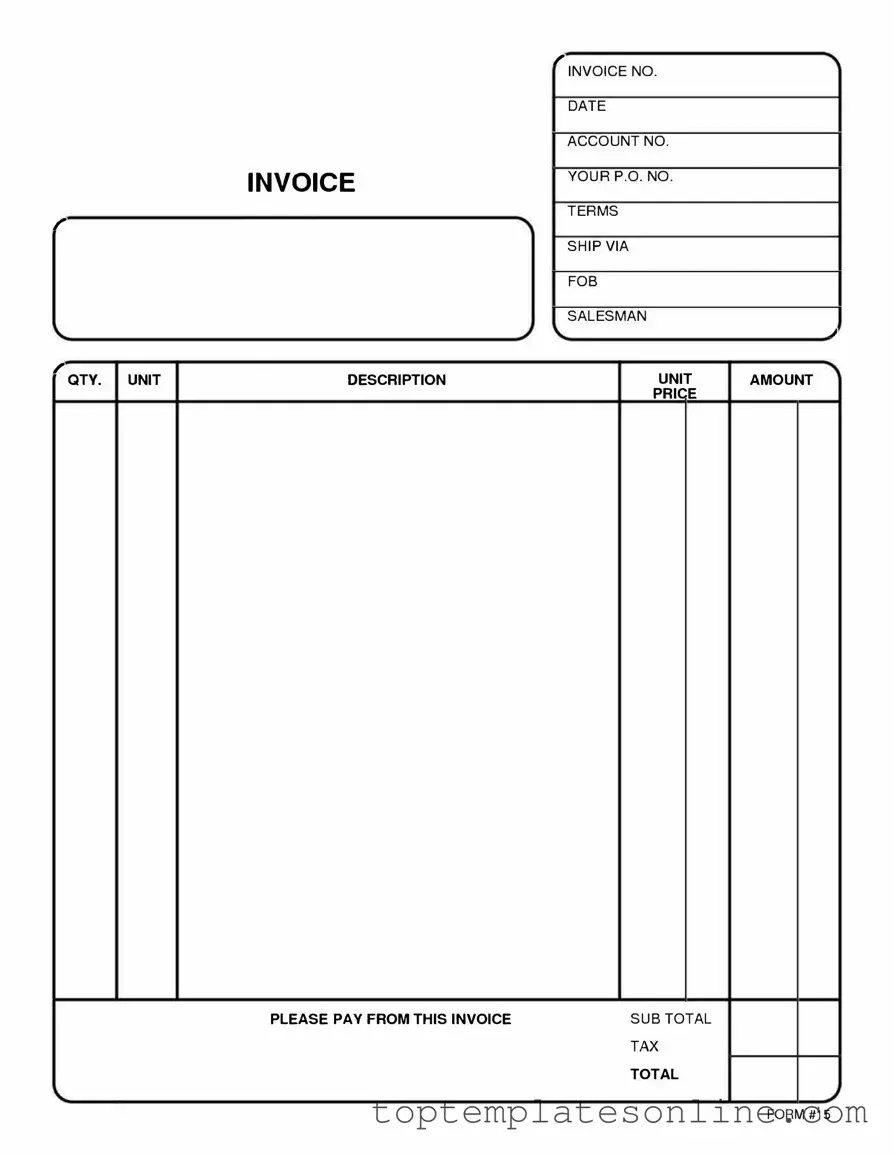

Fillable Free And Invoice Pdf Form

The Free And Invoice PDF form serves as a vital tool for individuals and businesses alike, streamlining the process of billing and payment collection. This form is designed to facilitate clear communication regarding services rendered or products sold, ensuring that all necessary information is included for both the issuer and the recipient. Key components of the form typically include the name and contact information of the seller, a detailed description of the goods or services provided, the total amount due, payment terms, and due dates. By utilizing this form, users can maintain accurate records of transactions, which is essential for accounting and tax purposes. Additionally, the PDF format ensures that the invoice can be easily shared and printed, providing a professional appearance that enhances credibility. Overall, the Free And Invoice PDF form is an indispensable resource for managing financial interactions efficiently and effectively.

Common PDF Templates

Employment Application Template - This form is used to apply for employment with the organization.

The California Employment Verification form is crucial for verifying an employee's job status and related information with their employer, serving important purposes such as loan applications and background checks. For those looking to access the form conveniently, visit PDF Documents Hub to get started.

Cg 2010 - Operational jurisdiction is defined within the endorsement.

Common mistakes

-

Omitting Important Information: Many individuals forget to include crucial details such as their full name, address, or contact information. This omission can lead to delays in processing or even rejection of the invoice.

-

Incorrect Formatting: Users often overlook the required format for dates, amounts, or item descriptions. Not adhering to the specified format can cause confusion and may result in errors during processing.

-

Failing to Review for Accuracy: It is common for people to submit forms without thoroughly checking for mistakes. Typos or incorrect figures can have significant implications, including payment delays or disputes.

-

Neglecting to Sign: Some individuals forget to sign the form, which is essential for validating the document. A lack of signature can render the invoice invalid, leading to complications in payment.

-

Not Keeping a Copy: After submitting the form, many fail to retain a copy for their records. Keeping a copy is vital for tracking payments and resolving any future discrepancies.

Guide to Writing Free And Invoice Pdf

Completing the Free And Invoice PDF form is a straightforward process that requires attention to detail. By following the steps outlined below, you can ensure that all necessary information is accurately provided. This will help facilitate the next stages of your transaction or request.

- Begin by downloading the Free And Invoice PDF form from the designated source.

- Open the form using a PDF reader that allows for editing or filling out forms.

- Locate the section for your personal information. Fill in your name, address, and contact details as requested.

- Move on to the area designated for the recipient's information. Provide the name and address of the person or entity you are invoicing.

- Next, find the section for itemized billing. List each item or service provided, along with the corresponding prices and quantities.

- Ensure that the total amount due is calculated correctly at the bottom of the itemized list.

- If applicable, include any additional notes or terms in the designated area.

- Review the entire form for accuracy. Make sure all fields are completed and that there are no errors.

- Save the filled form to your device, ensuring that you keep a copy for your records.

- Finally, print the form if a hard copy is required, or prepare it for electronic submission as needed.

Documents used along the form

When managing financial transactions, several forms and documents complement the Free And Invoice PDF form. Each of these documents plays a crucial role in ensuring clarity, compliance, and effective communication between parties. Below is a list of commonly used forms that can enhance your invoicing process.

- Purchase Order (PO): This document outlines the specifics of a purchase, including quantities, prices, and terms. It serves as a formal agreement between the buyer and seller before the goods or services are delivered.

- Receipt: A receipt is a proof of payment that details the transaction. It includes information such as the date, amount paid, and the items purchased, providing both parties with a record of the exchange.

- Credit Memo: This document is issued to adjust the amount owed by the buyer. It can be used to correct billing errors or to provide a refund for returned goods, ensuring accurate financial records.

- Statement of Account: A statement summarizes all transactions between a buyer and seller over a specific period. It helps both parties track outstanding balances and payment history.

- Contract Agreement: This legal document outlines the terms and conditions of a business relationship. It defines the responsibilities and expectations of each party, providing a framework for the transaction.

- RV Bill of Sale: To ensure proper transfer of ownership, refer to our guidelines for the essential RV Bill of Sale document which outlines all necessary details and legal requirements.

- Delivery Note: This document accompanies goods during transportation. It confirms the items delivered, their condition, and serves as a checklist for the recipient upon receipt.

- Tax Invoice: A tax invoice includes specific information required by tax authorities, such as tax identification numbers and applicable tax rates. It is essential for businesses to comply with tax regulations.

- Payment Terms Document: This document outlines the agreed-upon terms for payment, including due dates, late fees, and acceptable payment methods. Clear payment terms help prevent misunderstandings.

Utilizing these documents alongside the Free And Invoice PDF form can streamline your invoicing process and enhance communication. Each form serves a distinct purpose, and together they create a comprehensive system for managing financial transactions effectively.