Attorney-Approved Durable Power of Attorney Form

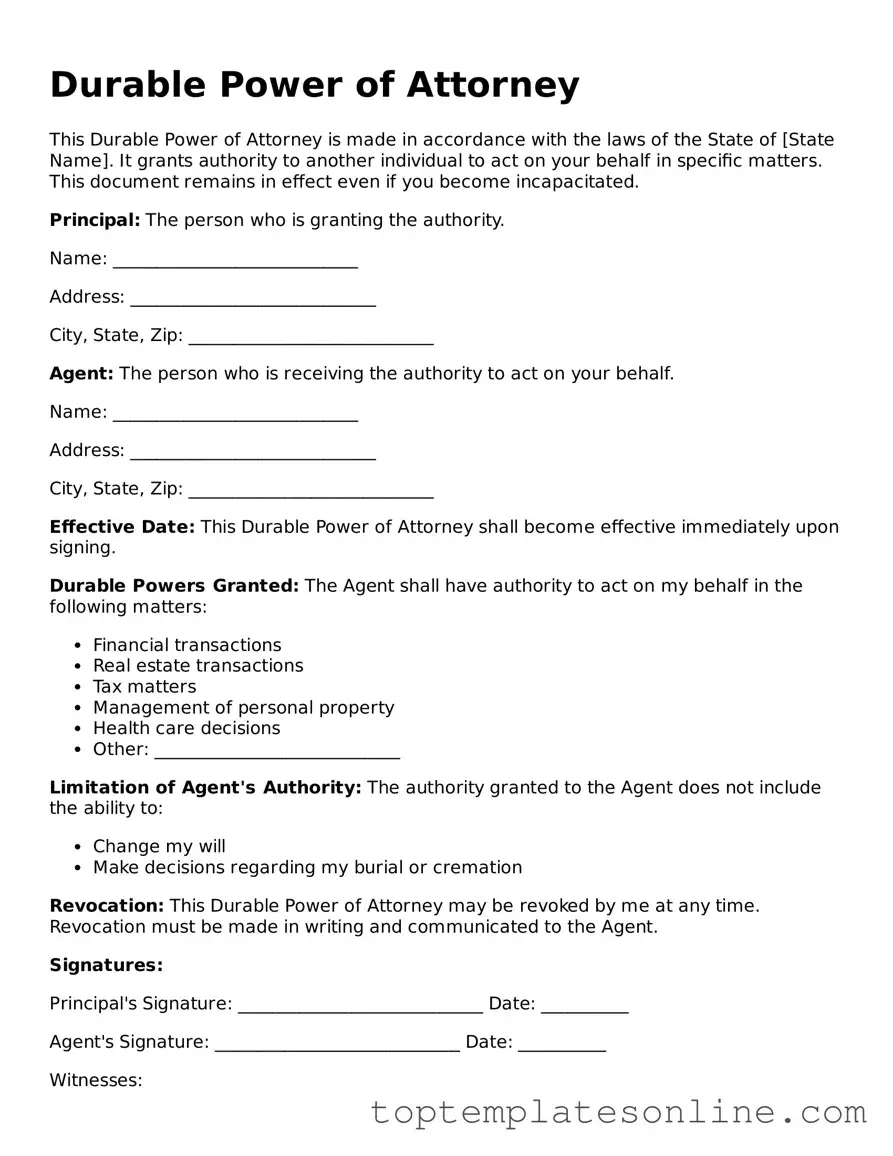

The Durable Power of Attorney (DPOA) form serves as a critical legal document that empowers an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated, ensuring that their wishes are honored during times of vulnerability. A DPOA can cover a wide range of decisions, including financial matters, healthcare choices, and property management, thus providing a comprehensive approach to managing one’s affairs. It is essential for the principal to select a trustworthy agent, as this person will hold significant power over important aspects of their life. Additionally, the DPOA can be tailored to specific needs, allowing for limitations or broad powers as desired. Proper execution of this document, including witnessing and notarization requirements, is crucial to ensure its validity and effectiveness. Understanding the implications and responsibilities associated with a Durable Power of Attorney is vital for both the principal and the agent, as it lays the groundwork for informed decision-making in the future.

State-specific Information for Durable Power of Attorney Documents

Find More Types of Durable Power of Attorney Templates

Real Estate Power of Attorney Template - Serves as a precaution for unexpected circumstances that may interfere with property management.

Power of Attorney for Child Florida - Establishes a legal basis for someone other than a parent to act.

When engaging in activities that involve potential risks, it is essential to have protective measures in place, such as the Hold Harmless Agreement. This agreement serves to shield one party from any liabilities associated with injuries or damages that may arise during the event. For those looking for a comprehensive template to formalize this arrangement, resources like NY Templates can be invaluable.

Power of Attorney for a Motor Vehicle - A Motor Vehicle Power of Attorney can provide peace of mind while you focus on other priorities.

Common mistakes

-

Not specifying the powers granted: It's crucial to clearly outline what powers you are giving to your agent. Vague language can lead to confusion and may limit your agent's ability to act on your behalf.

-

Failing to date the document: A date is essential. Without it, there may be questions about when the authority begins, which can complicate matters later.

-

Not signing in front of a witness: Many states require that the Durable Power of Attorney be signed in front of a witness or notarized. Skipping this step can render the document invalid.

-

Choosing the wrong agent: Selecting someone who may not act in your best interest can lead to serious issues. Choose someone trustworthy and capable of handling your affairs.

-

Ignoring state-specific requirements: Each state has its own rules regarding Durable Power of Attorney forms. Make sure to check your state’s requirements to avoid issues.

-

Not discussing the document with the agent: Your agent should know they have been appointed and understand your wishes. Failing to communicate can lead to misunderstandings.

-

Overlooking alternate agents: It’s wise to name an alternate agent in case your first choice is unable or unwilling to serve. This ensures your affairs will still be managed.

-

Not reviewing the document regularly: Life changes, and so do circumstances. Regularly reviewing your Durable Power of Attorney ensures it still reflects your current wishes.

-

Assuming it’s a one-time task: Many people believe that filling out this form is a one-and-done process. In reality, it may need updates or revisions over time.

Guide to Writing Durable Power of Attorney

After obtaining the Durable Power of Attorney form, you will need to complete it accurately to ensure it reflects your wishes. Follow these steps carefully to fill out the form correctly.

- Begin by entering your full name and address at the top of the form.

- Identify the person you are appointing as your agent. Write their full name and address in the designated section.

- Specify the powers you wish to grant your agent. Check the appropriate boxes or write in additional powers if needed.

- Indicate when the powers become effective. You can choose to make them effective immediately or at a future date.

- Sign and date the form in the presence of a notary public or witnesses, as required by your state.

- Provide a copy of the signed form to your agent and keep a copy for your records.

Documents used along the form

A Durable Power of Attorney (DPOA) is an important legal document that allows an individual to appoint someone else to make decisions on their behalf, especially in financial or medical matters. When preparing a DPOA, there are several other forms and documents that are often used to ensure comprehensive planning and protection. Below is a list of commonly associated documents.

- Living Will: This document outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. It typically addresses end-of-life care and life-sustaining treatments.

- Healthcare Proxy: Similar to a DPOA, a healthcare proxy designates a person to make medical decisions for someone else. It is specifically focused on health-related matters and can be crucial in emergencies.

- Last Will and Testament: This legal document expresses an individual's wishes regarding the distribution of their assets after death. It can also name guardians for minor children and is an essential part of estate planning.

- Revocable Living Trust: This trust allows an individual to manage their assets during their lifetime and specifies how those assets should be distributed upon death. It can help avoid probate and provide more control over asset distribution.

- Room Rental Agreement: To ensure clarity in rental agreements, consider the thorough Room Rental Agreement requirements designed to protect the rights of both landlords and tenants.

- Financial Power of Attorney: This form grants someone the authority to manage financial matters on behalf of another person. Unlike a DPOA, it may not be durable and can become invalid if the principal becomes incapacitated.

Each of these documents serves a unique purpose and can work in conjunction with a Durable Power of Attorney to create a comprehensive plan for managing health and financial matters. It is advisable to consider each document carefully to ensure that all aspects of personal and financial affairs are addressed.