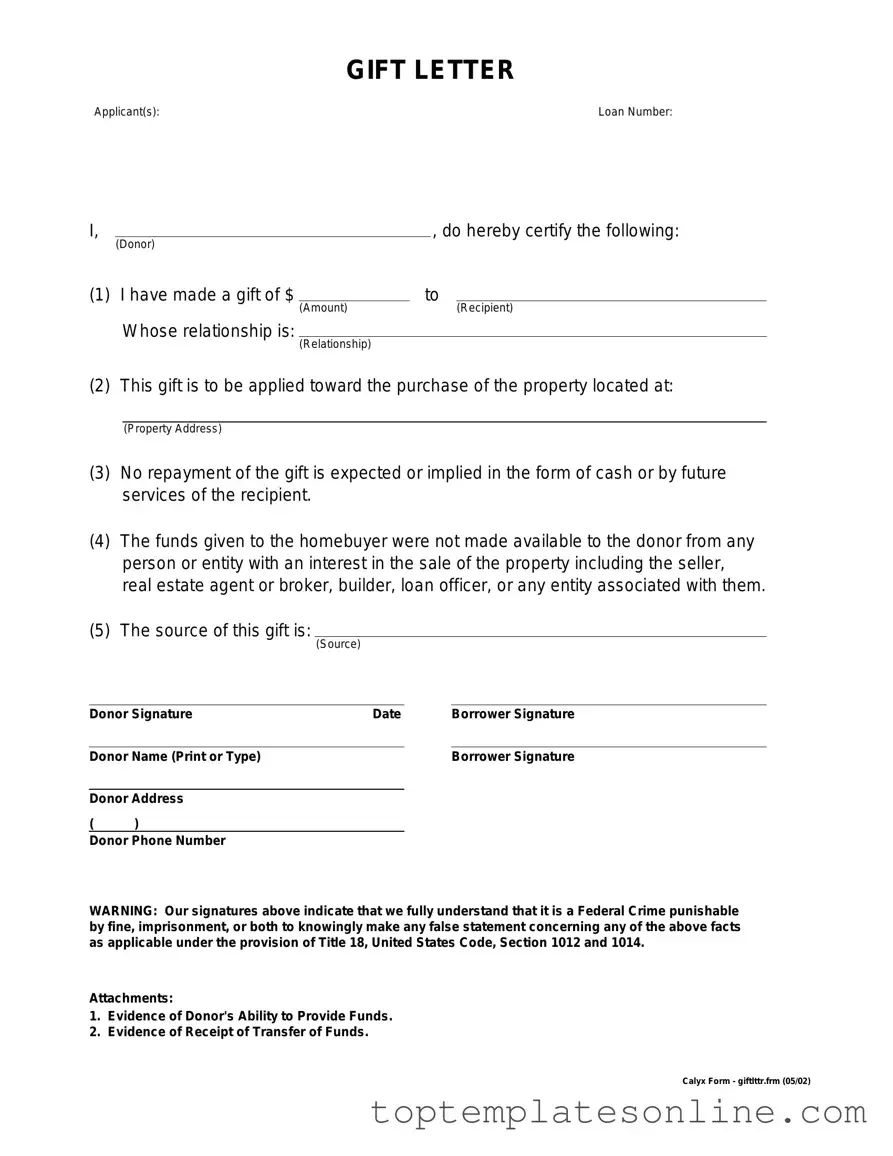

Fillable Gift Letter Form

When it comes to purchasing a home, financial assistance from family or friends can make a significant difference. The Gift Letter form serves as a crucial document in this process, providing a clear record of monetary gifts intended for the down payment or closing costs of a property. This form not only confirms that the funds are indeed a gift and not a loan, which could complicate mortgage approval, but it also outlines the relationship between the giver and the recipient. By including essential details such as the amount of the gift, the date it was given, and the donor's signature, the Gift Letter form helps to establish transparency in the transaction. Lenders often require this document to ensure compliance with their guidelines, making it a vital piece of paperwork in the home-buying journey. Understanding the importance of this form can empower both givers and recipients to navigate the financial aspects of homeownership with confidence.

Common PDF Templates

Citibank Atm Deposit - Sign up for direct deposit with Citibank for more convenient banking.

For individuals looking to establish a means for someone else to manage their affairs, a General Power of Attorney form in New York is a vital legal instrument. It empowers a designated person with the authority to handle important decisions, making it indispensable for those who may be unable to do so themselves. To explore templates that can help in this regard, you can visit NY Templates for further guidance.

Contractor Roof Certification Form - The certification must be printed on a licensed contractor's letterhead.

Employee Incident Report - The report is a key piece in keeping a safe worksite.

Common mistakes

-

Not including the donor's full name and address. This information is crucial for verifying the source of the funds.

-

Failing to specify the relationship between the donor and the recipient. Lenders often require this to assess the nature of the gift.

-

Leaving out the amount of the gift. The exact dollar amount must be clearly stated to avoid confusion.

-

Not signing the letter. A signature from the donor is essential to validate the gift.

-

Using vague language. It’s important to clearly state that the funds are a gift and do not need to be repaid.

-

Neglecting to date the letter. A date helps to establish when the gift was made, which can be important for documentation.

-

Not providing a statement about the donor's financial ability to make the gift. This reassures lenders that the donor is capable of providing the funds without financial strain.

-

Forgetting to include any relevant supporting documents. This could include bank statements or proof of funds, which can help substantiate the gift.

Guide to Writing Gift Letter

Filling out the Gift Letter form is an important step in documenting financial gifts, especially when it comes to securing a mortgage. Once you have completed the form, it will be used to verify that the funds you are receiving as a gift do not need to be repaid. This can help streamline the loan approval process.

- Begin by entering the date at the top of the form. Make sure to use the current date.

- Provide the name of the donor, who is giving the gift. Include their relationship to you, such as parent, sibling, or friend.

- Next, fill in the donor's address. This should include the street address, city, state, and zip code.

- Indicate the amount of the gift. Be clear and precise about the total dollar amount being gifted.

- In the next section, write a statement confirming that the gift is not a loan. This is often a simple declaration that the funds do not need to be repaid.

- Have the donor sign and date the form. Their signature is crucial for authenticity.

- Lastly, ensure that all sections are filled out completely and accurately before submitting the form.

Documents used along the form

When applying for a mortgage or a loan, the Gift Letter form is often accompanied by several other important documents. These documents help establish the legitimacy of the gift and provide the lender with a comprehensive understanding of the financial situation. Below is a list of common forms and documents that are typically used alongside the Gift Letter.

- Bank Statement: This document shows the donor's financial history and confirms that the funds are available. It helps verify that the gift is a legitimate transfer of money rather than a loan.

- Donor's Identification: A copy of the donor's ID, such as a driver's license or passport, is often required. This helps establish the identity of the person providing the gift.

- Loan Application: The borrower must complete a loan application that outlines their financial status. This document is crucial for the lender to assess the borrower's creditworthiness.

- Income Verification: Pay stubs, tax returns, or W-2 forms may be needed to verify the borrower's income. This information is essential for lenders to determine the borrower’s ability to repay the loan.

- Gift Fund Source Documentation: This document provides details on where the gift funds originated. Lenders may require a paper trail to ensure the funds are not from undisclosed sources.

- Purchase Agreement: If the gift is intended for a home purchase, the purchase agreement outlines the terms of the sale. This document is important for the lender to understand the transaction context.

- Residential Lease Agreement: To clearly outline rental terms, use the essential New York residential lease agreement considerations for effective landlord-tenant relationships.

- Credit Report: A credit report gives lenders insight into the borrower's credit history. It helps them evaluate the risk involved in lending money to the borrower.

- Gift Tax Return (if applicable): If the gift amount exceeds the annual exclusion limit, a gift tax return may be necessary. This document provides information about any potential tax implications for the donor.

Having these documents ready can streamline the mortgage process and help ensure that all parties involved have a clear understanding of the financial arrangements. Timely submission of these forms can significantly impact the approval timeline, so it’s important to gather them as soon as possible.