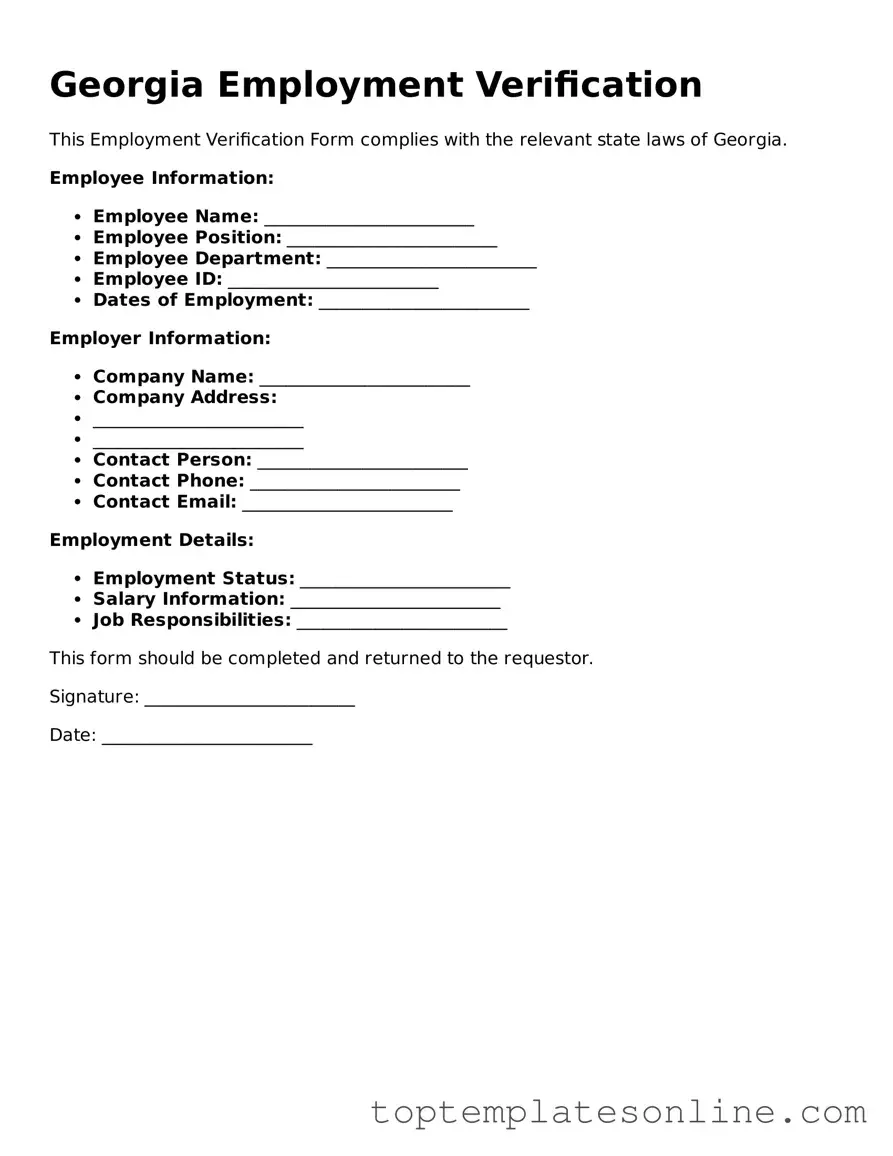

Blank Employment Verification Template for Georgia State

The Georgia Employment Verification form plays a crucial role in the employment process, serving as a key document that employers and employees alike rely on to confirm employment status. This form is essential for various situations, such as applying for loans, renting properties, or securing government benefits. Typically, it includes important details like the employee's name, job title, and dates of employment, along with the employer's information. The form may also require verification of salary or wages, which helps establish the employee's financial standing. Completing this document accurately is vital, as it ensures that all parties involved have the necessary proof of employment. Understanding the components of the Georgia Employment Verification form can streamline the verification process and facilitate smoother interactions between employers and employees.

Some Other State-specific Employment Verification Templates

Texas Income Comfirmation Letter - Verify employment history including dates of hire and position held.

It's important for landlords to be familiar with the Florida Notice to Quit form, which serves as a critical legal document in the eviction process. This form not only details the reasons for asking a tenant to vacate but also establishes a clear timeline for the move. For more comprehensive information on this subject, landlords can refer to various resources, including Florida Forms, which provide guidance on proper procedures and compliance with rental laws.

Ohio State Code Number - This document can assist in assessments for insurance eligibility.

Letter for Employment - This verification form promotes accountability and integrity in the workplace.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can delay the verification process. Each section must be completed accurately.

-

Incorrect Dates: Providing wrong employment dates can lead to confusion. Double-check start and end dates for accuracy.

-

Wrong Employer Details: Using outdated or incorrect employer information can cause issues. Ensure that the employer's name and address are current.

-

Missing Signatures: Omitting signatures from the form can render it invalid. Both the employee and employer must sign where required.

-

Inconsistent Job Titles: Using different job titles on the form than what is officially recognized can create discrepancies. Stick to the title used in official records.

-

Not Providing Contact Information: Failing to include contact details for the employer can hinder follow-up. Always provide a phone number and email address.

-

Neglecting to Read Instructions: Skipping the instructions can lead to mistakes. Take time to understand what each section requires.

-

Using Abbreviations: Avoid using abbreviations that may not be widely understood. Write out full names and terms to ensure clarity.

-

Not Keeping Copies: Failing to keep a copy of the completed form can be problematic. Always save a copy for your records.

-

Submitting Late: Delaying submission can affect employment opportunities. Submit the form as soon as possible to avoid issues.

Guide to Writing Georgia Employment Verification

Once you have the Georgia Employment Verification form, it's important to fill it out accurately to ensure the verification process goes smoothly. Follow these steps carefully to complete the form correctly.

- Begin by entering the employee's name in the designated field at the top of the form.

- Fill in the employee's social security number in the next section. Ensure this number is correct to avoid delays.

- Provide the employee's job title and the date of employment in the respective areas.

- Include the employer's name and contact information in the fields provided.

- Complete the section regarding the employee's salary and any other relevant compensation details.

- Sign and date the form at the bottom, confirming that all information is accurate to the best of your knowledge.

- Review the completed form for any errors or omissions before submitting it.

After filling out the form, it will need to be submitted to the appropriate party for verification. Ensure that you keep a copy for your records.

Documents used along the form

The Georgia Employment Verification form is commonly used to confirm an individual's employment status. Along with this form, several other documents may be required to provide additional context or verification. Below is a list of other forms and documents that are often used in conjunction with the Employment Verification form.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. It is typically provided by employers to employees for tax purposes.

- Dirt Bike Bill of Sale: When transferring ownership of dirt bikes, it's essential to use the required Dirt Bike Bill of Sale form details for a legally binding transaction.

- Pay Stubs: Pay stubs provide a detailed breakdown of an employee's earnings for a specific pay period. They include information on gross pay, deductions, and net pay.

- Offer Letter: An offer letter outlines the terms of employment, including position, salary, and benefits. It serves as a formal confirmation of the job offer made to the candidate.

- Employment Contract: This document details the terms and conditions of employment between the employer and employee. It may include job responsibilities, duration of employment, and compensation details.

- Tax Identification Number (TIN): This number is used for tax purposes and is required for reporting income to the IRS. It can be a Social Security Number (SSN) or an Employer Identification Number (EIN).

These documents collectively support the employment verification process and ensure that all necessary information is available for accurate assessment. It is important to gather and review these forms to facilitate a smooth verification experience.