Attorney-Approved Investment Letter of Intent Form

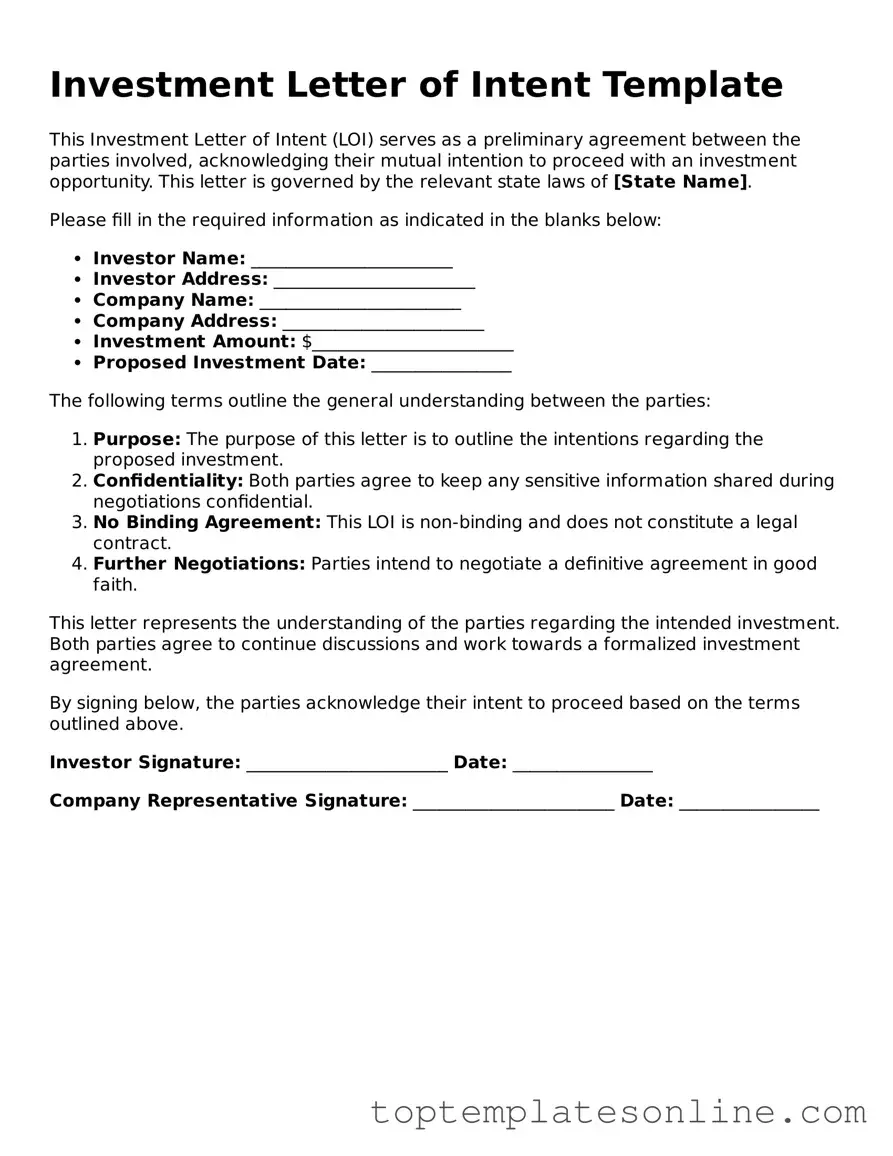

The Investment Letter of Intent form serves as a crucial document in the world of investment transactions. It outlines the key terms and conditions under which an investor intends to commit capital to a particular venture or project. This form typically includes essential details such as the amount of investment, the expected timeline for funding, and the rights and obligations of both parties involved. By clearly stating the intentions of the investor, the form helps to establish a mutual understanding between the investor and the recipient of the funds. Additionally, it often addresses confidentiality clauses and conditions that must be met before the investment is finalized. Overall, the Investment Letter of Intent is not just a formal step; it acts as a foundation for building trust and clarity in financial partnerships.

Find More Types of Investment Letter of Intent Templates

Letter of Intent Resume - Provides a basis for follow-up discussions regarding the offer.

Letter of Intent Real Estate Example - The letter can reinforce the buyer's commitment to following through with the purchase.

Sue Letter of Intent to Take Legal Action Template - This document serves as a formal notification to the opposing party.

Common mistakes

-

Not providing complete contact information. Ensure that your name, address, phone number, and email are accurate and up to date.

-

Failing to specify the investment amount. Clearly state how much you intend to invest to avoid confusion.

-

Overlooking the investment purpose. Describe why you are interested in this investment. This helps in understanding your goals.

-

Ignoring deadlines. Submit your form by the specified date to ensure your application is considered.

-

Not reviewing for errors. Typos or incorrect information can lead to delays or rejections.

-

Neglecting to sign the document. An unsigned form is not valid and will not be processed.

-

Using vague language. Be specific about your intentions and any conditions you may have.

-

Forgetting to attach required documents. Check the instructions to ensure you include everything needed for your application.

Guide to Writing Investment Letter of Intent

Filling out the Investment Letter of Intent form is a straightforward process. Once completed, this form will help outline your intentions regarding an investment opportunity. It's important to provide accurate information to ensure clarity and mutual understanding.

- Begin by entering your full name in the designated field.

- Provide your contact information, including your email address and phone number.

- Fill in the date on which you are completing the form.

- Indicate the name of the investment opportunity you are interested in.

- Describe the amount you intend to invest.

- Include any relevant details about your investment strategy or goals.

- Sign the form to acknowledge your commitment.

- Review the completed form for accuracy and completeness.

- Submit the form according to the provided instructions, either electronically or by mail.

Once you have submitted the form, you can expect to receive further communication regarding the next steps in the investment process. Be prepared to discuss your investment intentions in more detail.

Documents used along the form

The Investment Letter of Intent (LOI) serves as a preliminary agreement between parties interested in pursuing an investment opportunity. While the LOI outlines the basic terms and intentions, it is often accompanied by various other forms and documents that help clarify and formalize the investment process. Below is a list of common documents used alongside the Investment Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains confidential. It outlines the obligations of each party to protect proprietary information.

- Term Sheet: A term sheet summarizes the key terms and conditions of the investment. It serves as a reference point for negotiations and outlines the structure of the deal.

- Due Diligence Checklist: This checklist is used to guide the investigation of a potential investment. It typically includes financial, legal, and operational aspects that need to be reviewed.

- Subscription Agreement: This agreement is signed by an investor when purchasing shares in a company. It details the terms of the investment and the rights of the investor.

- Operating Agreement: For limited liability companies (LLCs), this document outlines the management structure and operational procedures of the company, including the roles of members and managers.

- Shareholder Agreement: This agreement governs the relationship between shareholders in a corporation. It includes provisions on voting rights, dividend distributions, and transfer of shares.

- Investment Memorandum: Also known as a private placement memorandum, this document provides potential investors with detailed information about the investment opportunity, including risks and financial projections.

- Closing Documents: These are various legal documents executed at the closing of a transaction, including the final purchase agreement and any necessary regulatory filings.

- Legal Opinion Letter: This letter is provided by legal counsel and assures investors that the transaction complies with applicable laws and regulations.

Each of these documents plays a crucial role in the investment process, helping to establish clarity and protect the interests of all parties involved. Understanding these documents can facilitate smoother negotiations and contribute to successful investment outcomes.