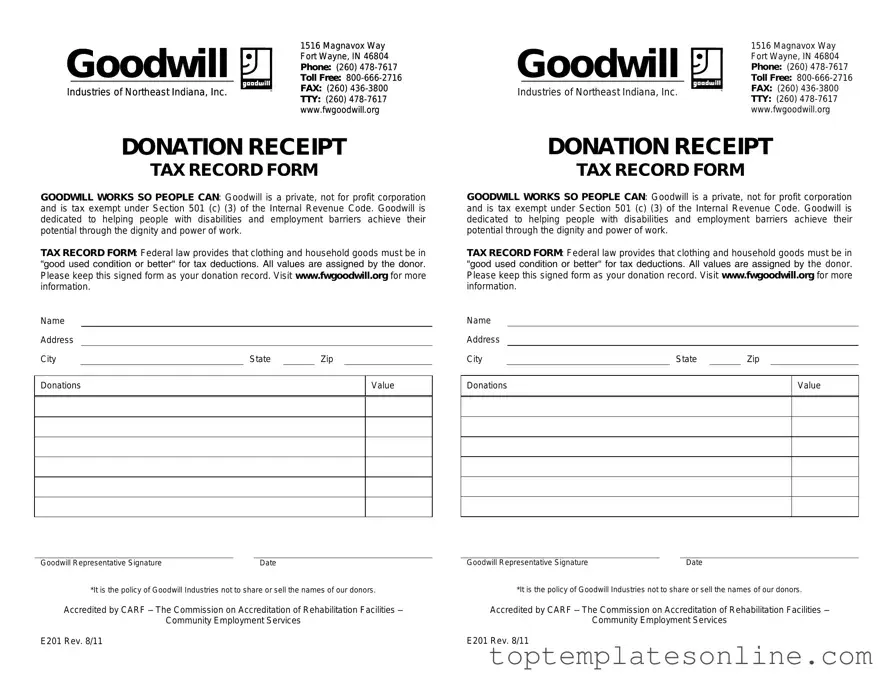

Fillable Goodwill donation receipt Form

When individuals choose to donate items to Goodwill, they not only contribute to their community but also create opportunities for themselves when it comes to tax deductions. The Goodwill donation receipt form plays a crucial role in this process. This form serves as a record of the items donated, providing both the donor and Goodwill with essential information. It typically includes the donor's name, address, and a detailed list of the donated items, along with their estimated values. The form is designed to be user-friendly, allowing donors to easily fill it out and retain a copy for their records. It is important to note that while Goodwill provides a general guideline for valuing items, the final determination of value rests with the donor. This form not only facilitates the donation process but also ensures that individuals can substantiate their charitable contributions when filing their taxes. Understanding the significance of the Goodwill donation receipt form can empower donors to make informed decisions and maximize the benefits of their generous acts.

Common PDF Templates

Where to Submit I 864 Affidavit of Support - Incorrectly completed I-864 forms may result in delays in visa processing times.

Clock in Clock Out Sheet - This document is needed for wage calculation verification.

To navigate the complexities of real estate transactions in Texas, it is essential to grasp the nuances of the Texas TREC Residential Contract form, a resource that can be further explored at https://texasformspdf.com, ensuring that all parties are well-informed and the process is conducted smoothly.

Wage and Tax Statement - Employees can request corrections to their W-2s if errors are found.

Common mistakes

-

Not including a date: Many people forget to write the date of the donation. This information is crucial for record-keeping and tax purposes.

-

Failing to list donated items: Donors often neglect to provide a detailed list of the items they are donating. A clear inventory helps in valuing the donation accurately.

-

Estimating values inaccurately: Some individuals guess the value of their items instead of using fair market value. This can lead to discrepancies during tax filing.

-

Not signing the receipt: It is common for donors to overlook signing the receipt. A signature validates the donation and is often required for tax deductions.

-

Leaving out personal information: Donors sometimes forget to include their name and address. This information is essential for Goodwill to provide proper acknowledgment.

-

Ignoring the purpose of the donation: Some people do not specify whether the donation is for a specific cause or program. This can impact how Goodwill allocates the items.

-

Not keeping a copy of the receipt: Many donors fail to retain a copy of the receipt for their records. Keeping a copy is important for tax documentation.

-

Not checking for completeness: After filling out the form, some individuals do not review it for completeness. Double-checking can prevent missing information.

-

Assuming electronic donations are treated the same: Donors often think that electronic donations do not require a receipt. However, all donations should be documented, regardless of the method.

Guide to Writing Goodwill donation receipt

After you gather your items for donation, you’ll need to fill out the Goodwill donation receipt form. This form helps you keep track of your contributions and may be useful for tax purposes. Follow these steps to ensure you complete the form accurately.

- Start by writing the date of your donation at the top of the form.

- Next, list the items you are donating. Be specific; include the type of items and their condition.

- Indicate the estimated value of each item. This can be a rough estimate based on what you believe the items are worth.

- Include your name and contact information. This helps Goodwill keep records and allows them to reach you if needed.

- Sign the form to confirm that the information you provided is accurate.

- Keep a copy of the completed form for your records. This is important for tax purposes.

Once you’ve filled out the form, you can hand it over to the Goodwill representative. They will provide you with a copy for your records. This receipt can be beneficial when you file your taxes, as it documents your charitable contribution.

Documents used along the form

When making donations to Goodwill or similar organizations, several forms and documents may accompany the Goodwill donation receipt form. Each document serves a specific purpose and can help ensure that the donation process is smooth and well-documented.

- Donation Inventory List: This document provides a detailed list of items donated, including descriptions and estimated values. It helps both the donor and the organization keep track of what was given.

- Tax Deduction Worksheet: A worksheet that helps donors calculate the potential tax deductions for their contributions. This can be particularly useful during tax season.

- Charitable Contribution Form: Some organizations require a specific form to be filled out for record-keeping purposes. This form may include donor information and details about the donation.

- Thank You Letter: After the donation is processed, organizations often send a thank you letter. This letter acknowledges the donation and can serve as an additional record for tax purposes.

- Florida Trailer Bill of Sale: This document is essential for ensuring the legal transfer of ownership of a trailer in Florida, providing a proof of sale for both parties involved. For more information, refer to Florida Forms.

- Appraisal Form: If high-value items are donated, an appraisal form may be necessary. This document provides a professional valuation of the items, which can be important for tax deductions.

- Donation Agreement: In some cases, a donation agreement may be used to outline the terms of the donation, including any restrictions on how the donated items can be used.

Understanding these documents can enhance the donation experience. By keeping organized records, donors can ensure that their contributions are properly acknowledged and maximized for tax benefits.