Attorney-Approved Gift Deed Form

When it comes to transferring property without the exchange of money, a Gift Deed form plays a crucial role. This legal document allows an individual, known as the donor, to voluntarily give their property or assets to another person, referred to as the recipient or donee. The process is not merely a casual agreement; it requires careful attention to detail to ensure that the transfer is valid and enforceable. Key aspects of a Gift Deed include the identification of the parties involved, a clear description of the property being gifted, and the intention of the donor to make the gift without expecting anything in return. Additionally, the form often requires signatures from witnesses to further authenticate the transaction. Understanding these elements is essential for anyone considering making a gift of property, as it helps safeguard both the donor's and the recipient's interests while complying with state laws. By ensuring that the Gift Deed is properly executed, individuals can enjoy the peace of mind that comes with knowing their intentions are legally recognized.

Find More Types of Gift Deed Templates

New Jersey Quitclaim Deed Form - It can assist in estate planning by transferring property to heirs upon death without going through probate.

Title Companies and Transfer on Death Deeds - In many cases, the Transfer-on-Death Deed is an effective way to ensure that a property quickly moves to heirs of the owner’s choosing.

The Florida Operating Agreement form is a crucial document for limited liability companies (LLCs) in the state. This form outlines the management structure, responsibilities, and financial arrangements of the company, ensuring all members are on the same page. By clearly defining roles and expectations, it helps prevent misunderstandings and promotes smooth operations. For more information and resources, you can refer to Florida Forms.

What Is Deed in Lieu of Foreclosure - This process allows the borrower to surrender their home while addressing their outstanding mortgage obligations.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the Gift Deed form. This includes missing names, addresses, or the relationship between the giver and receiver. Ensure every section is filled out accurately.

-

Incorrect Property Description: It is crucial to accurately describe the property being gifted. Mistakes in the legal description can lead to confusion or disputes later on. Always double-check the property details.

-

Not Including Witness Signatures: Some people overlook the requirement for witness signatures. A Gift Deed typically needs to be signed by at least two witnesses to be valid. Without this step, the deed may not hold up legally.

-

Failure to Notarize: While not always mandatory, notarization adds an extra layer of legitimacy to the Gift Deed. Many individuals neglect this step, which can complicate future transactions or disputes regarding the gift.

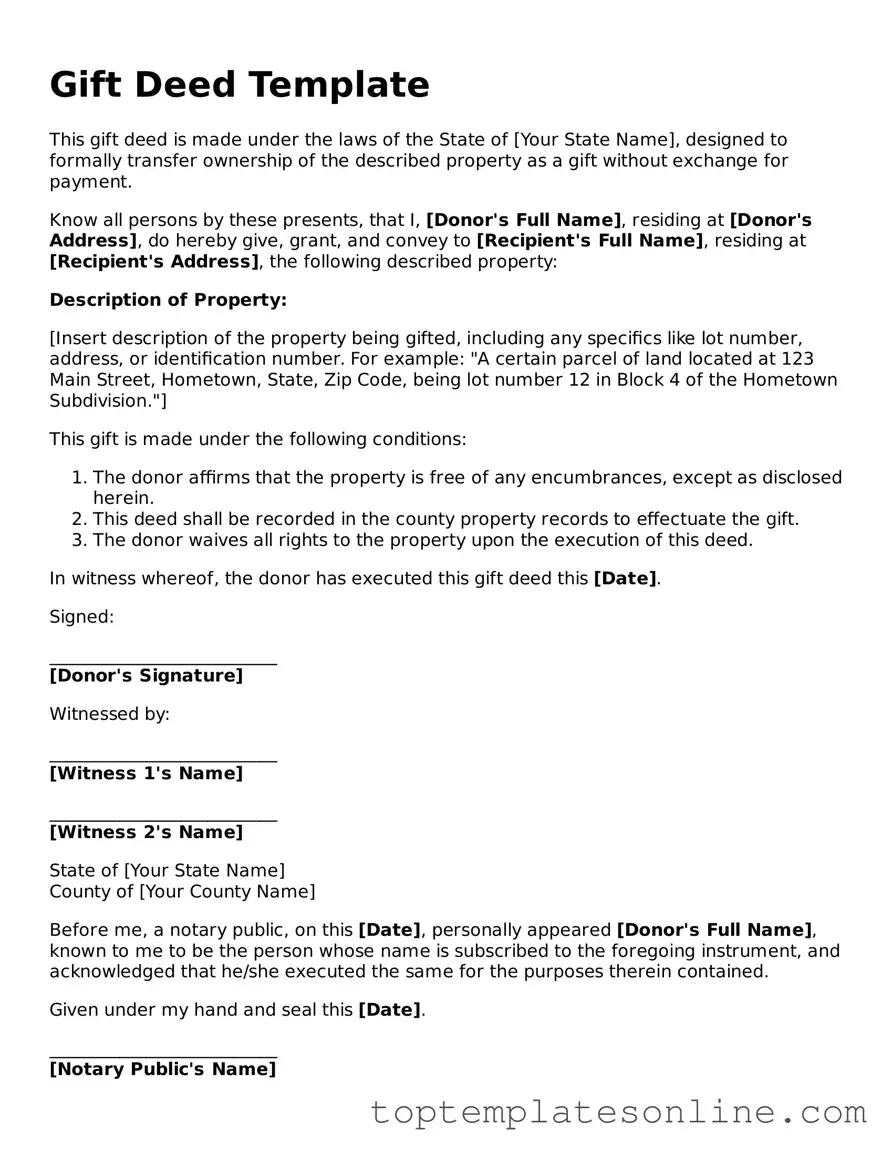

Guide to Writing Gift Deed

Once you have the Gift Deed form in front of you, it’s important to ensure that all necessary information is filled out accurately. This document will require specific details about the parties involved, the property being gifted, and any relevant conditions. Following the steps below will help you complete the form correctly.

- Begin by entering the date at the top of the form.

- Clearly state the full name and address of the donor (the person giving the gift).

- Next, provide the full name and address of the recipient (the person receiving the gift).

- Describe the property being gifted. Include details such as the address, legal description, and any identifying numbers.

- If there are any conditions attached to the gift, outline them in the designated section.

- Both the donor and recipient should sign the form. Ensure that signatures are dated.

- If required, have the form notarized to validate the signatures.

- Finally, make copies of the completed form for both the donor and recipient’s records.

Documents used along the form

When completing a Gift Deed, several other forms and documents may be necessary to ensure the transfer of property is legally recognized and properly documented. Each of these documents serves a specific purpose in the process of gifting property, and understanding them can help streamline the transaction.

- Property Title Deed: This document establishes ownership of the property being gifted. It provides details about the property and identifies the current owner, ensuring that the person giving the gift has the legal right to do so.

- Gift Tax Return (Form 709): Depending on the value of the gift, the donor may need to file this form with the IRS. It reports gifts that exceed the annual exclusion limit and helps determine any potential tax implications.

- Affidavit of Gift: This sworn statement can provide additional proof of the intent to gift. It outlines the details of the gift and can help clarify the donor's wishes if any disputes arise in the future.

- Change of Ownership Form: Some states require this form to officially update the ownership records with the local tax assessor's office. It helps ensure that property taxes are assigned to the new owner.

- Trailer Bill of Sale: This document is necessary for the transfer of ownership of a trailer in Florida. For more information, visit https://floridaforms.net/blank-trailer-bill-of-sale-form/.

- Power of Attorney (if applicable): If the donor is unable to sign the Gift Deed in person, a Power of Attorney may be necessary. This document allows someone else to act on the donor's behalf, ensuring the transfer can still take place.

- Notarization Certificate: While not always required, having the Gift Deed notarized adds an extra layer of authenticity. A notary public verifies the identities of the parties involved and witnesses the signing of the document.

Understanding these additional forms and documents can make the process of gifting property smoother and more efficient. Each document plays a role in ensuring that the gift is legally valid and that both the donor and recipient are protected throughout the transaction.