Blank Deed in Lieu of Foreclosure Template for Georgia State

In Georgia, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively settling the mortgage debt. By doing so, the homeowner can often avoid the lengthy and stressful foreclosure process. The Deed in Lieu of Foreclosure can provide a fresh start, as it may also help preserve the homeowner's credit score compared to a traditional foreclosure. It is important to understand that this form requires careful consideration and negotiation with the lender, as they must agree to accept the deed in lieu. Additionally, the homeowner should be aware of any potential tax implications and how this transfer might affect their financial situation moving forward. Overall, this option can serve as a practical solution for those looking to navigate the challenges of homeownership during difficult times.

Some Other State-specific Deed in Lieu of Foreclosure Templates

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - This process can provide an opportunity for families to regroup and strategize moving forward.

For those seeking to join the Commuter Benefits Program, accessing the Access-A-Ride NYC Application form is essential, and for a comprehensive resource, individuals can refer to NY Templates which provides guidance on the application process, ensuring all necessary steps are followed for successful enrollment in the Access-A-Ride/Paratransit plan.

Common mistakes

-

Not including all necessary parties: Ensure that all owners of the property are listed on the deed. Missing a signature can lead to legal complications later.

-

Incorrect property description: Provide a clear and accurate description of the property. Use the legal description from the original deed to avoid confusion.

-

Failure to notarize: The deed must be notarized to be valid. Skipping this step can render the document unenforceable.

-

Not understanding tax implications: Consult a tax professional. There may be tax consequences associated with transferring the property through a deed in lieu of foreclosure.

-

Omitting the lender's consent: Make sure you have the lender's agreement before proceeding. The lender must accept the deed for it to be effective.

-

Using outdated forms: Always use the most current version of the form. Laws change, and using an outdated form can lead to issues.

-

Not keeping copies: After completing the form, keep copies for your records. Having documentation is important for future reference.

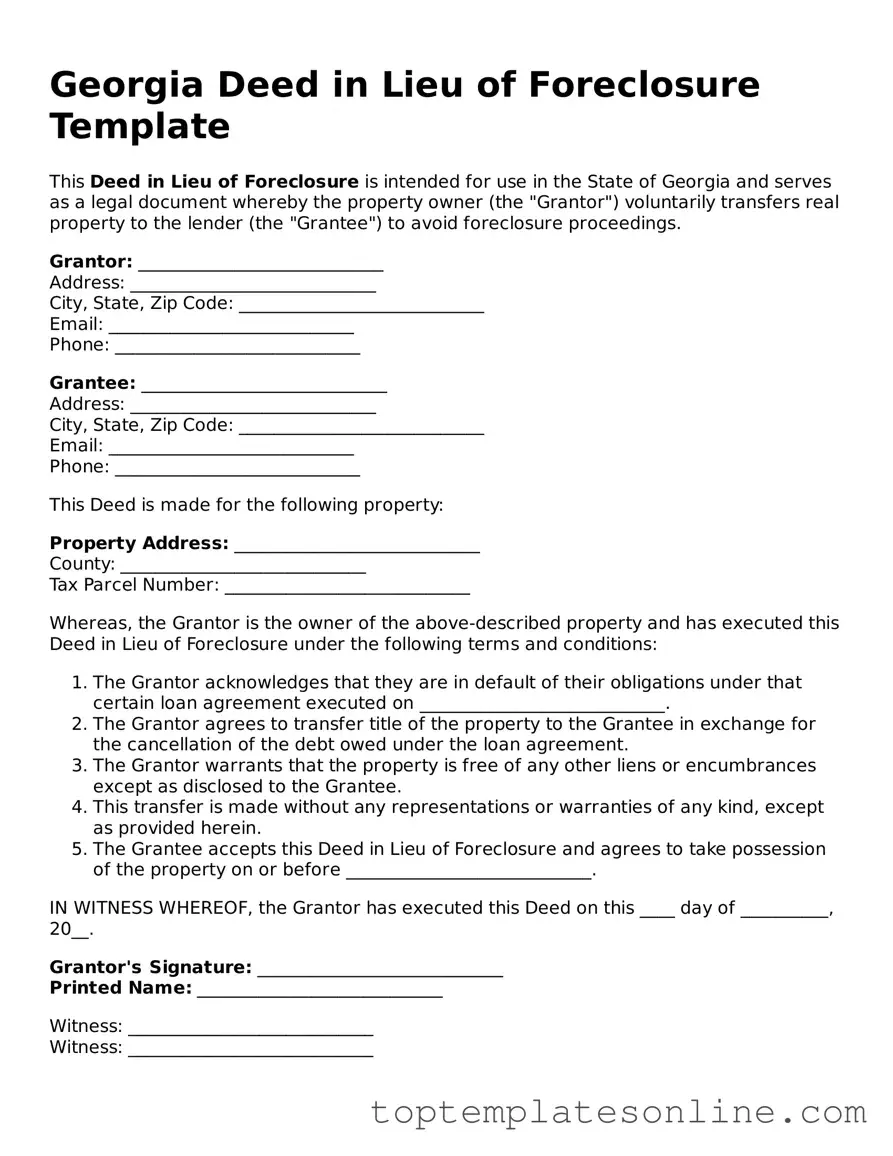

Guide to Writing Georgia Deed in Lieu of Foreclosure

After you complete the Georgia Deed in Lieu of Foreclosure form, it is important to ensure that all parties involved understand the next steps. This may include submitting the completed form to the appropriate parties, such as your lender or the county clerk's office, and following any additional requirements they may have.

- Begin by downloading the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- Read the entire form carefully to understand the information required.

- Fill in the date at the top of the form.

- Enter the names of the parties involved, including the borrower and the lender.

- Provide the property address, including the county and state.

- Include a legal description of the property. This may be found in your mortgage documents.

- State the reason for the deed in lieu of foreclosure in the designated area.

- Sign and date the form where indicated. Ensure that all signatures are provided by all parties involved.

- Have the form notarized. A notary public will verify the identities of the signers and witness the signing.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender and any other required parties, such as the county clerk’s office.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Georgia, several other documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and can help protect the interests of both the borrower and the lender. Below is a list of common forms and documents that are often used alongside the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms, which may include interest rates or repayment schedules. It can provide a more manageable solution for borrowers facing financial difficulties.

- Notice of Default: This formal notice informs the borrower that they are in default on their mortgage payments. It is a crucial step in the foreclosure process and must be provided before proceeding with a Deed in Lieu.

- Release of Liability: This document releases the borrower from any further obligations under the mortgage once the Deed in Lieu is executed. It protects the borrower from potential future claims by the lender.

- Property Inspection Report: Often required by lenders, this report assesses the condition of the property. It helps determine any necessary repairs or maintenance that may affect the value of the home.

- Title Search Report: This document verifies the ownership of the property and checks for any liens or encumbrances. A clear title is essential for a successful Deed in Lieu transaction.

- Affidavit of Title: This sworn statement confirms that the seller has clear title to the property and discloses any known issues. It provides assurance to the lender regarding the property’s status.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any costs associated with the Deed in Lieu. It ensures transparency between the parties involved.

- Florida Notice to Quit: A necessary form for landlords to legally notify tenants to vacate, ensuring compliance with Florida's rental laws. For more information on this form, visit Florida Forms.

- Borrower’s Financial Statement: This statement provides a detailed overview of the borrower’s financial situation. It helps the lender assess the borrower’s ability to meet any new terms or conditions.

Understanding these documents can help streamline the Deed in Lieu of Foreclosure process. Each plays a vital role in protecting both parties and ensuring that the transaction is conducted fairly and legally. If you are considering a Deed in Lieu, it is crucial to gather all necessary documents promptly to avoid complications.