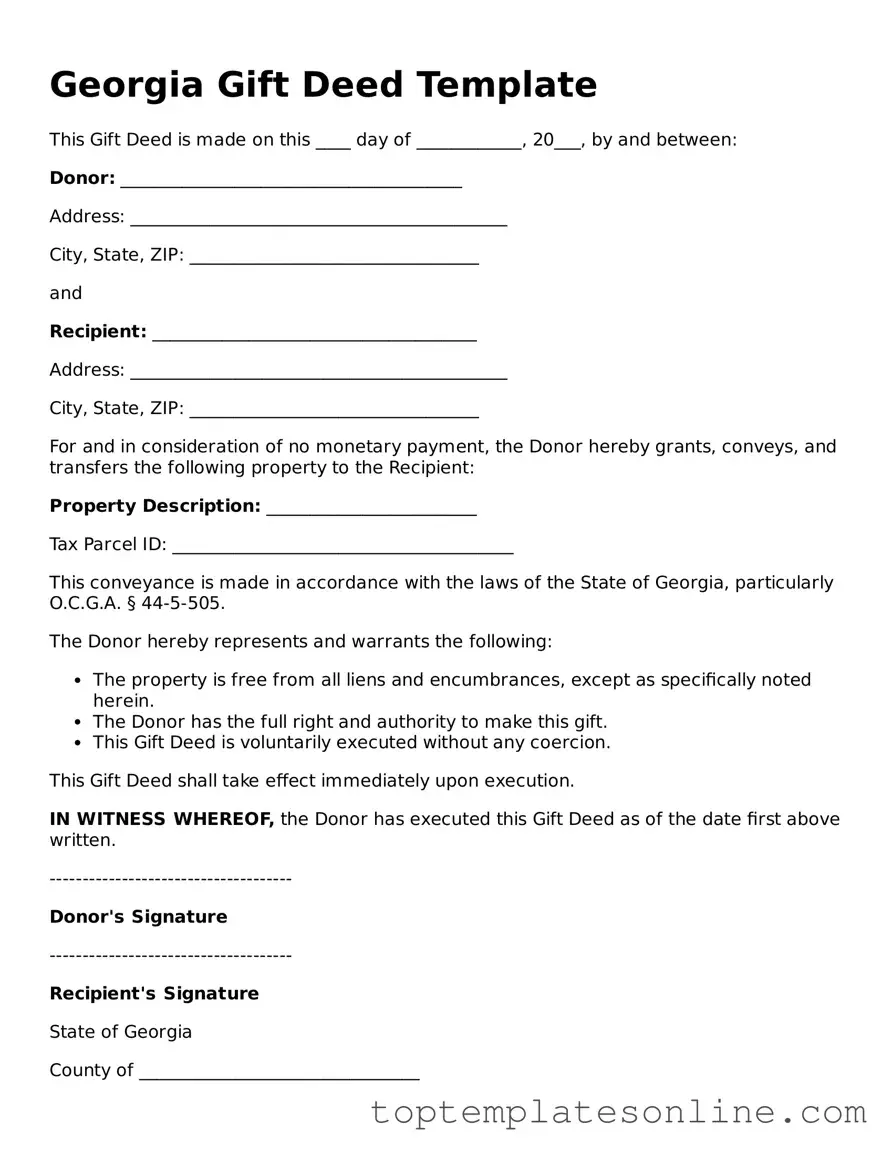

Blank Gift Deed Template for Georgia State

In the state of Georgia, the Gift Deed form serves as an essential legal document for individuals wishing to transfer property without any exchange of monetary compensation. This form is particularly significant for those looking to convey real estate or personal property as a gift to family members, friends, or charitable organizations. By utilizing the Gift Deed, the giver, often referred to as the grantor, can clearly outline the specifics of the transfer, including a detailed description of the property and the names of the recipients, known as grantees. It is vital for the document to include the date of the transfer and any relevant conditions or stipulations, ensuring that both parties understand the nature of the gift. Furthermore, the Gift Deed must be signed by the grantor and may require notarization to be legally valid. This process not only formalizes the gift but also provides a safeguard against future disputes regarding ownership. Understanding the nuances of the Gift Deed form is crucial for anyone considering making a property transfer in Georgia, as it ensures that the giver’s intentions are honored and legally recognized.

Some Other State-specific Gift Deed Templates

Gifting Property - This deed may have tax implications for both the donor and recipient.

When preparing a Florida Power of Attorney form, it's crucial to ensure that the document is comprehensive and reflects the principal's intentions. Utilizing resources like Florida Forms can aid individuals in understanding the legal implications and requirements associated with this significant decision, allowing them to designate their agent with confidence and clarity.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise and complete description of the property being gifted. This can lead to confusion and potential legal disputes later on.

-

Incorrect Names: Ensure that the names of both the giver and the recipient are spelled correctly. A simple typo can create complications in the future.

-

Not Including a Legal Description: Instead of just the address, a legal description of the property is necessary. This description is often found in the property's deed and is crucial for legal clarity.

-

Omitting Signatures: All required parties must sign the form. Forgetting a signature can invalidate the deed, making the gift ineffective.

-

Failure to Notarize: In Georgia, a Gift Deed must be notarized to be legally binding. Skipping this step can lead to issues with the deed's acceptance.

-

Not Including a Date: It may seem trivial, but failing to date the document can create ambiguity about when the gift was made.

-

Ignoring Tax Implications: People often overlook the potential tax consequences of gifting property. Understanding these implications can help avoid unexpected tax bills.

-

Not Consulting a Professional: Many individuals attempt to fill out the form without seeking legal advice. Consulting with a legal professional can prevent costly mistakes.

-

Failing to Record the Deed: After completing the form, it’s crucial to file it with the county clerk’s office. Neglecting this step means the gift may not be recognized legally.

Guide to Writing Georgia Gift Deed

After obtaining the Georgia Gift Deed form, you will need to carefully fill it out to ensure that the transfer of property is documented correctly. Completing the form accurately is crucial for the validity of the deed and to avoid potential disputes in the future.

- Begin by entering the date at the top of the form.

- In the section for the grantor (the person giving the gift), provide the full legal name and address.

- Next, fill in the details for the grantee (the person receiving the gift), including their full legal name and address.

- Describe the property being transferred. Include the address and any relevant legal descriptions, such as lot number or parcel number.

- Indicate the consideration, which in this case will typically be stated as “love and affection” or a nominal amount.

- Both the grantor and grantee should sign the form. Make sure that the signatures are dated.

- Have the form notarized. A notary public will need to witness the signatures and affix their seal.

- Finally, submit the completed form to the county clerk’s office where the property is located for recording.

Documents used along the form

When completing a Georgia Gift Deed, there are several other forms and documents that can be helpful or necessary to ensure a smooth process. Each of these documents serves a specific purpose and can assist in clarifying the terms of the gift or ensuring compliance with state laws. Here’s a list of commonly used forms and documents that you might consider alongside the Gift Deed.

- Warranty Deed: This document guarantees that the property title is clear and free from any claims. It provides assurance to the recipient that they are receiving full ownership rights.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor may have in the property without making any guarantees. It’s often used in situations where the parties know each other well, like family members.

- Affidavit of Value: This form states the value of the property being gifted. It can be important for tax purposes and helps establish the fair market value at the time of the gift.

- Property Tax Exemption Application: If the property is being gifted to a family member, this application can help ensure that the property is exempt from certain taxes, depending on the relationship.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit, this federal form must be filed to report the gift to the IRS.

- Title Search Report: This document provides a history of the property’s ownership and any claims against it. A title search can prevent future disputes regarding ownership.

- Property Survey: A survey outlines the boundaries of the property. This can be helpful in confirming what is being gifted and avoiding future boundary disputes.

- Consent to Transfer: If the property is subject to any agreements, such as a mortgage or a homeowners association, this document may be required to show that the transfer is allowed.

- Lease Agreement: It is a crucial document for renting property, providing clarity on terms and obligations. You can find a template at newyorkform.com/free-lease-agreement-template/.

- Power of Attorney: If the person making the gift cannot be present to sign the Gift Deed, a power of attorney allows someone else to sign on their behalf.

Having these documents ready can streamline the process of transferring property through a gift deed. It’s always wise to ensure that everything is in order to avoid complications down the road. Consider consulting with a professional if you have any questions about these forms or the gifting process.