Attorney-Approved Deed Form

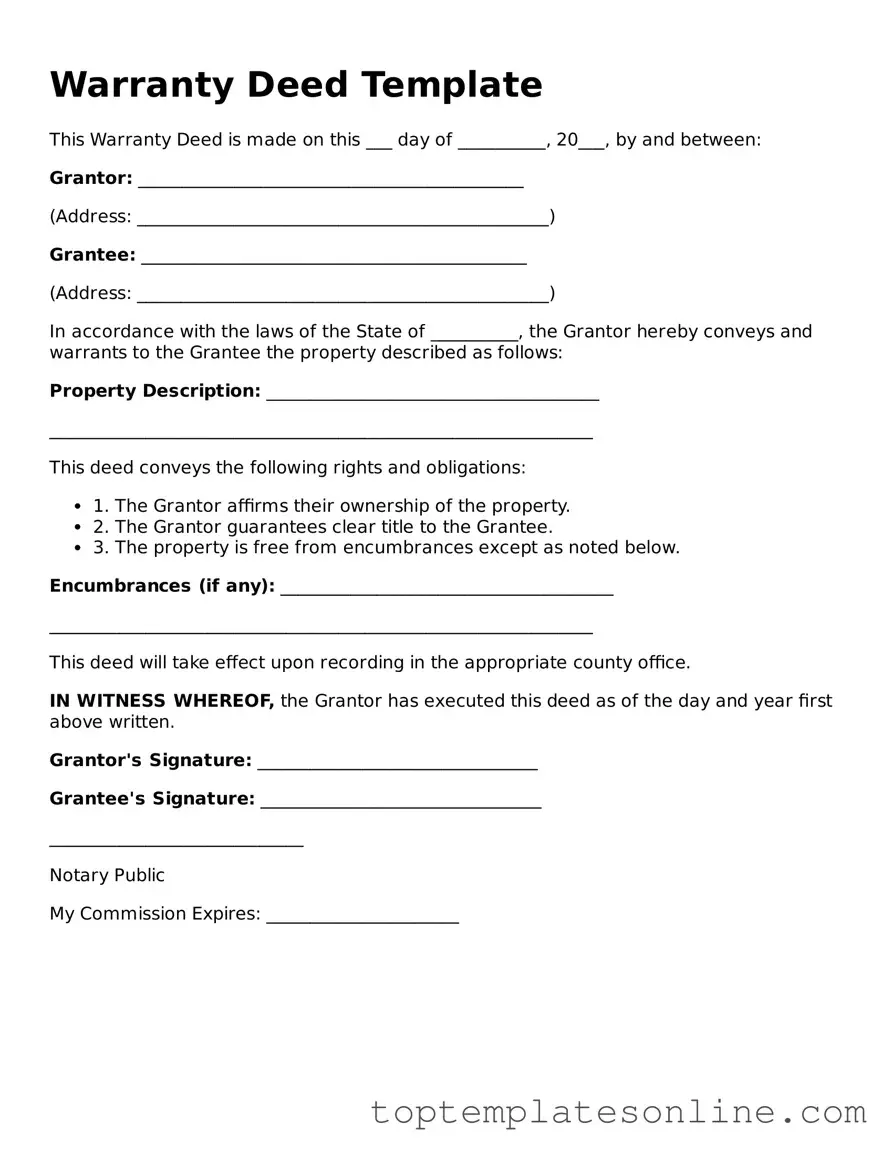

The Deed form plays a crucial role in real estate transactions, serving as a legal document that transfers ownership of property from one party to another. It outlines essential details such as the names of the grantor and grantee, a description of the property, and the terms of the transfer. Various types of deeds exist, including warranty deeds, quitclaim deeds, and special purpose deeds, each serving specific purposes and providing different levels of protection for the parties involved. Understanding the significance of this form is vital for anyone engaged in buying or selling property, as it ensures that the transfer is legally binding and protects the rights of both the seller and the buyer. Additionally, the Deed form must be properly executed, which includes signatures and, in some cases, notarization, to be valid. This document not only facilitates the transfer of ownership but also serves as a public record, providing transparency in property transactions.

State-specific Information for Deed Documents

Common Templates

Sue Letter of Intent to Take Legal Action Template - The letter functions as a catalyst for action from the other party.

Satisfaction and Release Form - This document should be maintained for your records after a note is released.

When navigating the complexities of renting in Florida, having access to the proper documentation is crucial, such as the Florida Forms, which provide essential templates like the Florida Residential Lease Agreement. This form not only details the terms between landlords and tenants but also ensures that both parties are aware of their rights and responsibilities, making it an indispensable tool for a smooth rental experience.

Loi Format - This document highlights both parties' visions for the transaction ahead.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the correct legal names of all parties involved. Ensure that first and last names are spelled correctly and match the names on identification documents.

-

Missing Signatures: All required signatures must be present. Omitting a signature can invalidate the deed. Double-check that everyone who needs to sign has done so.

-

Improper Notarization: Not having the deed properly notarized is another frequent error. A notary public must witness the signing. Make sure to follow all local requirements for notarization.

-

Inaccurate Property Description: Providing an unclear or incorrect description of the property can lead to disputes. Use precise language and include all necessary details, such as parcel numbers and boundaries.

Guide to Writing Deed

After obtaining the Deed form, you will need to complete it accurately to ensure proper documentation of the property transfer. Follow these steps carefully to fill out the form.

- Begin by entering the date at the top of the form.

- Provide the names of the parties involved in the transaction. List the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Include the address of the property being transferred. This should be the full legal description, including any lot or block numbers.

- Specify the consideration amount, which is the value exchanged for the property. This may be a monetary amount or other forms of value.

- Sign the form in the designated area. The grantor must sign, and if required, the grantee should also sign.

- Have the signatures notarized. This step is crucial for the validity of the deed.

- Make copies of the completed form for your records before submitting it.

- Submit the deed to the appropriate local government office for recording.

Documents used along the form

When dealing with property transactions, the Deed form is a crucial document. However, several other forms and documents often accompany it to ensure a smooth transfer of ownership and to address various legal requirements. Below is a list of these essential documents.

- Title Search Report: This document verifies the current ownership of the property and checks for any liens, encumbrances, or claims against it. It ensures that the seller has the right to sell the property and that the buyer will receive clear title.

- Bill of Sale: This document serves as a receipt for the transaction, detailing the sale of personal property that may be included with the real estate, such as appliances or fixtures. It provides proof of the transfer of ownership for these items.

- Hold Harmless Agreement Form: To safeguard against potential liabilities, utilize the relevant Hold Harmless Agreement resources during your transaction preparations.

- Affidavit of Title: This sworn statement by the seller confirms that they hold clear title to the property and discloses any known issues or claims. It protects the buyer by assuring them of the seller's legal right to sell the property.

- Closing Statement: This document outlines all financial aspects of the transaction, including the purchase price, closing costs, and any adjustments. It provides a detailed account of the financial exchange between the buyer and seller at closing.

These documents work in tandem with the Deed form to facilitate a successful property transaction. Each plays a vital role in ensuring that both parties are protected and that the transfer of ownership is executed smoothly.