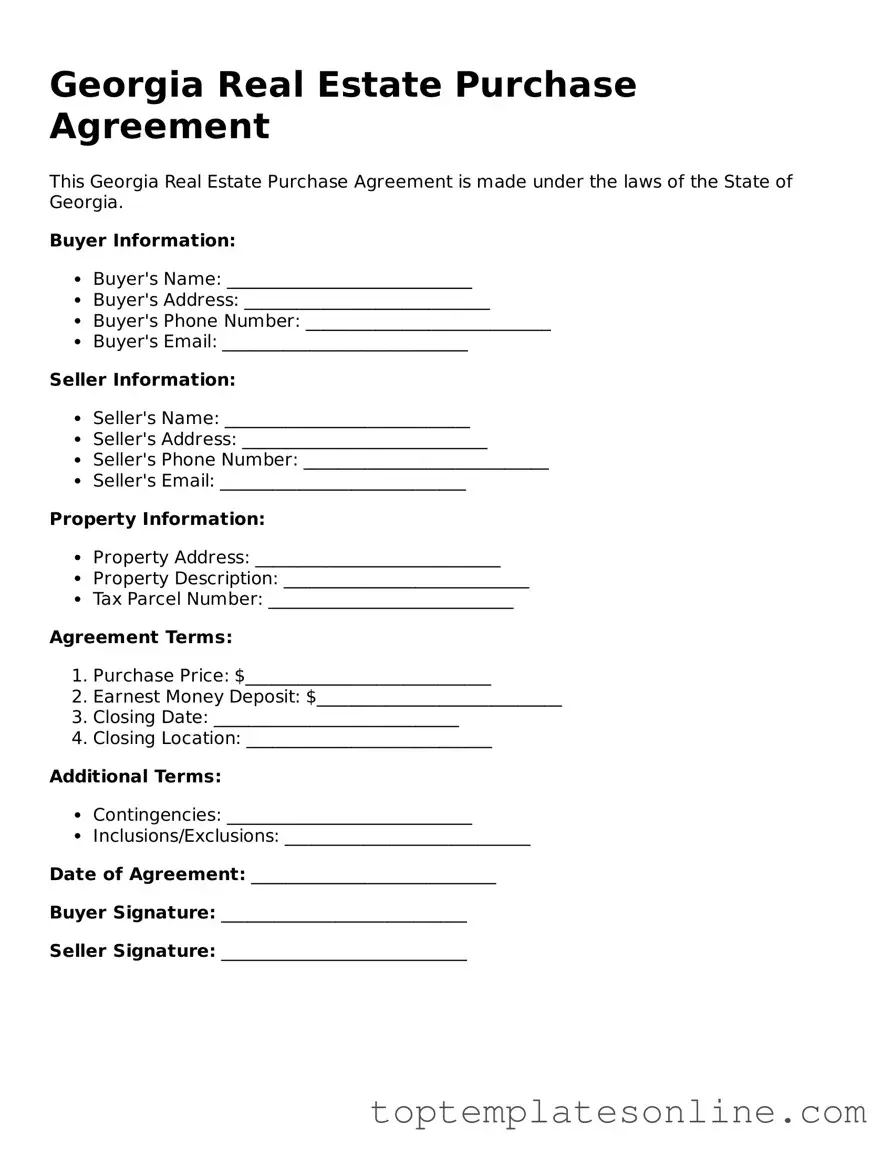

Blank Real Estate Purchase Agreement Template for Georgia State

The Georgia Real Estate Purchase Agreement form serves as a vital tool for buyers and sellers navigating the complexities of real estate transactions in the state. This comprehensive document outlines the terms and conditions of the sale, ensuring that both parties have a clear understanding of their rights and obligations. Key components include the purchase price, financing details, and the closing date, all of which are crucial for a smooth transaction. Additionally, the agreement addresses contingencies such as inspections and appraisals, providing protections for buyers while also setting expectations for sellers. It is essential for both parties to carefully review and negotiate the terms outlined in this form, as it serves not only as a roadmap for the transaction but also as a legally binding contract. Understanding each section of the agreement can empower individuals to make informed decisions, ultimately leading to a successful real estate experience in Georgia.

Some Other State-specific Real Estate Purchase Agreement Templates

Midland Title - It establishes a timeline for fulfilling contractual obligations associated with the sale.

In Florida, having a proper legal document like the Florida Trailer Bill of Sale is essential for smoothly transferring ownership of a trailer. This form not only serves as proof of the transaction but also establishes legitimate ownership, ensuring that both parties are protected. For those looking for a reliable template to facilitate this process, you can find it at https://floridaforms.net/blank-trailer-bill-of-sale-form/, which provides all necessary information about the trailer, the transaction, and the involved parties.

Michigan Real Estate Forms - Defines the obligations of both the buyer and seller during the sale.

Common mistakes

-

Not Reading the Entire Agreement: Many buyers and sellers skim through the document without fully understanding its contents. This can lead to missing critical clauses or obligations.

-

Incorrectly Filling Out Personal Information: Errors in names, addresses, or contact details can cause significant delays in the transaction process. Always double-check this information.

-

Neglecting to Specify the Purchase Price: Failing to clearly state the agreed-upon price can create confusion. Make sure this figure is accurate and prominently displayed.

-

Overlooking Contingencies: Buyers often forget to include necessary contingencies, such as financing or inspection clauses. These protect the buyer's interests and should not be ignored.

-

Ignoring Deadlines: Each section of the agreement may have specific timelines. Missing these deadlines can jeopardize the deal. Keep a close eye on dates and ensure compliance.

-

Not Including Earnest Money Details: The agreement should outline the amount of earnest money and the conditions under which it may be forfeited. Clarity on this point is essential.

-

Failing to Sign and Date: It may seem simple, but forgetting to sign or date the agreement renders it invalid. Ensure all parties have completed this step.

-

Neglecting to Consult a Professional: Some individuals attempt to navigate the process without legal or real estate guidance. Consulting a professional can help avoid costly mistakes.

Guide to Writing Georgia Real Estate Purchase Agreement

Filling out the Georgia Real Estate Purchase Agreement is an important step in the home buying process. This document outlines the terms of the sale and protects both the buyer and seller. Once you have completed the form, the next steps will involve reviewing the agreement with all parties involved and potentially negotiating terms before finalizing the sale.

- Obtain the Form: Start by acquiring the Georgia Real Estate Purchase Agreement form. You can find it online or request a copy from a real estate agent.

- Fill in Buyer Information: Enter the names and contact details of all buyers. Make sure to include any co-buyers.

- Fill in Seller Information: Provide the names and contact details of the sellers. This should match the names on the property title.

- Property Description: Clearly describe the property being sold. Include the address, legal description, and any relevant details about the property.

- Purchase Price: Specify the total purchase price for the property. This is the amount the buyer agrees to pay the seller.

- Earnest Money: Indicate the amount of earnest money the buyer will provide. This shows the seller that the buyer is serious about the purchase.

- Closing Date: Set a proposed closing date. This is when the ownership of the property will officially transfer from the seller to the buyer.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as financing or home inspections.

- Signatures: Ensure that all parties involved sign and date the agreement. This includes both buyers and sellers.

- Review the Agreement: Carefully review the completed form to ensure all information is accurate and complete before submitting it.

Documents used along the form

When engaging in a real estate transaction in Georgia, the Real Estate Purchase Agreement is a foundational document. However, several other forms and documents complement this agreement, ensuring that both buyers and sellers navigate the process smoothly and legally. Below is a list of commonly used documents that often accompany the purchase agreement.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues or defects related to the property. It protects buyers by providing transparency about the property's condition.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint and its hazards, ensuring they are aware before finalizing the purchase.

- Property Inspection Report: Conducted by a professional inspector, this report details the condition of the property, highlighting any repairs needed. Buyers often use this information to negotiate terms or request repairs.

- Financing Addendum: This document outlines the specifics of the buyer's financing, including loan type and terms. It clarifies how the purchase will be funded and can impact the sale's timeline.

- Title Commitment: Issued by a title company, this document outlines the legal ownership of the property and any liens or claims against it. A clear title is essential for a successful transaction.

- Closing Disclosure: This form provides a detailed account of all closing costs and fees associated with the transaction. It must be provided to the buyer at least three days before closing, allowing time to review and understand the financial obligations.

- Notice to Quit: Important for landlords and tenants alike, understanding the Florida Notice to Quit form is crucial in the eviction process. This form formalizes the request for tenants to vacate and outlines the reasons and timeframe for compliance, making resources such as Florida Forms essential for clarity and legal adherence.

- Affidavit of Title: In this document, the seller affirms their ownership of the property and confirms that there are no undisclosed claims or liens. This is crucial for protecting the buyer's interests during the closing process.

Understanding these additional forms and documents can enhance the real estate transaction experience. Each plays a vital role in ensuring that both parties are informed and protected throughout the buying and selling process. By familiarizing oneself with these documents, individuals can navigate their real estate endeavors with greater confidence and clarity.