Attorney-Approved Corrective Deed Form

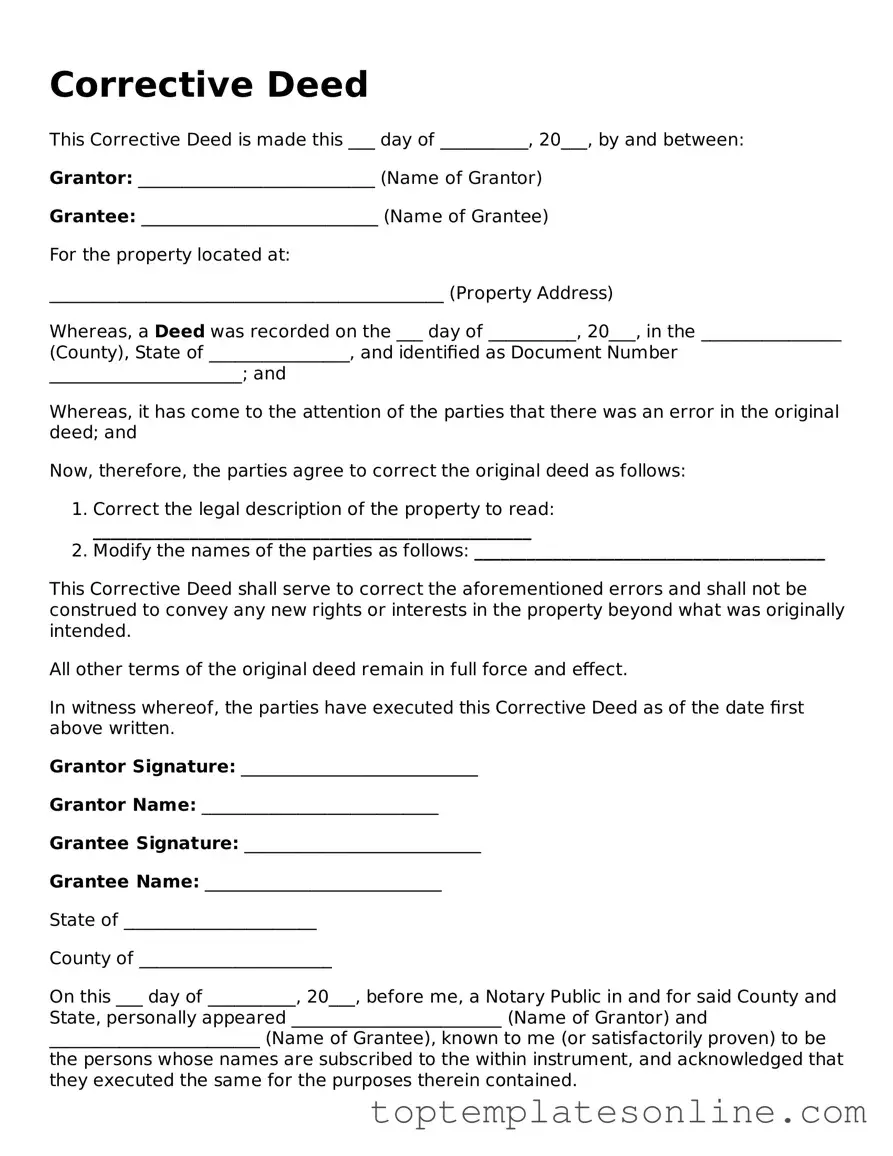

When it comes to real estate transactions, accuracy in property documentation is crucial. One important tool that helps rectify errors in property deeds is the Corrective Deed form. This form serves as a legal instrument to amend mistakes that may have occurred in the original deed, ensuring that the property records reflect the true ownership and details of the property. Common reasons for using a Corrective Deed include typographical errors, incorrect property descriptions, or misidentified owners. By utilizing this form, property owners can clarify any discrepancies, thereby protecting their rights and interests. Additionally, the Corrective Deed must be executed properly, following specific state guidelines, to ensure its validity. Understanding the nuances of this form can help individuals navigate the complexities of property law and maintain accurate public records.

Find More Types of Corrective Deed Templates

Lady Bird Deed Michigan Form - With a Lady Bird Deed, the property can be transferred to beneficiaries without tax implications during the owner's lifetime.

For those looking to navigate the complexities of property ownership in Georgia, utilizing a reliable resource is crucial, and you can find the necessary Georgia Deed form at georgiapdf.com/deed/, which provides guidance and structure to facilitate a smooth transfer of property ownership.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to delays. Ensure that all sections are filled out completely.

-

Incorrect Names: Spelling errors in names can create legal complications. Double-check the spelling of all parties involved.

-

Missing Signatures: Not obtaining all required signatures can invalidate the deed. Confirm that every necessary party has signed.

-

Wrong Notarization: Incorrect notarization can result in rejection. Ensure that the deed is notarized properly according to state requirements.

-

Failure to Use the Correct Form: Using an outdated or incorrect version of the form can lead to issues. Always use the latest version available.

-

Omitting Legal Descriptions: Neglecting to include accurate legal descriptions of the property can cause confusion. Provide precise and clear descriptions.

-

Not Reviewing Before Submission: Submitting without a final review can result in overlooked errors. Take the time to review the completed form thoroughly.

Guide to Writing Corrective Deed

Completing the Corrective Deed form is an essential step for ensuring that property records accurately reflect ownership details. After filling out the form, you will need to submit it to the appropriate local government office, where it will be recorded. This process helps clarify any discrepancies in property titles and ensures that all parties involved have a clear understanding of ownership.

- Begin by gathering all necessary information related to the property, including the current owner's name, the property address, and any previous deed information.

- Obtain the Corrective Deed form from your local government office or download it from their official website.

- Carefully fill out the form, ensuring that all fields are completed accurately. Include the names of all parties involved and the specific corrections needed.

- Review the form for any errors or omissions. It is crucial that all information is correct to avoid further complications.

- Sign the form in the designated area. If there are multiple owners, ensure that all necessary parties sign the document.

- Have the form notarized, if required. This step may be necessary to validate the document legally.

- Submit the completed and notarized Corrective Deed form to the appropriate local office for recording. Be prepared to pay any associated filing fees.

Documents used along the form

The Corrective Deed form is often used to amend or clarify errors in previously recorded deeds. When dealing with property transactions, several other forms and documents may accompany a Corrective Deed to ensure all legal requirements are met. Below is a list of commonly used documents that may be relevant in such situations.

- Original Deed: This document outlines the initial transfer of property ownership. It serves as the baseline for any corrections made in the Corrective Deed.

- Title Search Report: A report that identifies the current ownership and any liens or encumbrances on the property. It helps confirm the accuracy of the information in the Corrective Deed.

- Affidavit of Correction: A sworn statement that explains the nature of the errors in the original deed. This document can provide additional context for the changes made.

- Property Survey: A detailed drawing or map of the property. This document may be necessary to clarify boundaries or other physical aspects of the property that relate to the deed.

- Transfer Tax Declaration: A form that may be required to report the transfer of property for tax purposes. It is often filed alongside the Corrective Deed.

- Georgia Quitclaim Deed: To effectively transfer property interests, refer to the essential Georgia quitclaim deed documentation guide for clarity and compliance.

- Power of Attorney: If someone is signing the Corrective Deed on behalf of the property owner, this document grants them the authority to do so.

- Notice of Intent: A document that may be filed to inform interested parties about the intent to correct a deed. This can help prevent disputes after the fact.

- Closing Statement: This document summarizes the financial aspects of the property transaction, including any adjustments made as a result of the correction.

Understanding these documents can help ensure a smooth process when correcting a deed. Each plays a role in providing clarity and legal backing to property transactions.