Attorney-Approved Deed in Lieu of Foreclosure Form

Facing the possibility of foreclosure can be a daunting experience for homeowners. One option that may provide a way out is the Deed in Lieu of Foreclosure. This legal document allows a homeowner to voluntarily transfer their property to the lender in exchange for the cancellation of their mortgage debt. By choosing this route, homeowners can avoid the lengthy and often stressful foreclosure process. The form typically outlines the terms of the transfer, including any potential consequences for the homeowner, such as credit impacts. It also details the responsibilities of both the homeowner and the lender during the transaction. Understanding the implications of this form is crucial for anyone considering it as a solution to their financial difficulties. It’s important to weigh the benefits against potential drawbacks, ensuring that this option aligns with one’s long-term financial goals.

Find More Types of Deed in Lieu of Foreclosure Templates

Correction Deed Form California - A Corrective Deed modifies an existing deed with errors.

For those looking to create a legally binding agreement, utilizing resources such as NY Templates can greatly simplify the process of drafting a comprehensive ATV Bill of Sale that meets New York's legal requirements.

Free Printable Gift Deed Form - A Gift Deed can be beneficial in resolving any doubts about the ownership of the property in the future.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required information, such as names, addresses, and property details. Omitting this information can lead to delays or rejection of the deed.

-

Incorrect Property Description: Accurately describing the property is crucial. Errors in the legal description can cause complications in the transfer process.

-

Not Consulting with a Legal Expert: Some people attempt to fill out the form without seeking legal advice. This can result in misunderstandings about the implications of the deed.

-

Failure to Understand Tax Consequences: Individuals often overlook potential tax implications. A deed in lieu of foreclosure may have tax consequences that need to be understood beforehand.

-

Neglecting to Notify Lenders: Not informing the lender about the intent to execute a deed in lieu can lead to further complications. Communication with the lender is essential.

-

Forgetting to Sign and Date: A common mistake is neglecting to sign and date the document. Without these, the deed is not valid.

-

Not Keeping Copies: After submission, individuals often fail to keep copies of the completed form. Retaining a copy is important for future reference and verification.

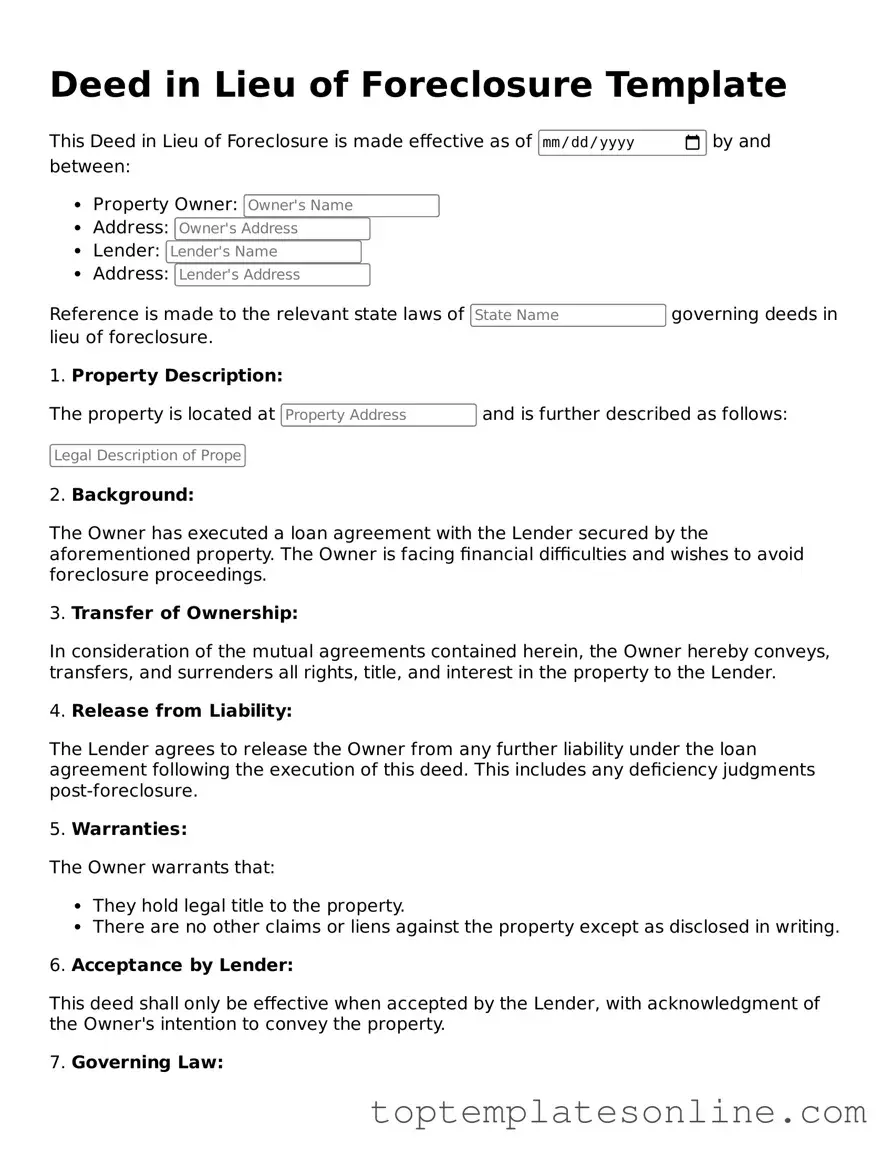

Guide to Writing Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. This action may initiate the process of transferring the property back to the lender, which can help you avoid foreclosure proceedings. Ensure that you keep copies of all documents for your records.

- Begin by entering the date at the top of the form.

- Provide the name of the borrower. This should be the individual or entity that holds the mortgage.

- Next, list the lender’s name and address. Make sure this information is accurate to avoid any delays.

- Include the property address. Specify the full address of the property that is subject to the deed.

- Indicate any outstanding mortgage balance. This is the amount owed on the property at the time of signing.

- Sign the form. The borrower must sign to acknowledge the transfer of property rights.

- Have the signature notarized. This step is often required to validate the deed legally.

- Submit the completed form to the lender. Ensure you keep a copy for your records.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This process often involves several other forms and documents to ensure a smooth transition. Below is a list of commonly used documents in conjunction with the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms, such as interest rates or payment schedules, that may be negotiated before considering a deed in lieu.

- Notice of Default: This formal notice is sent to the borrower indicating that they have defaulted on their mortgage payments. It serves as a precursor to foreclosure proceedings.

- Property Condition Disclosure: This form requires the homeowner to disclose any known issues with the property, ensuring the lender is aware of its condition before accepting the deed.

- Release of Liability: This document releases the homeowner from any further obligations related to the mortgage after the deed is executed, protecting them from future claims by the lender.

- Affidavit of Title: A sworn statement confirming the homeowner's ownership of the property and that there are no undisclosed liens or claims against it, ensuring clear title transfer.

- Non-Disclosure Agreement: This agreement protects sensitive information shared during the process and ensures confidentiality between parties involved. For further resources, visit https://newyorkform.com/free-non-disclosure-agreement-template.

- Settlement Statement: This document details all financial transactions involved in the deed in lieu process, including any costs or fees associated with the transfer of ownership.

Each of these documents plays a critical role in the process of executing a Deed in Lieu of Foreclosure. Understanding their purpose helps ensure a more efficient and clear transition for all parties involved.