Blank Last Will and Testament Template for Georgia State

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Georgia, this legal document serves as a clear directive for the distribution of your assets, the care of any dependents, and the appointment of an executor to manage your estate. It allows you to specify who will inherit your property, whether it be family members, friends, or charitable organizations. The form also provides a space for naming guardians for minor children, which is often one of the most important considerations for parents. Additionally, the Georgia Last Will and Testament form requires the signatures of at least two witnesses, ensuring that your intentions are validated and legally recognized. By taking the time to complete this form, you not only protect your legacy but also provide peace of mind for your loved ones during a difficult time.

Some Other State-specific Last Will and Testament Templates

Last Will and Testament Michigan - Helps individuals make their preferences clear regarding end-of-life decisions.

Last Will and Testament Sample - Must be signed and witnessed to be valid in most states.

The legal importance of a Non-disclosure Agreement cannot be overstated, as it plays a vital role in protecting confidential information during business negotiations. This form establishes a clear understanding of what information is deemed confidential, helping parties navigate the complexities of sharing sensitive data securely.

Last Will and Testament Nc - Provides a platform for discussing the distribution of family heirlooms, fostering understanding and communication.

Last Will and Testament Template New York Pdf - Can clarify how to handle sentimental items, addressing family dynamics regarding inheritance.

Common mistakes

-

Not Being Clear About Beneficiaries: One common mistake is failing to clearly identify who will receive your assets. It's important to use full names and, if possible, include their relationship to you. This avoids confusion and potential disputes later on.

-

Forgetting to Sign the Document: A will is not legally binding unless it is signed. Many people overlook this crucial step. Make sure you sign your will in the presence of witnesses, as required by Georgia law.

-

Neglecting Witness Requirements: Georgia requires that your will be witnessed by at least two individuals who are not beneficiaries. If you skip this step, your will could be deemed invalid.

-

Failing to Update the Will: Life changes such as marriage, divorce, or the birth of a child can impact your wishes. If you don't update your will accordingly, it may not reflect your current intentions.

-

Not Storing the Will Safely: After completing your will, it should be stored in a safe place. Leaving it in an easily accessible location can lead to loss or damage. Consider a fireproof safe or a safety deposit box.

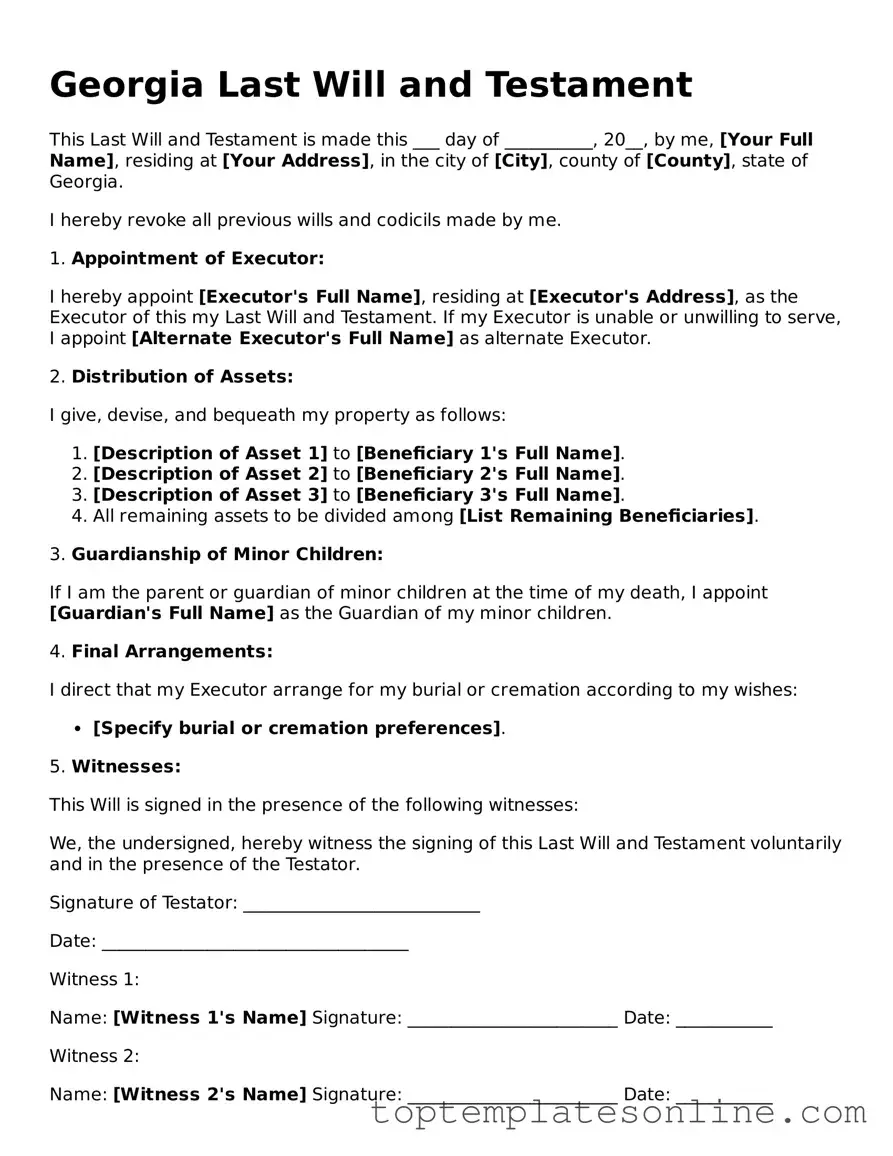

Guide to Writing Georgia Last Will and Testament

After obtaining the Georgia Last Will and Testament form, you will need to fill it out carefully to ensure that your wishes are clearly stated. Once completed, it will need to be signed and witnessed according to Georgia law.

- Begin by entering your full legal name at the top of the form.

- Provide your address, including city, state, and zip code, in the designated section.

- Clearly state that this document is your Last Will and Testament.

- Designate an executor by naming the individual you trust to carry out your wishes. Include their full name and address.

- List your beneficiaries. Include their names and relationships to you, as well as what they will inherit.

- If you have minor children, name a guardian for them and provide their information.

- Include any specific bequests, detailing items or amounts you wish to leave to specific individuals.

- Indicate how you want your remaining assets distributed after specific bequests have been made.

- Sign the document in the presence of at least two witnesses. Ensure they also sign and provide their addresses.

- Consider having the will notarized for added legal validity, although it is not required in Georgia.

Documents used along the form

When creating a Georgia Last Will and Testament, several other documents may be necessary to ensure your wishes are carried out effectively. These documents provide additional support and clarity regarding your estate planning. Below are some commonly used forms that complement a will.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. It grants the designated person the authority to make decisions on your behalf, ensuring your financial interests are protected.

- Dirt Bike Bill of Sale: This essential document is necessary for the sale and transfer of ownership of a dirt bike in New York, providing vital information for both buyers and sellers, similar to resources available at NY Templates.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this form allows you to designate an individual to make medical decisions for you if you are unable to do so. It ensures your healthcare preferences are respected and followed.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate your preferences. It provides guidance to your healthcare providers and loved ones about your end-of-life care choices.

- Revocable Trust: A Revocable Trust allows you to place your assets into a trust during your lifetime. You maintain control over the assets and can make changes as needed. Upon your passing, the trust can help avoid probate, ensuring a smoother transfer of assets to your beneficiaries.

Incorporating these documents into your estate planning can provide peace of mind and clarity for both you and your loved ones. Each form serves a unique purpose, working together to ensure your wishes are honored.