Blank Quitclaim Deed Template for Georgia State

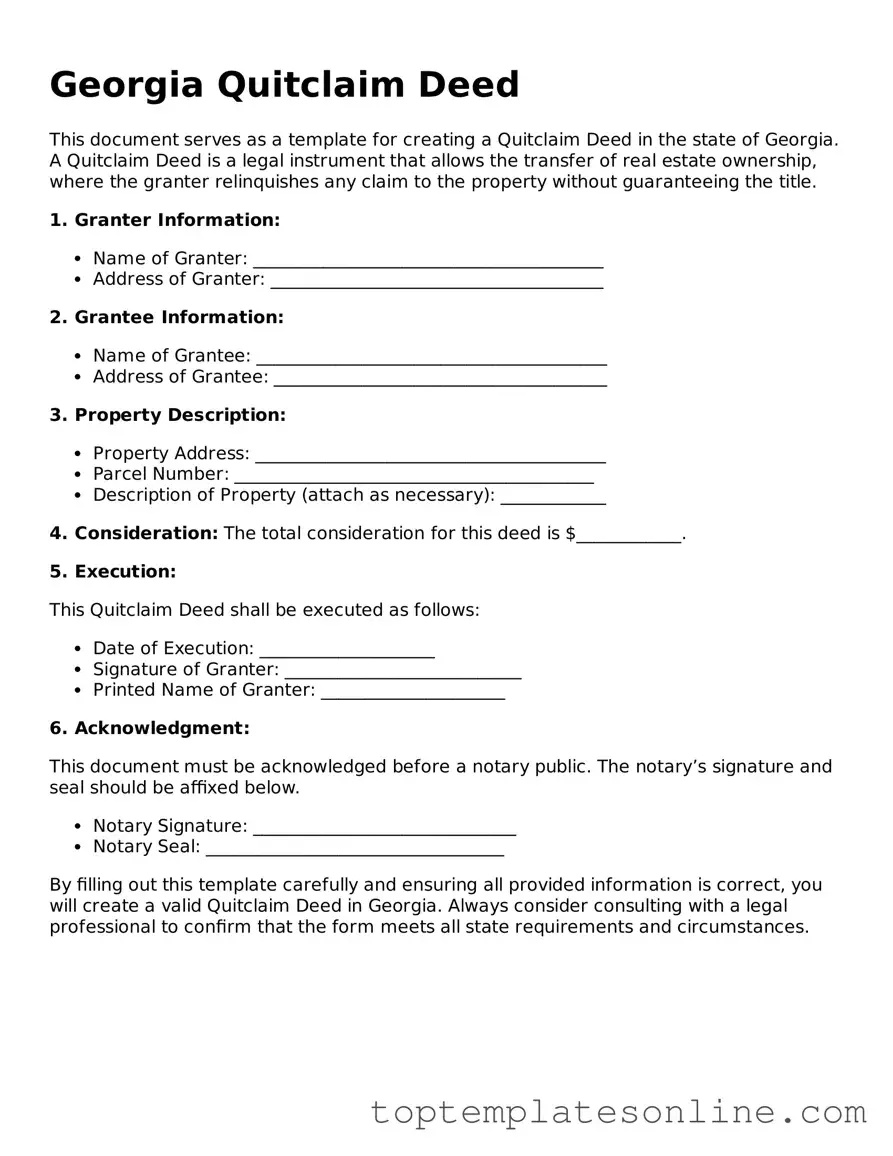

The Georgia Quitclaim Deed form serves as a vital instrument in real estate transactions, allowing property owners to transfer their interest in a property to another individual without guaranteeing the title's validity. This form is particularly useful in situations where the parties involved have a pre-existing relationship, such as family members or friends, and trust each other's claims to the property. The Quitclaim Deed does not provide the same level of protection as other types of deeds, such as warranty deeds, since it does not include any warranties regarding the title. It is essential for the grantor, or the person transferring the property, to understand that they are relinquishing their rights without any assurances. The form requires specific information, including the names of the grantor and grantee, a legal description of the property, and the date of transfer. After completion, the Quitclaim Deed must be signed and notarized to ensure its validity. Once recorded with the appropriate county office, the deed serves as public notice of the transfer, which can help prevent future disputes regarding ownership. Understanding these aspects is crucial for anyone considering using a Quitclaim Deed in Georgia.

Some Other State-specific Quitclaim Deed Templates

Quitclaim Deed Ohio - This document effectively removes the grantor’s legal claims to the property.

A General Power of Attorney form in New York is a legal document that allows one person to grant another the authority to act on their behalf in a variety of matters. This form can be crucial for managing financial, legal, and personal affairs when someone is unable to do so themselves. For further details and templates, resources like NY Templates can be very helpful in understanding its purpose and how to complete it correctly.

Quick Claim Deeds Michigan - Every party involved in a transaction should be fully informed before proceeding.

Quit Claim Deed Form New York Pdf - It's advisable to have the Quitclaim Deed notarized for better acknowledgment.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the correct lot number, street address, or legal description as recorded in public records.

-

Missing Signatures: All parties involved in the transaction must sign the Quitclaim Deed. A frequent error is neglecting to secure the necessary signatures, which can invalidate the document.

-

Improper Notarization: The Quitclaim Deed must be notarized to be valid. Some individuals forget to have the document notarized, or they may use an unqualified notary.

-

Failure to Record the Deed: After completing the Quitclaim Deed, it must be filed with the appropriate county office. Many people overlook this step, which can lead to complications in proving ownership.

-

Inaccurate Grantee Information: The grantee's name must be spelled correctly and match their identification. Errors in this section can lead to disputes or issues with property transfer.

Guide to Writing Georgia Quitclaim Deed

Once you have your Georgia Quitclaim Deed form ready, it’s time to fill it out accurately. This form is essential for transferring property ownership, so it's important to follow the steps carefully to ensure everything is in order. After completing the form, you will need to have it signed, notarized, and then filed with the appropriate county office.

- Start by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, fill in the name of the grantee (the person receiving the property) immediately below the grantor's name.

- Provide the complete address of the property being transferred. This includes the street address, city, state, and zip code.

- Include a legal description of the property. This may require a separate document or reference to a previous deed to ensure accuracy.

- Indicate the date of the transfer. This is typically the date you are filling out the form or the date you plan to execute the deed.

- Sign the form in the designated area. Ensure that the grantor’s signature is clear and matches the name provided at the top.

- Have the signature notarized. A notary public will verify your identity and witness the signing of the deed.

- Finally, make copies of the completed and notarized deed for your records before filing it with the county clerk's office.

Documents used along the form

When dealing with property transfers in Georgia, several forms and documents often accompany the Quitclaim Deed. Each document serves a specific purpose and helps ensure a smooth transaction. Below is a list of commonly used forms.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. It offers more protection to the buyer compared to a quitclaim deed.

- Property Transfer Tax Form: This form is required to report the transfer of property for tax purposes. It helps local governments assess property taxes accurately.

- Affidavit of Title: This sworn statement confirms the seller’s ownership and outlines any claims against the property. It protects the buyer by ensuring there are no undisclosed issues.

- Closing Statement: Also known as a HUD-1, this document itemizes all costs associated with the property transfer. It details what each party owes and what funds are exchanged at closing.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the property’s title. It ensures that the title is free from defects or disputes.

- Mortgage Documents: If the property is being financed, various mortgage documents will be necessary. These outline the loan terms and the obligations of both the borrower and lender.

- Residential Lease Agreement Form: For individuals looking to secure their rental arrangements, the detailed understanding of the Residential Lease Agreement requirements is essential for protecting both landlords and tenants.

- Power of Attorney: If the seller cannot be present for the signing, a power of attorney allows someone else to act on their behalf. This document must be properly executed to be valid.

- Notice of Transfer: This document informs local authorities and relevant parties about the change in ownership. It is often required to update public records.

Understanding these documents can help streamline the property transfer process and protect all parties involved. Being prepared with the right forms can make a significant difference in ensuring a successful transaction.