Fillable Employee Advance Form

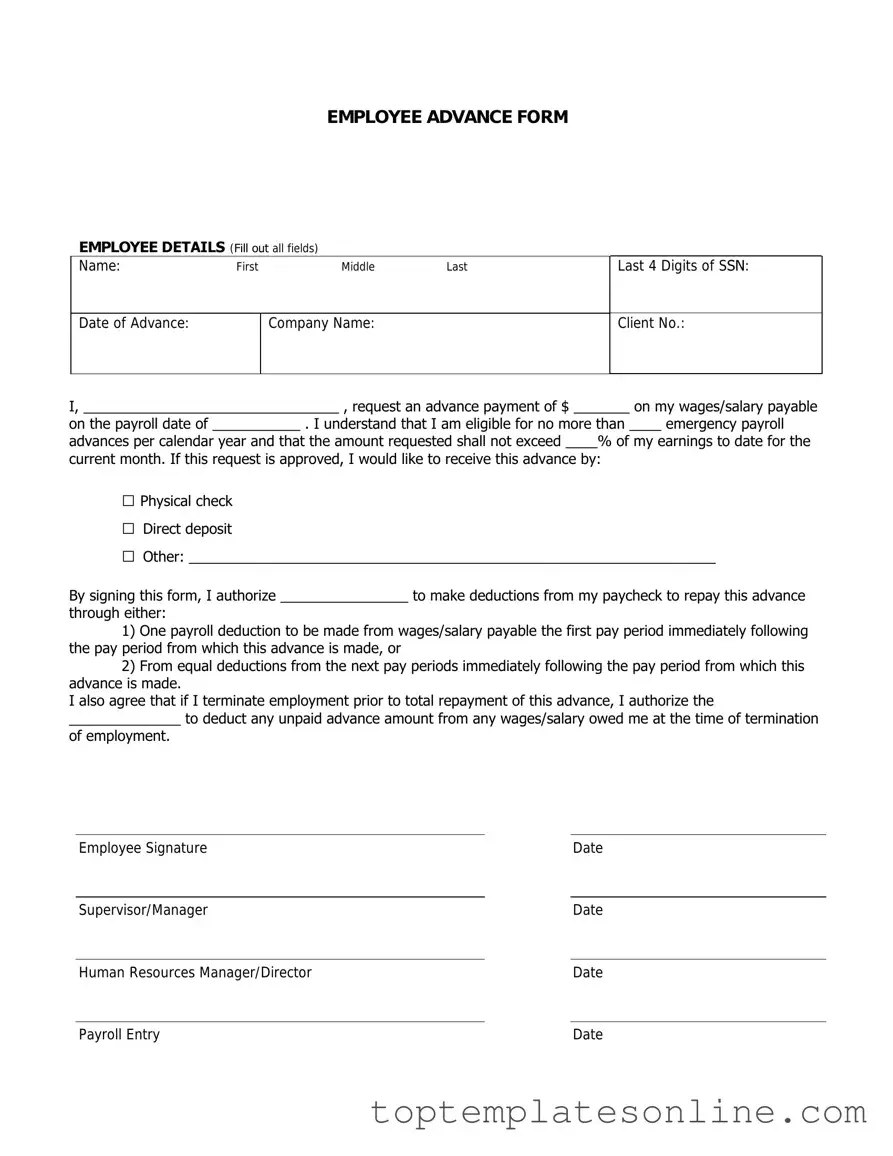

When navigating the complexities of employee compensation, the Employee Advance form emerges as a crucial tool for both employers and employees. This form serves as a request mechanism for employees seeking financial assistance before their regular paychecks are issued. It outlines the essential details of the advance, including the amount requested, the purpose of the advance, and the repayment terms. Employers benefit from having a standardized process to manage these requests, ensuring consistency and clarity in financial dealings. Additionally, this form helps maintain transparency, as it requires employees to specify how the advance will be utilized, fostering responsible financial behavior. Understanding the intricacies of the Employee Advance form can empower employees to make informed decisions while providing employers with a structured approach to financial support. Properly completing and submitting this form can lead to smoother payroll processes and improved employee satisfaction.

Common PDF Templates

Dd 214 - The form is considered an important record and should be safeguarded appropriately.

Profits or Loss From Business - Stay aware of the deadlines for filing Schedule C to avoid penalties and interest on late submissions.

A comprehensive understanding of the Florida Quitclaim Deed is crucial for both grantors and grantees. This legal document not only facilitates the transfer of property ownership without warranties but also simplifies transactions, especially between family members. For anyone looking to navigate this process seamlessly, resources such as Florida Forms can provide the necessary guidance and templates to ensure the deed is executed correctly.

California Sdi - The DE 2501 helps determine how much financial support a claimant may receive.

Common mistakes

-

Missing Information: One of the most common mistakes is leaving out essential details. Make sure to fill in your name, employee ID, and department. Missing even one piece of information can delay the approval process.

-

Incorrect Amount Requested: Double-check the amount you’re requesting. It’s easy to miscalculate or enter the wrong figure. Ensure that the amount aligns with your intended expenses.

-

Not Providing a Purpose: Failing to clearly state the purpose of the advance can lead to confusion. Be specific about why you need the funds. This helps your supervisor understand the necessity of the request.

-

Neglecting to Attach Documentation: If required, always include supporting documents. Whether it's receipts or estimates, having the right paperwork can strengthen your case for the advance.

-

Ignoring Company Policy: Every company has its own policies regarding advances. Familiarize yourself with these guidelines. Not adhering to them can result in your request being denied.

-

Submitting Late: Timeliness matters. If you submit your request too close to the date you need the funds, it may not get processed in time. Aim to submit your form as early as possible.

-

Forgetting to Sign: It sounds simple, but forgetting to sign the form can cause delays. Always check to ensure your signature is on the document before submission.

-

Not Following Up: After submission, don’t assume everything is in order. It’s wise to follow up to confirm that your request is being processed. This can help catch any issues early.

Guide to Writing Employee Advance

After you have gathered the necessary information, you are ready to complete the Employee Advance form. This form is essential for requesting an advance on your salary for specific expenses. Follow these steps carefully to ensure accurate submission.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your employee identification number. This helps to identify your records in the system.

- Fill in the date on which you are submitting the form.

- Specify the amount you are requesting as an advance. Make sure this amount aligns with your intended expenses.

- Clearly state the purpose of the advance. Briefly explain what the funds will be used for.

- Include any supporting documentation if required. Attach copies of receipts or estimates related to your request.

- Review all the information you have entered for accuracy.

- Sign and date the form to confirm your request.

- Submit the completed form to your supervisor or the designated department.

Documents used along the form

When dealing with employee advances, several other forms and documents often accompany the Employee Advance form to ensure a smooth and transparent process. Each of these documents plays a crucial role in documenting the transaction and maintaining accountability within the organization.

- Expense Reimbursement Form: This form allows employees to claim reimbursement for out-of-pocket expenses incurred while performing their job duties. It details the nature of the expenses and requires receipts for verification.

- Payroll Deduction Authorization: This document authorizes the employer to deduct the amount of the advance from the employee's future paychecks. It outlines the repayment terms and ensures both parties are aware of the financial arrangement.

- Articles of Incorporation: This essential document establishes a corporation in New York, detailing its name, purpose, office address, and incorporator information. For a comprehensive guide, you can refer to the newyorkform.com/free-articles-of-incorporation-template.

- Employee Agreement: This is a formal agreement that outlines the terms and conditions of the advance. It typically includes the amount, repayment schedule, and any potential consequences for non-repayment.

- Budget Approval Form: Often necessary for larger advances, this form requires managerial approval to ensure that the requested funds align with the company’s budget and financial policies.

- Request for Leave Form: If the advance is related to a personal matter requiring time off, this form is used to formally request leave from work. It helps the employer manage staffing and operational needs.

- Tax Documentation: Depending on the nature of the advance, certain tax documents may be required to ensure compliance with IRS regulations. These documents help clarify the tax implications for both the employee and employer.

By using these additional forms and documents, organizations can create a structured approach to managing employee advances. This not only fosters transparency but also helps in maintaining accurate records, ultimately benefiting both the employee and the employer.