Blank Promissory Note Template for Georgia State

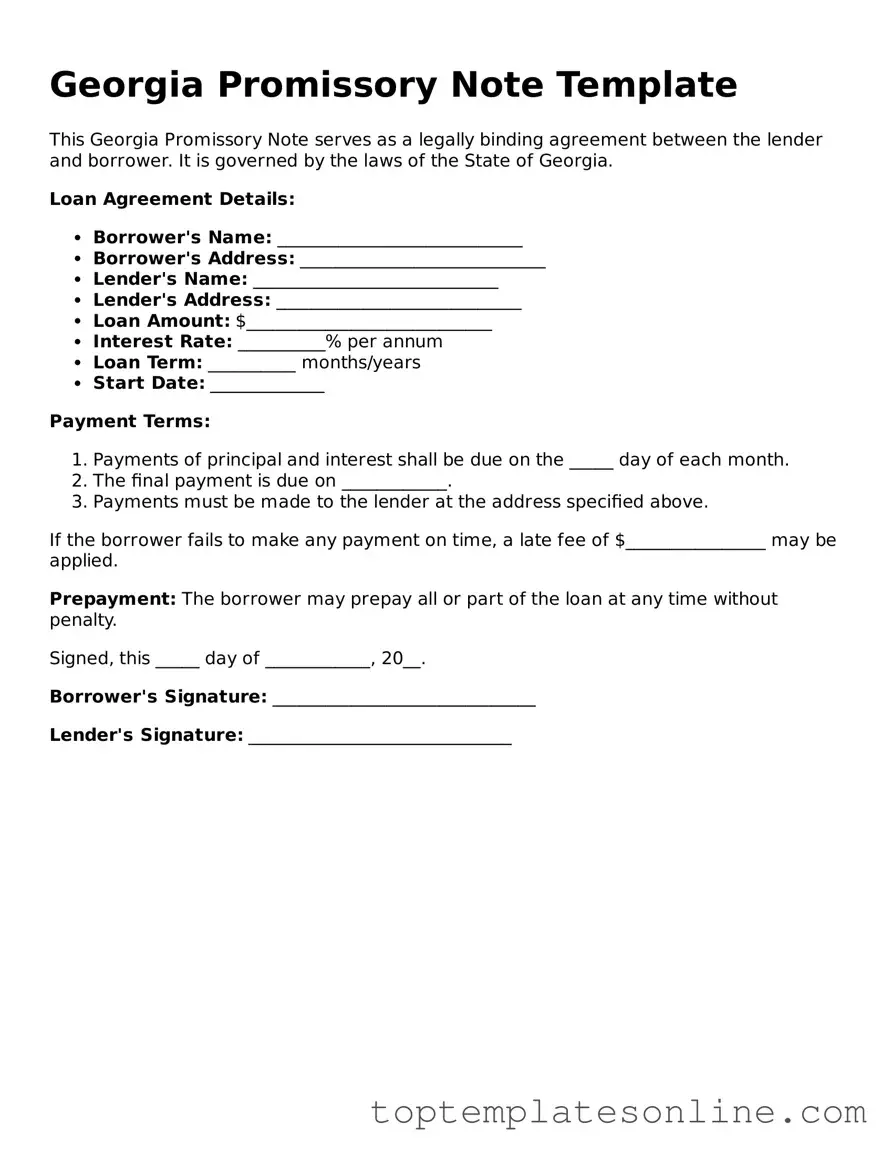

The Georgia Promissory Note form serves as a vital tool in financial transactions, providing a clear agreement between a borrower and a lender. This legally binding document outlines the terms of a loan, including the principal amount borrowed, the interest rate, and the repayment schedule. In addition to these essential details, the form also specifies the consequences of default, ensuring that both parties understand their rights and obligations. It can be used for various types of loans, whether for personal, business, or real estate purposes. By putting the terms in writing, the Promissory Note helps prevent misunderstandings and disputes in the future. Understanding this form is crucial for anyone involved in lending or borrowing money in Georgia, as it lays the groundwork for a transparent financial relationship.

Some Other State-specific Promissory Note Templates

Promissory Note for Personal Loan - Various repayment methods, such as installments, can be outlined in the note.

Loan Agreement Template Texas - A promissory note can be a crucial tool in personal finance management.

Michigan Promissory Note Example - A promissory note can specify the jurisdiction to handle any legal disputes related to the loan.

For those looking to streamline the application process, resources like NY Templates can provide helpful templates and guidance to ensure all necessary information is included and accurately submitted.

Loan Promissory Note - This document outlines the borrower's commitment to repay a loan under agreed terms.

Common mistakes

-

Inaccurate Borrower Information: Many individuals fail to provide complete and accurate personal details, such as the full name, address, and contact information of the borrower. This can lead to confusion and complications later on.

-

Missing Lender Information: Similar to the borrower, the lender's information is crucial. Omitting or incorrectly entering the lender's name and address can hinder the enforceability of the note.

-

Improper Loan Amount: Some people mistakenly write the loan amount incorrectly. It is essential to ensure that both the numerical and written forms of the amount match to avoid disputes.

-

Failure to Specify Interest Rate: The interest rate must be clearly stated. Leaving this blank or using vague language can lead to misunderstandings about the terms of repayment.

-

Neglecting Payment Terms: The payment schedule should be detailed. Individuals often overlook specifying whether payments are due monthly, quarterly, or at another interval, which can create ambiguity.

-

Not Signing the Document: A common oversight is forgetting to sign the promissory note. Without the proper signatures from both parties, the document may not hold up in court if disputes arise.

Guide to Writing Georgia Promissory Note

Once you have the Georgia Promissory Note form, you will need to complete it accurately to ensure it is valid and enforceable. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Identify the borrower. Write the full name and address of the person or entity borrowing the money.

- Next, identify the lender. Provide the full name and address of the person or entity lending the money.

- Specify the principal amount. Clearly write the amount of money being borrowed in both numbers and words.

- Indicate the interest rate. Write the annual interest rate as a percentage.

- Set the repayment terms. Detail how and when the borrower will repay the loan. Include the payment frequency (e.g., monthly, quarterly) and the final due date.

- Include any late fees. If applicable, specify the amount charged for late payments.

- Sign and date the form. The borrower must sign and date the document. If there are multiple borrowers, each must sign.

- Have the lender sign and date the form. This confirms their agreement to the terms.

After completing the form, ensure both parties keep a copy for their records. This document serves as a legal agreement and should be stored safely.

Documents used along the form

When entering into a loan agreement in Georgia, a Promissory Note is often accompanied by several other important documents. Each of these documents serves a specific purpose and helps clarify the terms of the loan, ensuring that both parties are protected. Below is a list of commonly used forms and documents that may be utilized alongside a Georgia Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any fees associated with the loan.

- Operating Agreement: For LLCs in Florida, having an operating agreement is essential. This document not only outlines management structure and member responsibilities but also ensures that all parties understand their roles. For more information, refer to Florida Forms.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security and the rights of the lender in case of default.

- Personal Guarantee: This document may be required from a third party, ensuring that they will repay the loan if the primary borrower defaults.

- Disclosure Statement: This statement provides borrowers with essential information about the loan, including the total cost of credit and any potential risks involved.

- Amortization Schedule: This schedule details each payment over the life of the loan, showing how much of each payment goes toward interest and principal.

- Loan Payment Receipt: After each payment, a receipt is issued to confirm the amount paid and the remaining balance on the loan.

- Default Notice: If the borrower fails to make payments, this notice informs them of the default and the potential consequences.

- Release of Lien: Once the loan is paid in full, this document releases any claims the lender had on the collateral, restoring the borrower's rights to the asset.

- Modification Agreement: If any terms of the original loan need to be changed, this agreement outlines the new terms and conditions.

- Affidavit of Debt: This sworn statement confirms the amount owed by the borrower and can be used in legal proceedings if necessary.

Understanding these documents is crucial for both borrowers and lenders. They provide clarity and security in financial transactions, ensuring that all parties know their rights and responsibilities. By being informed, individuals can navigate the lending process with greater confidence.