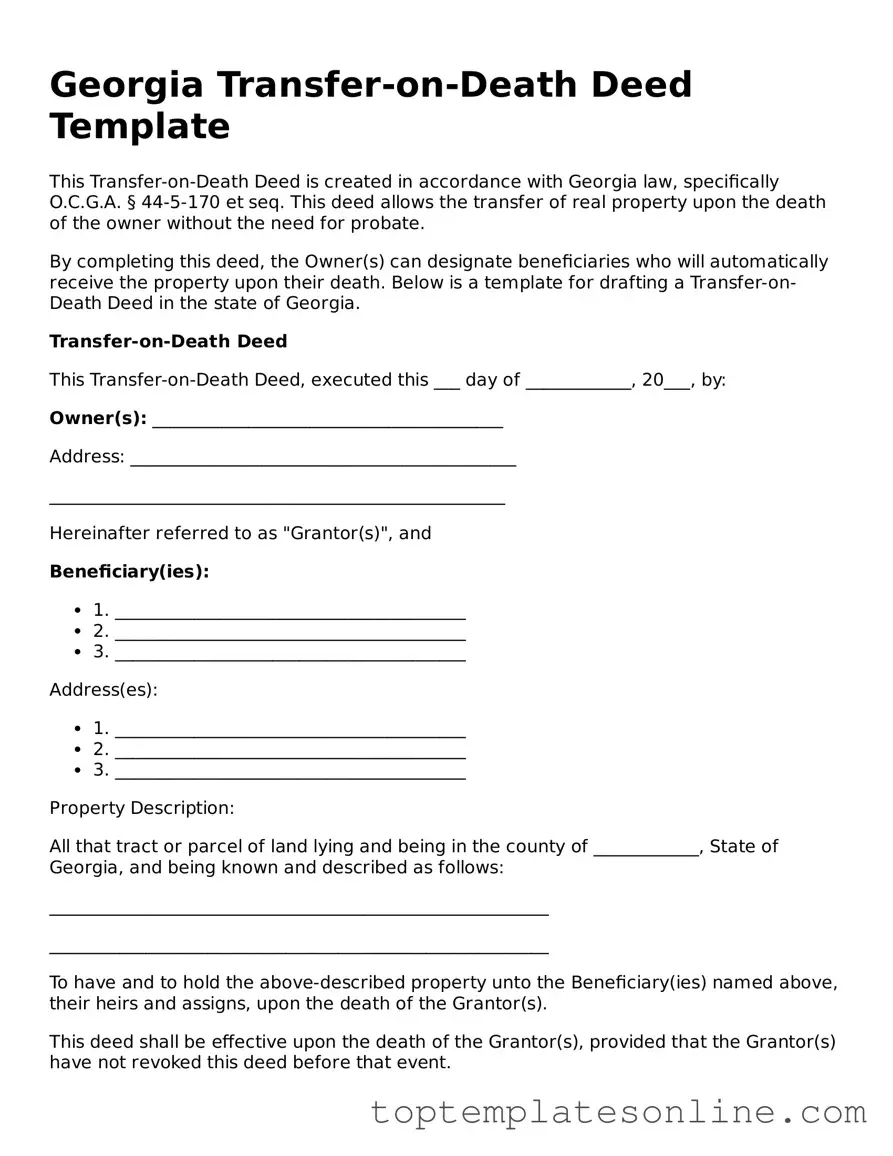

Blank Transfer-on-Death Deed Template for Georgia State

In the state of Georgia, the Transfer-on-Death Deed (TOD) form serves as a valuable tool for individuals looking to streamline the transfer of property upon their passing. This legal instrument allows property owners to designate beneficiaries who will inherit their real estate without the need for probate, simplifying the process for loved ones during an already challenging time. By filling out this form, individuals can maintain control over their property during their lifetime while ensuring that their wishes are honored after death. The TOD deed must be properly executed and recorded with the county to be effective, and it can be revoked or altered at any point before the owner's death. Understanding the nuances of this form can empower property owners to make informed decisions, providing peace of mind that their assets will be transferred smoothly and efficiently to their chosen heirs. With the right guidance, navigating this process can be straightforward and beneficial for families seeking to avoid the complexities of probate court.

Some Other State-specific Transfer-on-Death Deed Templates

How to Gift Land to Family Member - The deed can simplify matters for families, avoiding the often convoluted and emotional process of probate court.

A New York Non-disclosure Agreement form, often referred to as an NDA, is a legally binding document aimed at protecting proprietary and confidential information. When signed, it restricts the sharing of sensitive details to unauthorized parties. This tool is vital for individuals and companies looking to safeguard their intellectual property or trade secrets in New York. For further details, you can access a template at https://newyorkform.com/free-non-disclosure-agreement-template/.

Problems With Transfer on Death Deeds - A federally recognized option, the Transfer-on-Death Deed is gaining popularity.

Tod Title - A Transfer-on-Death Deed is not effective if the owner sells or otherwise transfers the property before death.

Transfer on Death Designation Affidavit - The deed is not effective if the property is sold or transferred to someone else before the owner's death.

Common mistakes

-

Incorrectly Identifying the Property: One common mistake is failing to accurately describe the property being transferred. It is crucial to include the correct legal description, which may differ from the address.

-

Not Including All Owners: If the property is co-owned, all owners must sign the deed. Omitting a co-owner can lead to disputes or invalidation of the deed.

-

Failure to Sign and Date: A Transfer-on-Death Deed must be signed and dated by the property owner. Neglecting to do so can render the deed ineffective.

-

Not Recording the Deed: After completing the form, it must be recorded with the county. Failing to record the deed means it may not be recognized during the transfer process.

Guide to Writing Georgia Transfer-on-Death Deed

Once you have the Georgia Transfer-on-Death Deed form in hand, you will need to complete it carefully to ensure that your intentions are clearly documented. Follow these steps to fill out the form accurately.

- Begin by entering the name of the property owner(s) in the designated section. Include the full legal names as they appear on the property title.

- Next, provide the address of the property. This should include the street address, city, county, and zip code.

- Identify the beneficiaries by writing their full names. These individuals will receive the property upon the owner's death.

- Include the relationship of each beneficiary to the property owner. This helps clarify the connection between the owner and the beneficiaries.

- Specify whether the beneficiaries will receive the property in equal shares or if there are specific percentages allocated to each. If applicable, state the percentage for each beneficiary.

- Sign the form in the presence of a notary public. Ensure that the notary acknowledges your signature appropriately.

- Lastly, file the completed deed with the county clerk’s office where the property is located. Confirm any filing fees and requirements that may apply.

Documents used along the form

The Georgia Transfer-on-Death Deed is a useful tool for individuals looking to transfer real property upon death without the need for probate. However, several other forms and documents may accompany this deed to ensure a smooth transfer process and proper legal compliance. Below is a list of commonly used documents in conjunction with the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines an individual's wishes regarding the distribution of their assets after death. It may include provisions that complement the Transfer-on-Death Deed.

- Durable Power of Attorney: This form allows an individual to designate someone to make financial and legal decisions on their behalf while they are still alive, but incapacitated.

- Living Will: A living will specifies an individual's preferences regarding medical treatment and end-of-life care, ensuring that their wishes are honored if they become unable to communicate.

- Beneficiary Designation Forms: These forms are used for financial accounts, such as life insurance policies or retirement accounts, allowing individuals to name beneficiaries directly, bypassing probate.

- Affidavit of Heirship: This document may be used to establish the heirs of a deceased person, particularly when there is no will or when the estate is small enough to avoid probate.

- Articles of Incorporation: Essential for establishing a corporation in New York, this document outlines vital information such as the corporation's name, purpose, and structure. For more details, refer to the NY Templates.

- Quitclaim Deed: This type of deed is used to transfer ownership of property without guaranteeing that the title is clear. It may be relevant in property transfers among family members.

- Property Title Search Report: This report provides information about the ownership history of a property, helping to ensure that the Transfer-on-Death Deed is executed correctly and that there are no liens or claims against the property.

Understanding these documents can help individuals navigate the complexities of property transfer and estate planning in Georgia. It is advisable to consult with a legal professional to ensure all necessary forms are completed accurately and in compliance with state laws.