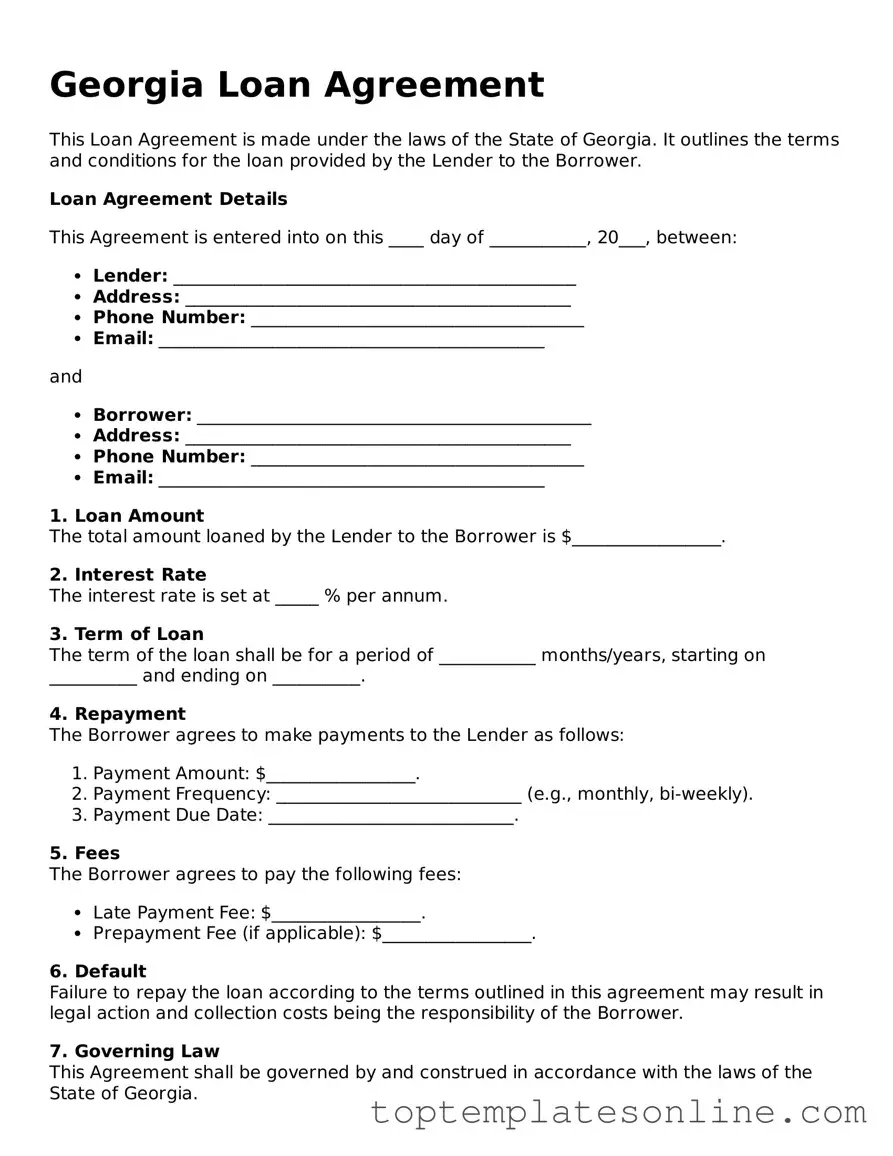

Blank Loan Agreement Template for Georgia State

The Georgia Loan Agreement form serves as a crucial document in the realm of borrowing and lending, outlining the terms and conditions agreed upon by both the lender and the borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it addresses the rights and responsibilities of each party, ensuring that both sides are aware of their obligations. The clarity provided by this form helps to prevent misunderstandings and disputes in the future. Furthermore, it often contains provisions for default, which outline the consequences should the borrower fail to meet their repayment obligations. By establishing a clear framework for the loan transaction, the Georgia Loan Agreement form plays a vital role in promoting transparency and accountability in financial dealings.

Some Other State-specific Loan Agreement Templates

Texas Promissory Note Template - It often contains a “whole agreement” clause that captures all terms agreed upon.

For those looking to complete a transaction involving a trailer, it is essential to utilize the Florida Trailer Bill of Sale form, which can be found at floridaforms.net/blank-trailer-bill-of-sale-form. This legal document ensures that all necessary information is recorded, providing clarity and security for both the buyer and seller in the ownership transfer process.

Promissory Note New York - A Loan Agreement can specify whether the loan is personal or business-related.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to double-check their names, addresses, and contact details. This can lead to delays or issues in processing the loan.

-

Missing Signatures: Some borrowers forget to sign the form or have all required parties sign. This can result in the agreement being deemed invalid.

-

Inaccurate Loan Amount: Entering the wrong loan amount is a common mistake. It’s essential to ensure that the amount requested matches what was discussed with the lender.

-

Failure to Read Terms: Skimming through the terms and conditions can lead to misunderstandings about interest rates and repayment schedules. Taking the time to read these sections is crucial.

-

Omitting Financial Information: Some people neglect to provide complete financial details, such as income or existing debts. This information is vital for the lender's assessment.

-

Not Keeping Copies: Failing to keep a copy of the filled-out form can create problems later. It’s advisable to retain a copy for personal records and future reference.

Guide to Writing Georgia Loan Agreement

Filling out the Georgia Loan Agreement form requires careful attention to detail to ensure all necessary information is accurately provided. Once completed, the form will serve as a legally binding document outlining the terms of the loan between the parties involved.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the borrower and the lender in the designated sections.

- Specify the loan amount clearly in the appropriate field.

- Indicate the interest rate applicable to the loan, if any.

- Provide the repayment terms, including the start date and duration of the loan.

- Include any collateral information if the loan is secured.

- Review the terms and conditions section carefully, ensuring all required clauses are addressed.

- Sign and date the form at the bottom, ensuring both parties do the same.

- Make copies of the completed form for both the borrower and lender for their records.

Documents used along the form

When entering into a loan agreement in Georgia, several other forms and documents may accompany the primary loan agreement to ensure clarity and protect the interests of both the lender and borrower. Each of these documents serves a specific purpose in the lending process.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Disclosure Statement: Required by federal law, this statement provides borrowers with essential information about the loan terms, including fees, interest rates, and total repayment costs, ensuring transparency in the lending process.

- Notice to Quit: This legal document notifies tenants they must vacate the rental property, serving as a vital part of the eviction process. It's important for landlords and tenants to understand this form well. For more details, visit Florida Forms.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are pledged to guarantee repayment. It details the rights of the lender in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required from the borrower or a third party. This document makes an individual personally liable for the loan if the borrower defaults.

- Loan Application: This form collects necessary information from the borrower, including financial history, income, and creditworthiness, helping the lender assess risk before approving the loan.

- Closing Statement: This document summarizes the final terms of the loan, including any fees and adjustments. It is presented at the closing of the loan transaction, ensuring all parties agree on the details.

- Amortization Schedule: This schedule breaks down each payment over the loan term, showing how much goes toward interest and principal. It helps borrowers understand their repayment obligations.

- Default Notice: If the borrower fails to meet the terms of the loan, this document formally notifies them of the default and outlines the steps the lender may take to recover the owed amount.

Understanding these documents is crucial for both lenders and borrowers. They not only facilitate a smoother transaction but also provide legal protection and clarity throughout the loan process. Being informed about each document can help ensure a successful borrowing experience.