ownership of personal property associated with the real estate, such as appliances or furniture, from the seller to the buyer.

- Escrow Agreement: This agreement details the terms under which an escrow agent holds funds or documents until all conditions of the sale are met, ensuring a secure transaction.

- Power of Attorney: If a party cannot be present at closing, this document allows someone else to act on their behalf, facilitating the completion of the transaction.

Understanding these documents can enhance your experience during the closing process. Each form plays a vital role in protecting the interests of all parties involved, ensuring a smooth transition of property ownership.