Attorney-Approved Employee Loan Agreement Form

The Employee Loan Agreement form serves as a crucial document in the employer-employee relationship, providing a structured framework for financial assistance within the workplace. This form outlines the specific terms and conditions under which an employee can receive a loan from their employer, ensuring clarity and mutual understanding. Key elements typically included in the agreement are the loan amount, repayment schedule, interest rates, and any penalties for late payments. Additionally, the form may specify the purpose of the loan, whether it is for personal needs, emergencies, or other designated uses. By detailing the responsibilities of both parties, the Employee Loan Agreement fosters transparency and protects the rights of both the employer and the employee. Ultimately, this form not only facilitates financial support but also reinforces trust and cooperation in the workplace, making it an essential tool for managing employee relations.

Common mistakes

-

Inaccurate Personal Information: Employees often forget to double-check their names, addresses, or Social Security numbers. Mistakes in this section can delay the processing of the loan.

-

Loan Amount Errors: Some individuals miscalculate the amount they wish to borrow. It's crucial to ensure that the requested amount aligns with the company’s lending policies and personal needs.

-

Missing Signatures: Failing to sign the agreement or leaving out required witness signatures can render the document invalid. Each signature is essential for the agreement to be enforceable.

-

Overlooking Repayment Terms: Employees may not fully understand or may overlook the repayment schedule. This can lead to confusion about when payments are due and how much is owed.

-

Ignoring Company Policies: Not reviewing the company’s loan policies before filling out the form can lead to misunderstandings. Each organization has specific guidelines that must be followed.

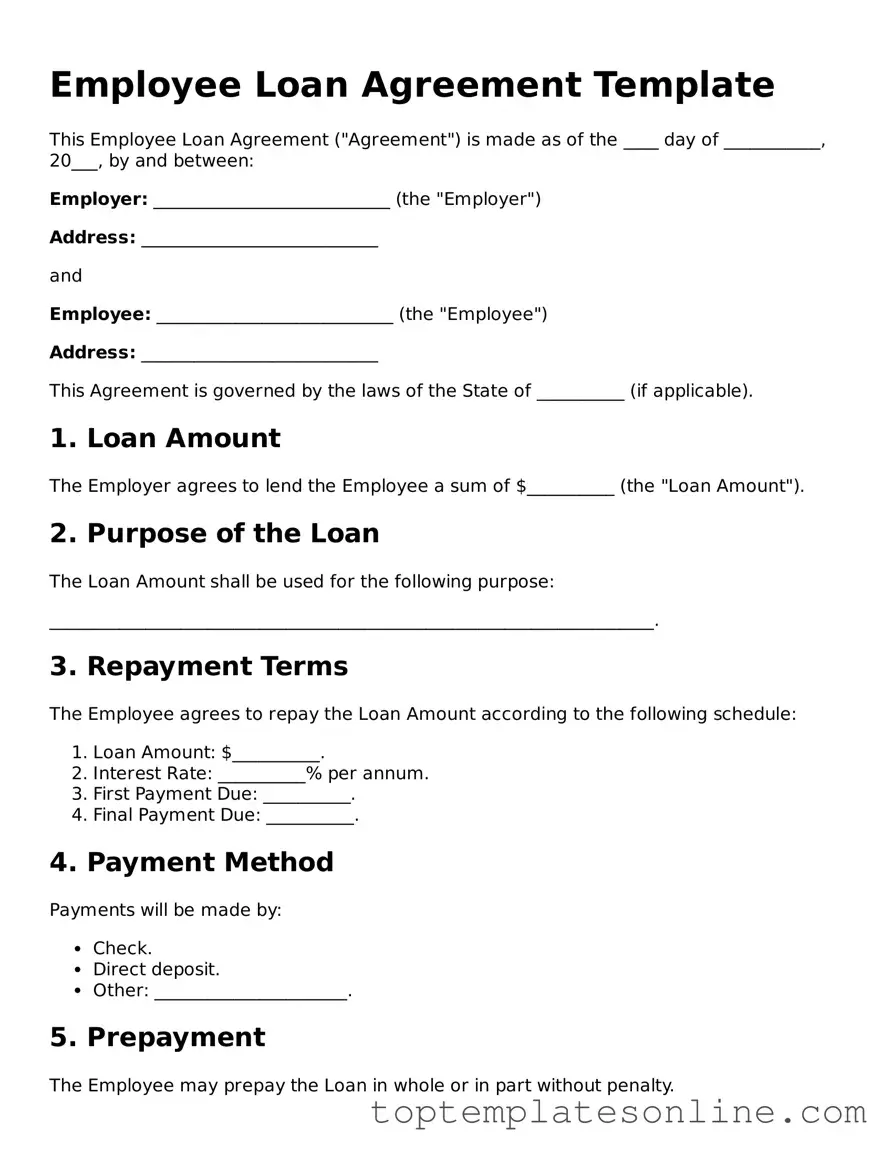

Guide to Writing Employee Loan Agreement

Completing the Employee Loan Agreement form is an important step in formalizing the terms of the loan between an employee and the employer. This process ensures that both parties understand their rights and responsibilities. Follow the steps below to fill out the form accurately.

- Begin by entering the date at the top of the form.

- Provide the employee's full name in the designated section.

- Fill in the employee's job title and department.

- State the total amount of the loan being requested.

- Specify the purpose of the loan in the appropriate field.

- Indicate the repayment terms, including the duration and frequency of payments.

- Include any interest rate applicable to the loan, if relevant.

- Sign and date the form at the bottom to confirm agreement.

- Have the employer or authorized representative sign the form as well.

After completing the form, it is advisable to keep a copy for personal records. Both parties should maintain a clear understanding of the agreement to ensure a smooth repayment process.

Documents used along the form

An Employee Loan Agreement form is a crucial document that outlines the terms and conditions of a loan provided to an employee by their employer. However, several other forms and documents often accompany this agreement to ensure clarity and legal compliance. Below is a list of these documents, each serving a specific purpose in the loan process.

- Promissory Note: This document serves as a written promise from the employee to repay the loan amount. It includes details such as the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Application Form: Employees typically fill out this form to formally request a loan. It includes personal information, the amount requested, and the purpose of the loan.

- Repayment Schedule: This document outlines the timeline for loan repayment, including due dates and amounts. It helps both parties keep track of payments and obligations.

- Authorization for Payroll Deduction: Employees may need to sign this form to allow the employer to deduct loan payments directly from their paycheck, simplifying the repayment process.

- Loan Disclosure Statement: This statement provides a summary of the loan terms, including fees, interest rates, and total repayment amounts, ensuring transparency for the employee.

- Loan Agreement form: A necessary document that serves as a legally binding contract between a lender and a borrower, outlining terms and conditions, repayment schedules, and responsibilities of all parties involved. For more information and to fill out the form, visit https://legaldocumentstemplates.com/.

- Employee Agreement to Terms: This document confirms that the employee understands and agrees to the terms outlined in the Employee Loan Agreement and any related documents.

- Default Notice: In the event of missed payments, this notice serves as a formal communication to the employee regarding the default status and potential consequences.

- Termination of Loan Agreement: This document is used to formally conclude the loan agreement once it has been fully repaid or if it is terminated for any reason.

Each of these documents plays an important role in the employee loan process, ensuring that both the employer and employee have a clear understanding of their rights and responsibilities. Proper documentation helps prevent misunderstandings and provides a structured approach to managing employee loans.