Blank Operating Agreement Template for Georgia State

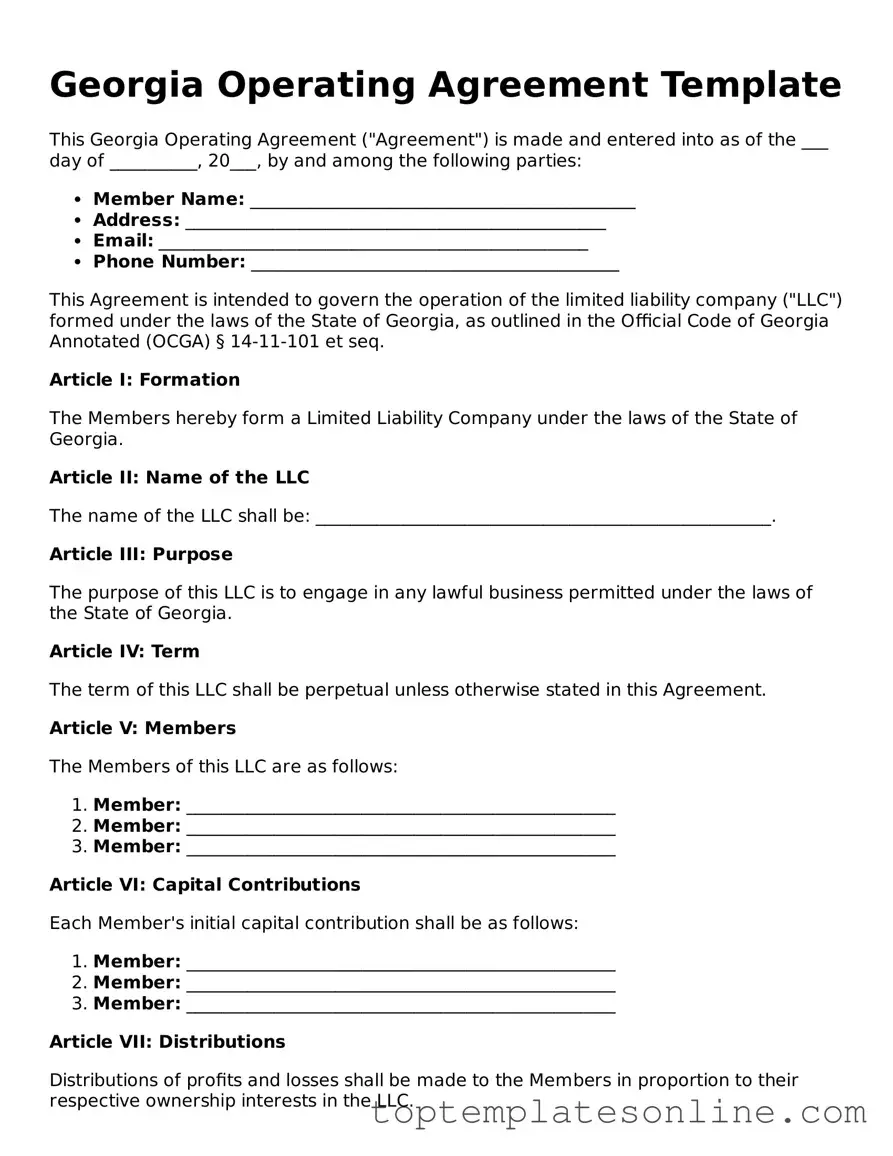

The Georgia Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. It outlines the internal management structure and operational procedures of the LLC, ensuring that all members are on the same page regarding their rights and responsibilities. Key aspects of the form include provisions for member contributions, profit distribution, and decision-making processes. Additionally, the agreement addresses the roles of managers, if applicable, and specifies the procedures for adding or removing members. By detailing these elements, the Operating Agreement helps prevent disputes among members and provides a clear framework for the company's governance. This document is not only essential for compliance with state law but also acts as a roadmap for the LLC's future operations and growth.

Some Other State-specific Operating Agreement Templates

Create an Operating Agreement - An Operating Agreement is beneficial for avoiding disputes over profit-sharing.

The New York Articles of Incorporation form is a crucial document that establishes a corporation in the state of New York. This form outlines essential details such as the corporation's name, purpose, and structure. For those looking to create this document, resources like NY Templates can help ensure a smooth incorporation process and set the foundation for your business's success.

Ohio Llc Operating Agreement Template - The agreement plays a role in protecting trade secrets and company information.

New Jersey Operating Agreement - This document can specify contributions in the form of services or goods.

Common mistakes

When completing the Georgia Operating Agreement form, individuals may encounter several common pitfalls. Awareness of these mistakes can help ensure that the document is filled out correctly and serves its intended purpose. Below is a list of ten frequent errors to avoid:

-

Omitting Member Information: Failing to include the names and addresses of all members can lead to confusion about ownership and responsibilities.

-

Not Specifying Ownership Percentages: Neglecting to clearly outline each member's ownership percentage may result in disputes later on.

-

Inadequate Description of Management Structure: A vague explanation of how the business will be managed can create uncertainty regarding decision-making processes.

-

Ignoring Profit Distribution Details: Failing to detail how profits will be distributed among members can lead to misunderstandings and conflict.

-

Not Including Procedures for Adding New Members: Omitting guidelines for how new members can be added to the agreement may complicate future growth.

-

Overlooking Dispute Resolution Methods: Not specifying how disputes will be resolved can lead to prolonged conflicts without a clear path to resolution.

-

Neglecting to Address Member Responsibilities: Failing to outline specific responsibilities for each member can result in a lack of accountability.

-

Forgetting to Include Amendment Procedures: Not detailing how the agreement can be amended in the future may hinder necessary changes.

-

Using Vague Language: Employing ambiguous terms can lead to different interpretations of the agreement, causing potential disputes.

-

Failing to Sign and Date the Agreement: Not having all members sign and date the document can render it invalid, negating its intended legal protections.

By being mindful of these common mistakes, individuals can create a more effective and clear Operating Agreement that protects the interests of all members involved.

Guide to Writing Georgia Operating Agreement

After you have gathered all necessary information and documents, you are ready to fill out the Georgia Operating Agreement form. This form outlines the structure and rules for your business. Follow the steps below to complete it accurately.

- Start with the name of your LLC. Write the full legal name as registered with the state.

- Provide the principal office address. This should be the main location where your business operates.

- List the names and addresses of all members. Include each member’s full name and their corresponding address.

- Define the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Detail the ownership percentages. Clearly state how much of the LLC each member owns.

- Outline the voting rights. Specify how decisions will be made and how voting will occur among members.

- Include provisions for profit and loss distribution. Explain how profits and losses will be shared among members.

- Address the process for adding or removing members. Describe how new members can join and how existing members can exit.

- Sign and date the agreement. All members must sign to make the agreement valid.

Once you have completed the form, review it carefully for any errors. Ensure that all members have signed before you proceed with any filing or additional steps for your business.

Documents used along the form

When forming a limited liability company (LLC) in Georgia, the Operating Agreement is a crucial document. However, it is often accompanied by several other important forms and documents that help establish the structure and operations of the business. Below is a list of commonly used documents that you may need to consider alongside your Georgia Operating Agreement.

- Articles of Organization: This is the foundational document that officially creates your LLC. It must be filed with the Georgia Secretary of State and includes basic information about your business, such as its name and registered agent.

- Member Consent: This document outlines the agreement among members regarding the management and operations of the LLC. It can be useful for clarifying roles and responsibilities before the Operating Agreement is finalized.

- Non-disclosure Agreement: A critical document for protecting sensitive information shared among members, especially when discussing proprietary ideas or business strategies. For more details, you can refer to https://newyorkform.com/free-non-disclosure-agreement-template/.

- Bylaws: While not required for LLCs, bylaws can provide additional structure. They typically cover the internal rules governing the LLC, including how meetings are conducted and how decisions are made.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They can help formalize the ownership structure and are often issued in conjunction with the Operating Agreement.

- Initial Capital Contribution Agreement: This document details the initial investments made by members into the LLC. It clarifies how much each member is contributing and can help prevent future disputes over ownership stakes.

- Tax Identification Number (EIN) Application: An EIN is essential for tax purposes. This document, filed with the IRS, allows your LLC to hire employees, open a bank account, and file tax returns.

- Operating Procedures Manual: This manual outlines the day-to-day operations of the LLC. It can include policies, procedures, and guidelines that members must follow, ensuring consistency in operations.

- Non-Disclosure Agreement (NDA): If your LLC deals with sensitive information, an NDA can protect your business secrets. It ensures that members and employees do not disclose confidential information to outsiders.

Each of these documents plays a vital role in establishing a well-organized and legally compliant LLC in Georgia. Taking the time to prepare and understand these forms can save you from potential issues down the road. Be proactive in your approach to ensure your business is set up for success.