Fillable Intent To Lien Florida Form

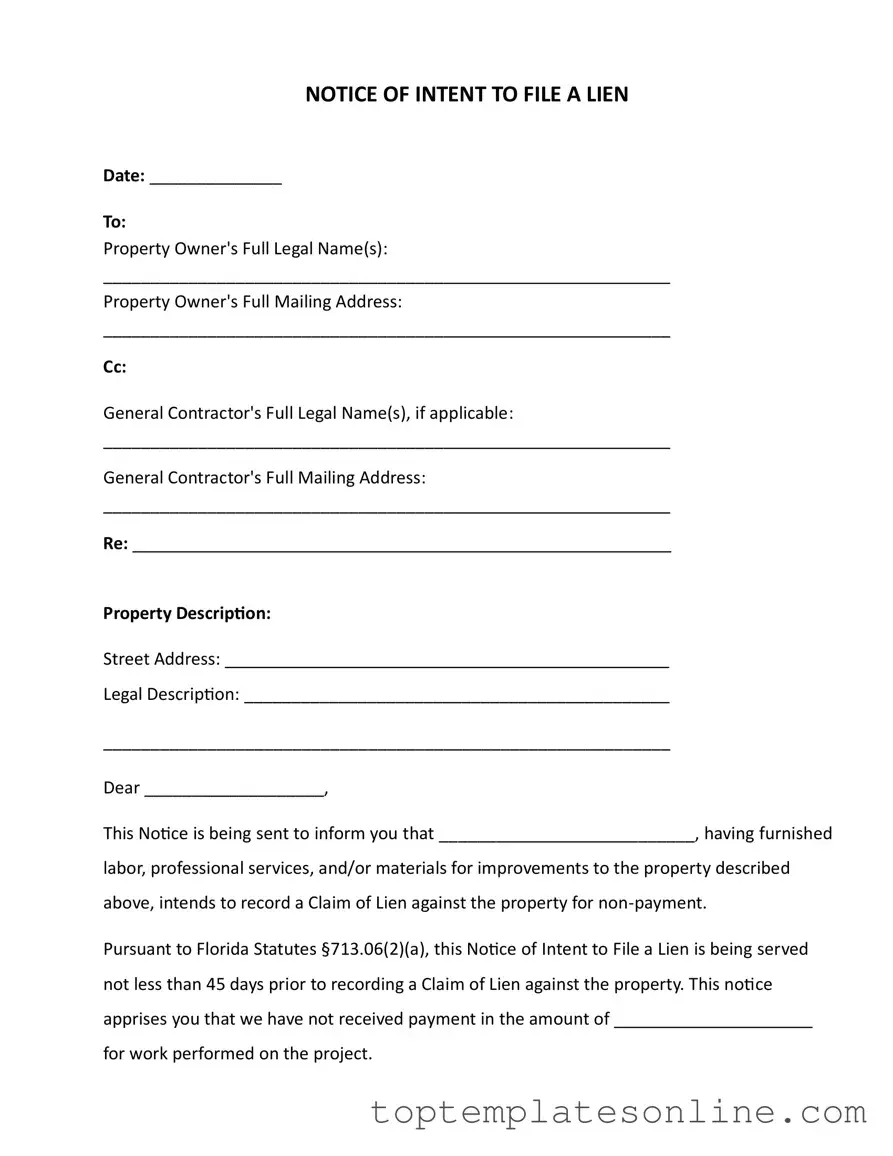

The Intent to Lien form in Florida serves as a crucial notice for property owners regarding potential claims against their property due to unpaid services or materials related to construction or improvement projects. This form is typically issued by contractors, subcontractors, or suppliers who have not received payment for their contributions to a property. By completing and sending this notice, the sender informs the property owner that they intend to file a lien if payment is not made within a specified timeframe. The form includes essential details such as the date, property owner's legal name and address, and a description of the property involved. It also outlines the amount owed and emphasizes the legal implications of failing to respond, including the risk of foreclosure and additional costs. The notice must be served at least 45 days before the lien is recorded, providing the property owner with a clear opportunity to address the outstanding payment. In addition, the sender certifies the method of delivery to ensure that the notice has been properly communicated. Overall, this form is a vital tool in the construction industry, balancing the rights of service providers with the interests of property owners.

Common PDF Templates

Roofing Inspection Template - Emergency repairs are noted to assess the urgency and extent of prior issues.

When Are 1098 Forms Available - Details about additional principal payments can guide you in accelerating your mortgage payoff.

In addition to maintaining clear records, utilizing the Florida Forms can streamline the process of completing a Trailer Bill of Sale, ensuring that every detail is accurately captured and legally binding for both the buyer and seller.

Form I 589 - This form allows individuals to seek protection from persecution.

Common mistakes

-

Incorrect Dates: Failing to fill in the date accurately can cause delays and confusion.

-

Missing Property Owner Information: Omitting the full legal name or mailing address of the property owner can invalidate the notice.

-

Incomplete General Contractor Details: If applicable, not including the general contractor’s full name and address can lead to complications.

-

Insufficient Property Description: Not providing a clear street address and legal description may result in challenges to the lien.

-

Failure to State Amount Due: Leaving out the specific amount owed for services or materials can weaken your claim.

-

Ignoring Timelines: Not serving the notice at least 45 days before filing a lien can jeopardize your rights.

-

Neglecting to Mention Payment Terms: Not specifying the 30-day response period for payment can lead to misunderstandings.

-

Missing Signature: Forgetting to sign the document can render it ineffective.

-

Improper Certificate of Service: Not accurately completing the certificate of service can lead to disputes over whether the notice was properly served.

-

Failure to Keep Copies: Not retaining a copy of the notice for your records can hinder future actions.

Guide to Writing Intent To Lien Florida

After completing the Intent To Lien form, it is essential to serve it properly to ensure that the property owner is aware of the impending lien. This step is crucial in protecting your rights regarding payment for services rendered. Following these instructions will help you fill out the form accurately.

- Date: Write the current date at the top of the form.

- Property Owner's Name: Fill in the full legal name(s) of the property owner(s).

- Property Owner's Mailing Address: Enter the complete mailing address of the property owner.

- General Contractor's Name: If applicable, include the full legal name(s) of the general contractor.

- General Contractor's Mailing Address: Provide the mailing address for the general contractor, if relevant.

- Property Description: Fill in the street address of the property.

- Legal Description: Include the legal description of the property as required.

- Dear [Property Owner's Name]: Address the property owner in the salutation.

- Statement of Intent: Indicate the name of the individual or company intending to file the lien.

- Amount Due: Specify the amount that has not been paid for work performed.

- Signature: Sign the form with your name, title, phone number, and email address.

- Certificate of Service: Fill in the date the notice was served and the name of the individual who received it.

- Method of Service: Check the appropriate box indicating how the notice was delivered.

- Name and Signature: Include the name and signature of the person serving the notice.

Documents used along the form

When dealing with property improvements and potential payment disputes in Florida, the Intent to Lien form is just one of several important documents that may be involved in the process. Understanding these additional forms can help clarify the steps that may follow if payment issues arise. Here’s a brief overview of other key documents often used alongside the Intent to Lien form.

- Claim of Lien: This document is filed to formally assert a lien against a property when payment has not been received. It provides details about the work performed and the amount owed, making it a critical step in protecting the rights of contractors and suppliers.

- Notice to Owner: This is a notice sent to the property owner to inform them that someone has begun work or supplied materials for their property. It serves to protect the rights of subcontractors and suppliers by ensuring the owner is aware of potential liens.

- Release of Lien: Once payment is received, a Release of Lien is filed to remove the lien from the property. This document confirms that the debt has been satisfied and that the property is no longer encumbered.

- Affidavit of Non-Payment: This document can be used to affirm that payment has not been received for services rendered. It may be required in certain situations to support a claim for a lien.

- Notice of Non-Payment: Similar to the Intent to Lien, this notice is sent to inform the property owner that payment has not been received. It serves as a reminder and may help prompt payment before further action is taken.

- Hold Harmless Agreement Form: To protect against liability, utilize the necessary Hold Harmless Agreement documentation in various activities and projects.

- Sworn Statement: This document is often used by contractors and subcontractors to confirm the amount owed for work completed. It may be required by the property owner or general contractor to verify claims.

- Construction Contract: This legal agreement outlines the terms of the work to be performed, including payment schedules and responsibilities. It serves as the foundation for the relationship between the property owner and the contractor.

- Payment Application: This document is submitted by contractors to request payment for work completed. It typically includes details about the work performed and the amount requested, ensuring transparency in the payment process.

Understanding these documents can help property owners, contractors, and suppliers navigate the complexities of construction and payment issues in Florida. Being proactive and informed can prevent disputes and ensure smoother transactions in property improvement projects.