Blank Prenuptial Agreement Template for Georgia State

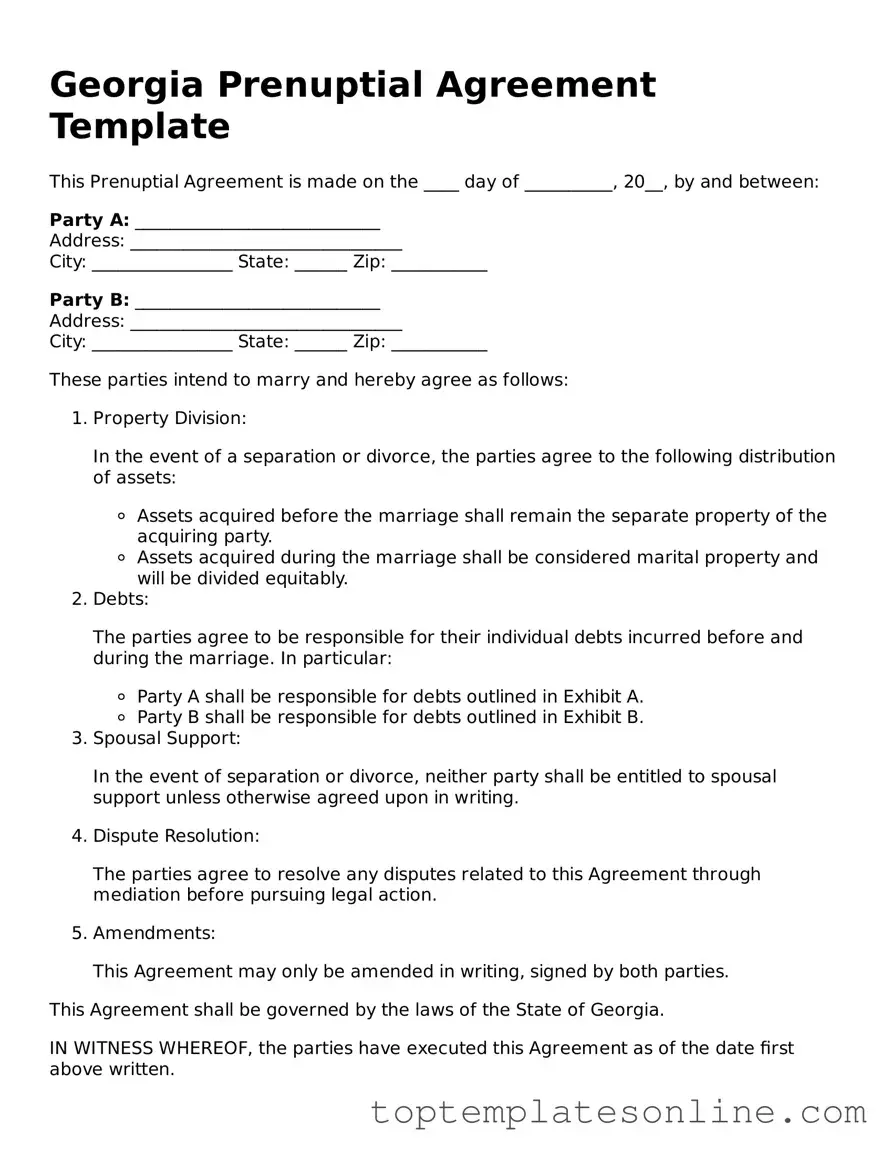

In the journey toward a lifelong partnership, many couples in Georgia consider a prenuptial agreement as a practical step to protect their interests and clarify expectations before tying the knot. This legal document serves as a roadmap, outlining the financial and property rights of each partner in the event of a divorce or separation. A well-crafted prenuptial agreement can address various aspects, including the division of assets, management of debts, and even spousal support. Couples can customize the terms to reflect their unique circumstances and values, ensuring that both parties feel secure and understood. While discussing such topics may feel daunting, approaching the conversation with openness can foster trust and transparency. Understanding the importance of this agreement can empower couples to enter their marriage with confidence, knowing they have a plan in place for the future.

Some Other State-specific Prenuptial Agreement Templates

New York Prenuptial Contract - Discussing a prenup can foster open communication about finances and shared goals in a marriage.

Ohio Prenuptial Contract - A prenuptial agreement is not just about the end of a marriage, but also about planning for the future.

For further information and resources related to the Texas VTR-850 form, you can visit https://texasformspdf.com, which provides detailed guidance on completing the application and ensuring that your classic vehicle meets all the necessary requirements.

North Carolina Prenuptial Contract - Offers an opportunity to discuss and align on financial goals early in the marriage.

Michigan Prenuptial Contract - A prenup can specify how financial disputes will be resolved.

Common mistakes

-

Not Disclosing All Assets: One of the most common mistakes is failing to fully disclose all assets and liabilities. Transparency is crucial. Both parties should list everything they own, including bank accounts, real estate, and debts.

-

Using Ambiguous Language: Clarity is key. Vague terms can lead to misunderstandings. Be specific about what is included in the agreement and avoid terms that could be interpreted in multiple ways.

-

Not Considering Future Changes: Life circumstances change. Failing to include provisions for future changes, such as the birth of children or significant income changes, can render the agreement less effective.

-

Not Seeking Legal Advice: Many individuals attempt to draft the agreement without professional help. This can lead to legal pitfalls. Consulting an attorney ensures that the agreement meets legal standards and protects both parties.

-

Forgetting to Sign and Date: A prenuptial agreement is not valid unless it is signed and dated by both parties. Ensure that both signatures are present and that the document is dated correctly.

-

Not Reviewing the Agreement Periodically: Once the agreement is signed, many people forget about it. Regularly reviewing the document ensures it remains relevant and addresses any changes in circumstances.

Guide to Writing Georgia Prenuptial Agreement

Completing the Georgia Prenuptial Agreement form requires careful attention to detail. After gathering the necessary information, you will be ready to fill out the form accurately. Follow these steps to ensure the process goes smoothly.

- Begin by obtaining the Georgia Prenuptial Agreement form. This can be done online or through legal offices.

- Read through the entire form to understand the sections and requirements.

- Fill in the full names of both parties at the top of the form.

- Provide the current addresses of both parties, ensuring accuracy.

- Include the date of the intended marriage.

- List any premarital assets and debts for both parties. Be thorough and honest in this section.

- Specify how you wish to handle property acquired during the marriage.

- Discuss and outline any spousal support agreements, if applicable.

- Review the completed form for accuracy and completeness.

- Both parties should sign and date the form in the designated areas.

- Consider having the document notarized for added legal validity.

Documents used along the form

When preparing for marriage, individuals often consider a variety of legal documents to ensure clarity and protection of their interests. Alongside the Georgia Prenuptial Agreement, several other forms can help outline financial arrangements, responsibilities, and other important aspects of a marital relationship. Here is a list of documents frequently used in conjunction with a prenuptial agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets and debts will be handled in the event of divorce or separation.

- Marital Settlement Agreement: This agreement is used during divorce proceedings to settle issues like property division, alimony, and child custody, ensuring both parties agree on the terms.

- Financial Disclosure Statement: This document requires both parties to disclose their assets, debts, and income. Transparency is crucial for a fair prenuptial agreement.

- Power of Attorney: This legal document allows one spouse to make decisions on behalf of the other regarding financial and medical matters, especially in case of incapacitation.

- Living Will: A living will outlines a person’s wishes regarding medical treatment in situations where they cannot communicate their preferences, ensuring that their desires are respected.

- Will: A will specifies how a person’s assets will be distributed upon their death. It can help avoid disputes and ensure that wishes are honored.

- Trust Agreement: This document establishes a trust to manage assets for the benefit of a spouse or children, providing control over how and when assets are distributed.

- Child Custody Agreement: If children are involved, this agreement outlines custody arrangements and parenting responsibilities, helping to prevent conflicts later on.

- Address NYCERS Form: This document is used by members to update their address information with the New York City Employees Retirement System (NYCERS). Ensuring correct address information is vital for receiving important communications and benefits. For more details, members can refer to NY Templates.

- Debt Agreement: This document specifies how debts incurred before or during the marriage will be handled, protecting both parties from unexpected financial burdens.

These documents can complement a prenuptial agreement by addressing various aspects of marital and financial relationships. Consulting with a legal professional can provide guidance tailored to individual circumstances, ensuring that all necessary protections are in place.