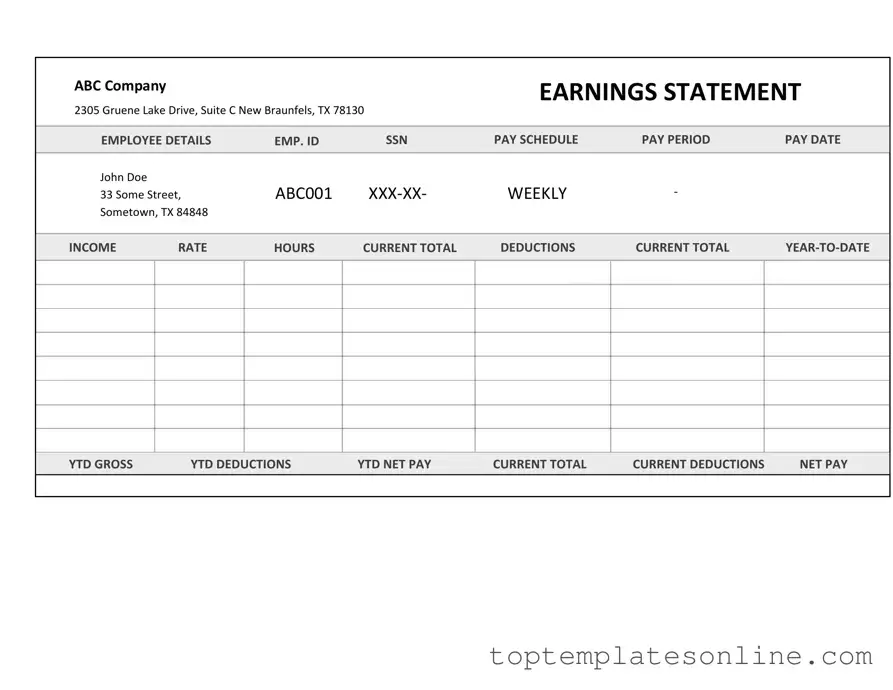

Fillable Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form serves as an essential document for freelancers and independent contractors, providing a clear record of earnings for each pay period. This form typically includes key information such as the contractor's name, address, and Social Security number, alongside details about the services rendered, hours worked, and the agreed-upon payment rate. Additionally, it outlines any deductions that may apply, ensuring transparency in financial transactions. By breaking down the total amount paid, the pay stub helps contractors track their income and simplifies tax reporting. This form not only benefits the contractors but also serves as a valuable tool for clients, as it formalizes the payment process and maintains accurate records for accounting purposes. Understanding the components of the Independent Contractor Pay Stub is crucial for both parties to ensure compliance and clarity in their business relationship.

Common PDF Templates

Panel Load Calculation - Users can expect detailed guidance through the sections of this calculation form.

Bf Application Form - Interested in finding someone who loves animals and caring for pets.

For individuals and businesses looking to safeguard their sensitive information, understanding the importance of a Non-disclosure Agreement is vital. This essential Non-disclosure Agreement form serves to protect proprietary information from unauthorized disclosure, allowing parties to communicate freely while maintaining confidentiality. You can explore more about it through this link.

Declaration of Financial Support - It is advisable to review the I-134 thoroughly before submission.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details such as their full name, address, or Social Security number. This can lead to issues with tax reporting and payments.

-

Miscalculating Hours Worked: Some contractors either underestimate or overestimate the hours they have worked. This can result in underpayment or overpayment, which complicates financial records.

-

Omitting Payment Rates: It’s essential to clearly state the payment rate for services rendered. Failing to include this information can create confusion and disputes regarding compensation.

-

Neglecting Deductions: Contractors often overlook necessary deductions, such as taxes or retirement contributions. This can lead to unexpected tax liabilities at the end of the year.

-

Not Keeping Copies: Some individuals forget to keep copies of their pay stubs for personal records. This can be problematic when it comes time to file taxes or verify income for loans.

Guide to Writing Independent Contractor Pay Stub

Once you have the Independent Contractor Pay Stub form ready, you’ll need to fill it out accurately to ensure proper payment processing. Follow these steps to complete the form correctly.

- Enter Your Name: Start by filling in your full name at the top of the form.

- Provide Your Address: Next, include your current address. Make sure to write it clearly.

- List Your Tax ID Number: Enter your Social Security Number or Employer Identification Number (EIN) as required.

- Fill in the Pay Period: Specify the start and end dates of the pay period for which you are being compensated.

- State Your Payment Amount: Clearly write the total amount you are to be paid for the work completed during the pay period.

- Include Deductions: If applicable, list any deductions that should be taken from your payment, such as taxes or benefits.

- Sign and Date the Form: Finally, sign the form and include the date to confirm that all information is accurate.

After completing these steps, review the form to ensure all information is correct. Once verified, submit it according to the guidelines provided by the contracting entity.

Documents used along the form

When working with independent contractors, several forms and documents may be necessary to ensure proper record-keeping and compliance. Below is a list of commonly used documents that often accompany the Independent Contractor Pay Stub form.

- Independent Contractor Agreement: This document outlines the terms of the working relationship, including payment rates, responsibilities, and duration of the contract.

- W-9 Form: Contractors complete this form to provide their taxpayer identification number to the hiring company for tax reporting purposes.

- Boat Bill of Sale: Essential for transferring ownership of a watercraft in New York, this legal document provides a clear record of the transaction, ensuring all necessary details are documented. For more information, visit NY Templates.

- Invoice: An invoice is submitted by the contractor to request payment for services rendered, detailing the work completed and the amount owed.

- Payment Authorization Form: This form authorizes the company to process payments to the contractor, ensuring that all financial transactions are documented.

- 1099 Form: At the end of the tax year, this form is issued to report payments made to the contractor, which is necessary for tax filing.

- Time Sheet: A time sheet records the hours worked by the contractor, providing a basis for payment calculations.

- Non-Disclosure Agreement (NDA): This document protects confidential information shared between the contractor and the company during their working relationship.

- Work Product Agreement: This agreement clarifies the ownership of work produced by the contractor, ensuring that the company retains rights to the final product.

These documents are essential for maintaining clarity and legality in the contractor relationship. Proper documentation helps protect both the contractor and the hiring company, ensuring that all parties understand their rights and obligations.