Fillable Generic Direct Deposit Form

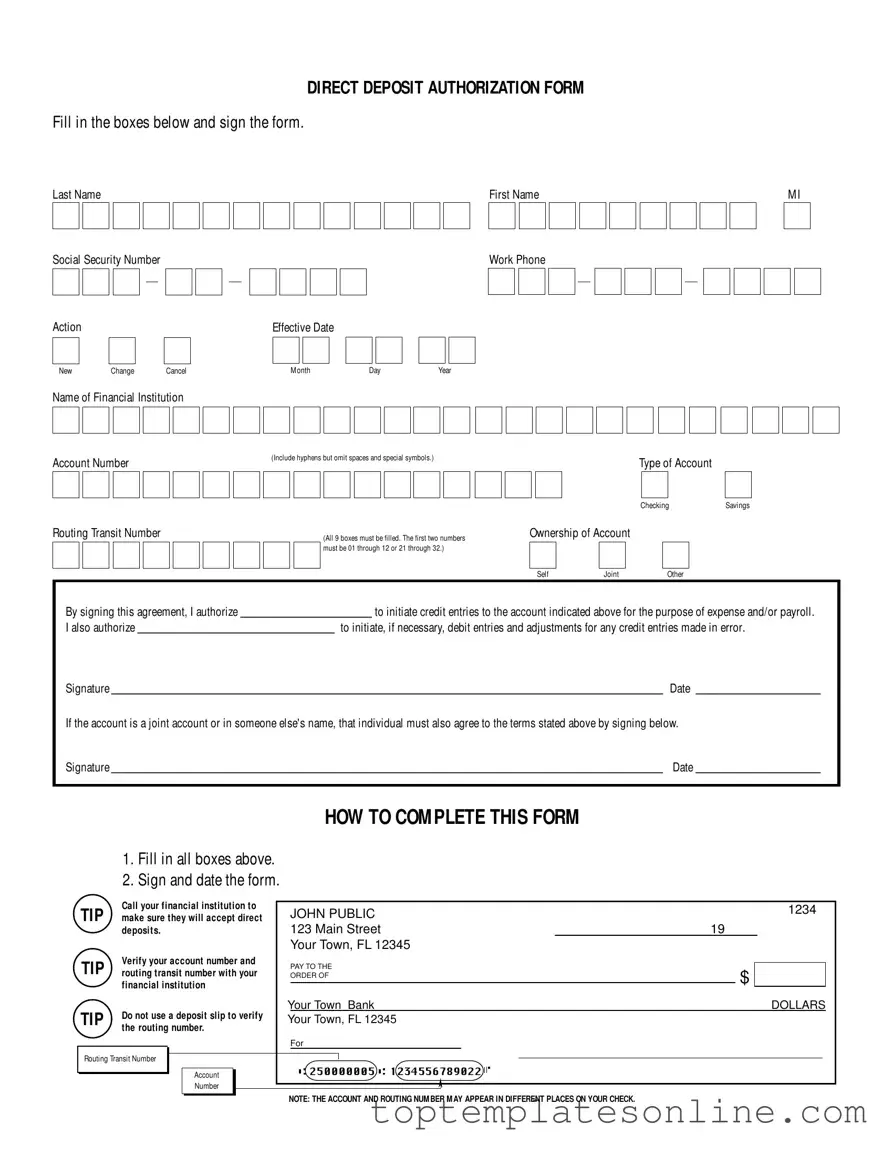

The Generic Direct Deposit form is an essential tool for individuals looking to streamline their payment processes. This form allows you to authorize your employer or another organization to deposit funds directly into your bank account, eliminating the need for paper checks. To complete the form, you'll need to provide your personal information, including your name and Social Security number, as well as details about your financial institution, such as the account number and routing transit number. It's important to specify whether you want the funds deposited into a checking or savings account. The form also includes options for new setups, changes, or cancellations of existing direct deposit arrangements. By signing the form, you grant permission to initiate credit entries and, if necessary, debit entries for any errors. For joint accounts, both account holders must sign to agree to the terms. Clear instructions guide you through the completion process, ensuring that all necessary fields are filled out correctly to avoid delays in receiving your funds.

Common PDF Templates

Roof Estimate Sample - Receive a transparent breakdown of repair or replacement costs.

The New York Hold Harmless Agreement form is a legal document designed to protect one party from liability for any injuries or damages that may occur during a specific activity or event. By signing this form, individuals agree to assume the risk and release the other party from responsibility. This agreement is commonly used in various contexts, including events, construction projects, and recreational activities, and you can find a useful template at NY Templates.

Insurance Card Maker - The card must be presented to authorities upon request during an accident investigation.

Common mistakes

-

Neglecting to fill in all required fields: Every box must be completed. Missing information can lead to delays or errors in processing.

-

Incorrect Social Security Number: Ensure the number is accurate and formatted correctly. Mistakes can cause significant issues with payroll.

-

Not confirming the account type: Specify whether the account is a savings or checking account. This is essential for proper processing.

-

Routing Transit Number errors: All nine boxes must be filled. Double-check with your financial institution to avoid mistakes.

-

Using special symbols or spaces: When entering the account number, omit any spaces or special symbols. This can lead to processing failures.

-

Failing to sign and date the form: Both signatures are required if the account is joint. Missing signatures will invalidate the form.

-

Not verifying with the financial institution: Always confirm that your bank accepts direct deposits before submitting the form.

-

Using a deposit slip for verification: Avoid this practice. It can lead to incorrect routing numbers. Always verify directly with your bank.

-

Providing outdated information: Ensure all details are current, including your name and address. Changes can affect payment processing.

-

Ignoring the effective date: Specify the effective date for the direct deposit. Failing to do so can result in delays in receiving funds.

Guide to Writing Generic Direct Deposit

After completing the Generic Direct Deposit form, you will submit it to your employer or the designated department. This will help ensure that your payments are deposited directly into your bank account. Follow these steps to fill out the form correctly.

- Write your Last Name, First Name, and M I in the provided boxes.

- Enter your Social Security Number in the format of XXX-XX-XXXX.

- Select the appropriate Action (New, Change, or Cancel) and fill in the Effective Date (Month, Day, Year).

- Provide your Work Phone number in the format of XXX-XXX-XXXX.

- Write the name of your Financial Institution in the designated box.

- Fill in your Account Number (include hyphens, but omit spaces and special symbols).

- Select the Type of Account (Savings or Checking).

- Enter your Routing Transit Number (ensure all 9 boxes are filled and the first two numbers are between 01-12 or 21-32).

- Indicate the Ownership of Account (Self, Joint, or Other).

- Sign and date the form in the appropriate sections.

- If applicable, have the other account holder sign and date the form as well.

Make sure to double-check all entries for accuracy before submitting the form. This will help avoid any delays in processing your direct deposit.

Documents used along the form

The Generic Direct Deposit form is essential for setting up automatic deposits into a bank account. However, it is often accompanied by several other important documents that help streamline the process and ensure accuracy. Below is a list of five common forms and documents that may be used alongside the Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. By providing information about allowances and additional withholding, it helps determine the amount of federal income tax to withhold from each paycheck.

- Bank Account Verification Letter: A letter from the financial institution confirming the account holder's details. This document typically includes the account number and routing number, ensuring the employer has accurate information for direct deposits.

- Employment Verification Form: This document serves to confirm the employment status of an individual. It may be required by the bank or financial institution to process the direct deposit request.

- Room Rental Agreement Form: For those looking to rent in New York, the necessary Room Rental Agreement form details outline the obligations of both landlords and tenants, ensuring clarity in the rental arrangement.

- Void Check: A check that has "VOID" written across it is often requested to verify account details. It provides the necessary routing and account numbers in a clear format, reducing the chance of errors.

- Direct Deposit Agreement: This is a formal agreement between the employee and employer regarding the terms of the direct deposit. It outlines the responsibilities of both parties and may include details about how changes to the deposit can be made.

These documents collectively help ensure that the direct deposit process is efficient and accurate. By preparing and submitting them alongside the Generic Direct Deposit form, individuals can facilitate a smoother experience with their payroll or expense reimbursements.