Fillable Erc Broker Market Analysis Form

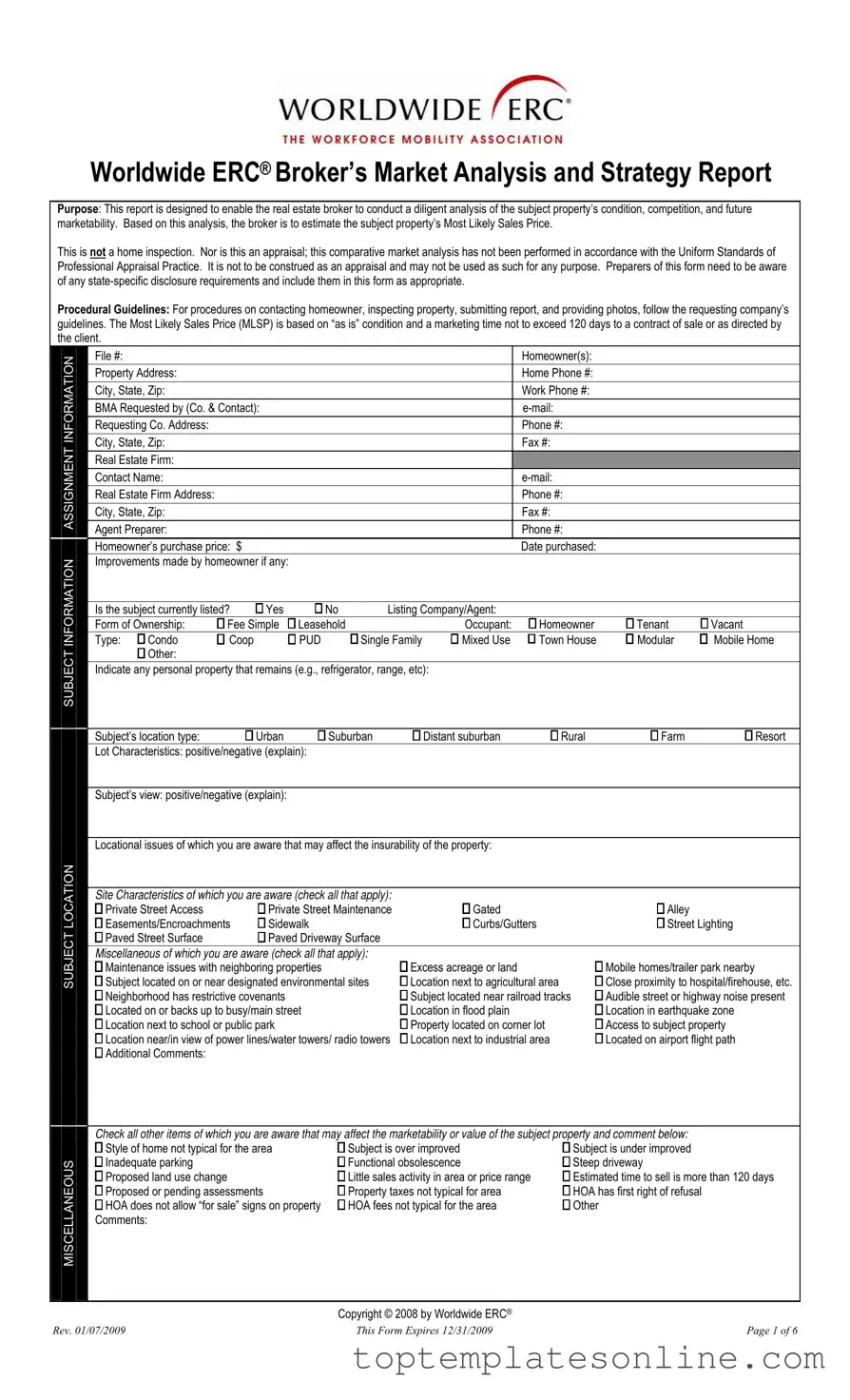

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a critical tool for real estate brokers tasked with evaluating a property's market position. This comprehensive form guides brokers in assessing the condition of the subject property, its competitive landscape, and its potential for future marketability. Through a detailed analysis, brokers estimate the Most Likely Sales Price (MLSP) based on the property's current state and anticipated marketing time, which should not exceed 120 days unless otherwise directed by the client. It is essential to note that this report is distinct from a home inspection or an appraisal, as it does not adhere to the Uniform Standards of Professional Appraisal Practice. Brokers must also consider any state-specific disclosure requirements, ensuring compliance while filling out the form. The report includes sections for gathering vital information about the property, such as its location, type, ownership, and any improvements made by the homeowner. Additionally, it prompts brokers to document the property’s condition, necessary repairs, and any locational issues that may impact insurability. By systematically gathering this information, brokers can provide a more accurate and informed market analysis, ultimately benefiting homeowners and potential buyers alike.

Common PDF Templates

Profits or Loss From Business - Incorporating an accountant's help when filling out Schedule C may aid in maximizing tax benefits.

A Florida Non-disclosure Agreement (NDA) is a legally binding contract designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping confidential information private, ensuring that proprietary details remain secure. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets in the state of Florida, and for more information, you can consult Florida Forms.

Death Certificate Affidavit - The document assures that the property title reflects the surviving tenant’s rights after a joint tenant dies.

Wage and Income Transcript - The customer file number facilitates internal tracking for tax authorities and is unique to the taxpayer's account.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to misunderstandings and incomplete analyses. Ensure every section is addressed.

-

Incorrect Contact Details: Providing inaccurate homeowner or broker contact information can hinder communication. Double-check phone numbers and email addresses.

-

Omitting Property Condition: Not noting specific property issues like water damage or structural concerns can mislead potential buyers. Always document visible defects.

-

Ignoring Local Regulations: Each state has unique disclosure requirements. Neglecting to incorporate these can lead to legal complications.

-

Misestimating Market Value: Failing to base the Most Likely Sales Price on accurate market data can result in pricing errors. Use recent sales data for better accuracy.

-

Neglecting Competing Listings: Not comparing the subject property with similar listings can lead to a flawed market analysis. Always include relevant comparables.

-

Overlooking Neighborhood Issues: Ignoring locational factors such as noise or proximity to undesirable sites can affect marketability. Be thorough in your assessments.

-

Inaccurate Financing Information: Misrepresenting potential financing options or issues can confuse buyers and agents. Clearly outline financing possibilities.

-

Failing to Document Repairs: Not listing necessary repairs or improvements can misrepresent the property's condition. Be explicit about what needs attention.

Guide to Writing Erc Broker Market Analysis

Filling out the ERC Broker Market Analysis form requires careful attention to detail. This process is essential for accurately assessing a property’s condition and marketability. The information collected will guide the broker in estimating the Most Likely Sales Price for the property. Following these steps will help ensure that the form is completed thoroughly and correctly.

- Begin by entering the File #, Homeowner(s), and Property Address in the designated fields.

- Provide the Home Phone #, Work Phone #, and the e-mail address of the homeowner.

- Fill in the details for the BMA Requested by section, including Company & Contact, Address, Phone #, City, State, Zip, and Fax #.

- Complete the Real Estate Firm section with the Firm Name, Contact Name, e-mail, Address, Phone #, City, State, Zip, and Fax #.

- Document the Agent Preparer information and the homeowner’s purchase price along with the Date purchased.

- Indicate any Improvements made by the homeowner and whether the property is currently listed.

- Specify the Form of Ownership and the Occupant type (Homeowner, Tenant, or Vacant).

- Detail the Type of property (e.g., Condo, Single Family, etc.) and any personal property that remains.

- Assess the Subject’s location type and describe the Lot Characteristics and Subject’s view.

- List any Locational issues that may affect the insurability of the property.

- Check all applicable Site Characteristics and Miscellaneous

- Evaluate the Property Condition and check the appropriate boxes for any observed issues.

- Estimate costs for Recommended Repairs and Improvements for both interior and exterior items.

- Identify all required inspections and disclosures relevant to the property.

- Determine the most probable means of financing for the subject property and describe any financing concessions needed.

- Assess the Subject Neighborhood and Broader Market Area, noting any economic conditions affecting marketability.

- Compile a list of Competing Listings and Comparable Sales with detailed information for each.

- Finally, provide any additional comments or insights regarding the property and its market conditions.

Documents used along the form

When preparing the ERC Broker Market Analysis form, several other documents are often needed to provide a comprehensive overview of the property and its market context. Below is a list of these forms, each serving a specific purpose in the process.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. It ensures transparency between the seller and buyer about the condition of the home.

- Comparative Market Analysis (CMA): A CMA helps to evaluate similar properties in the area that have recently sold. It assists in determining a fair market price for the subject property.

- Inspection Report: This report is generated by a licensed inspector and details the physical condition of the property. It identifies any repairs that may be needed before a sale.

- Appraisal Report: An appraisal provides an independent assessment of the property’s value. This document is often required by lenders before approving a mortgage.

- Title Report: This report confirms the legal ownership of the property and checks for any liens or encumbrances. It ensures that the seller has the right to sell the property.

- Sales Contract: This legal document outlines the terms of the sale, including the purchase price, contingencies, and closing date. It is essential for formalizing the transaction.

- Dirt Bike Bill of Sale Form: To ensure a smooth transfer of ownership, consider our dirt bike bill of sale form essentials that outline the necessary legal requirements.

- Financing Pre-Approval Letter: This letter from a lender indicates that a buyer is pre-approved for a mortgage. It strengthens the buyer's position in negotiations.

These documents collectively provide a clearer picture of the property’s marketability and condition. Ensuring that all necessary forms are completed accurately will facilitate a smoother transaction process.