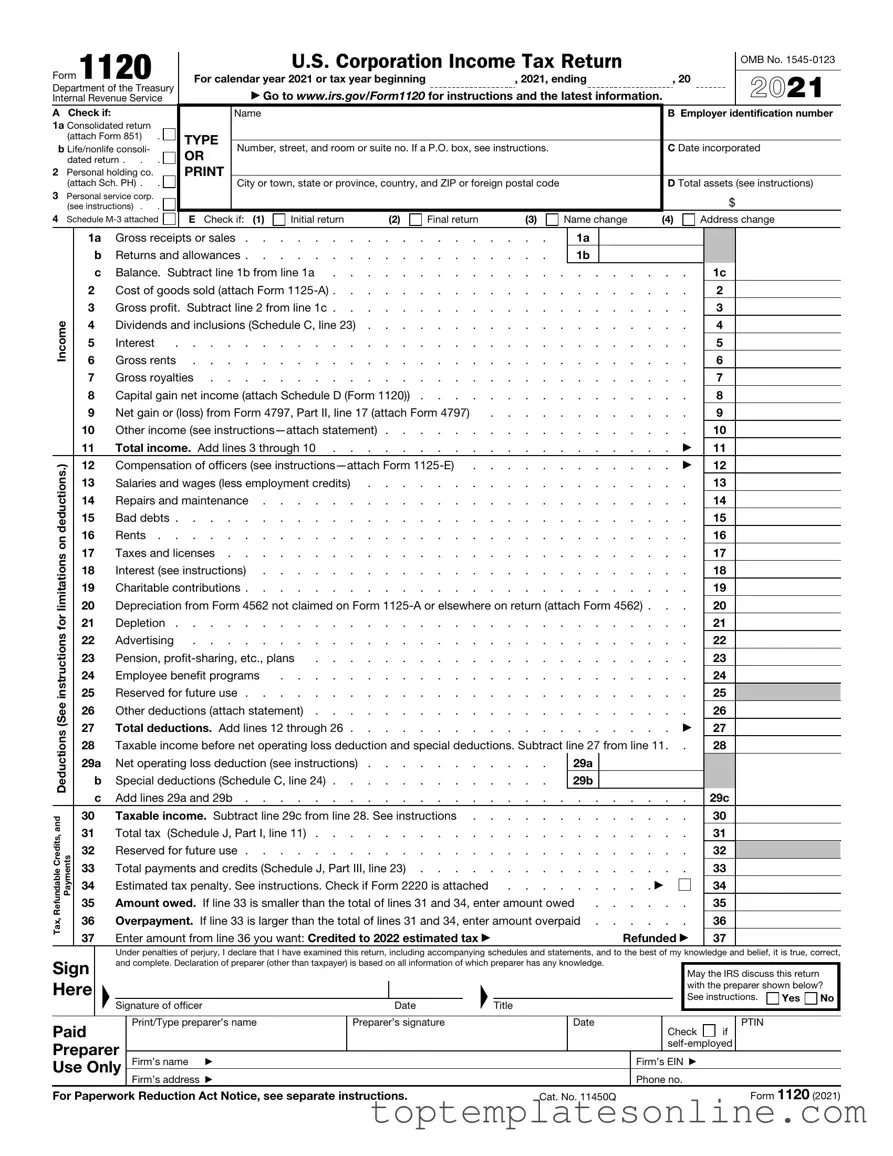

Fillable IRS 1120 Form

The IRS 1120 form serves as a critical document for corporations operating within the United States, providing a comprehensive overview of their financial activities for the tax year. This form is used to report income, gains, losses, deductions, and credits, ultimately determining the corporation's tax liability. Corporations, including C corporations, must file this form annually, ensuring compliance with federal tax regulations. Key components of the form include sections for reporting gross receipts, cost of goods sold, and various deductions such as operating expenses and taxes. Additionally, corporations must disclose information regarding their shareholders and any dividends paid. Accurate completion of the IRS 1120 is essential, as it directly impacts the corporation's tax obligations and potential refunds. Understanding the intricacies of this form can aid corporations in effective tax planning and compliance, minimizing the risk of errors that could lead to penalties or audits.

Common PDF Templates

Broward County Animal Care - Delineates the animal’s gender and reproductive status.

A Florida Non-disclosure Agreement (NDA) is a legally binding contract designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping confidential information private, ensuring that proprietary details remain secure. For detailed guidance on this form, it's beneficial to consult resources such as Florida Forms, as understanding the nuances of this document is essential for anyone looking to safeguard their intellectual property or trade secrets in the state of Florida.

Reprint Label Fedex - Ensure that all special markings for hazardous materials are properly designated.

Positive Pregnancy Result Planned Parenthood Pregnancy Confirmation Letter - This form emphasizes discussing emotional or physical health concerns freely.

Common mistakes

-

Incorrect Business Name or Address: Many taxpayers fail to ensure that the business name and address on the form match the information registered with the IRS. This can lead to processing delays or rejections.

-

Missing Employer Identification Number (EIN): Some filers forget to include their EIN. This number is crucial for identifying your business and must be provided accurately.

-

Inaccurate Income Reporting: Underreporting or overreporting income can have serious consequences. It's essential to ensure that all sources of income are accurately reflected on the form.

-

Failure to Claim Deductions: Many businesses miss out on valuable deductions. Be sure to review all eligible expenses, as overlooking them can lead to higher tax liabilities.

-

Improperly Calculating Tax Liability: Errors in calculating your tax liability can result in underpayment or overpayment. Double-check your math and consider using tax software or consulting a professional.

-

Neglecting to Sign the Form: A common mistake is forgetting to sign the form before submission. An unsigned form is considered invalid and may delay processing.

-

Not Keeping Copies: Failing to keep a copy of the submitted form can be problematic. Always retain a copy for your records in case of future inquiries or audits.

-

Missing Deadlines: Filing the form late can incur penalties. Be aware of the deadlines to ensure timely submission and avoid unnecessary fees.

-

Ignoring State Requirements: Each state may have additional filing requirements. Not checking for state-specific obligations can lead to complications down the line.

Guide to Writing IRS 1120

Filling out the IRS Form 1120 is an essential step for corporations in the United States to report their income, gains, losses, deductions, and credits. Completing this form accurately ensures compliance with tax laws and helps avoid potential penalties. Here’s a straightforward guide to help you through the process.

- Gather necessary documents, including financial statements, receipts, and any previous tax returns.

- Obtain the latest version of IRS Form 1120 from the IRS website or a tax professional.

- Fill out the corporation’s name, address, and Employer Identification Number (EIN) at the top of the form.

- Report the corporation's income in Part I, including gross receipts and any other income sources.

- Complete Part II by detailing the corporation's deductions, such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income in Part III.

- In Part IV, report any tax credits the corporation is eligible for.

- Complete the signature section, including the date and the title of the person signing the form.

- Double-check all entries for accuracy and completeness.

- File the completed Form 1120 with the IRS by the due date, either electronically or via mail.

Once you have filled out the form, it’s crucial to keep a copy for your records. This will not only help you in future filings but also serve as a reference in case of any inquiries from the IRS.

Documents used along the form

The IRS Form 1120 is a crucial document for corporations in the United States, used to report income, gains, losses, deductions, and credits. However, several other forms and documents often accompany this primary filing. Each of these documents serves a specific purpose and helps ensure compliance with federal tax regulations.

- Form 1125-A: This form is used to report the cost of goods sold. Corporations must detail their inventory and the costs associated with producing or purchasing their products.

- Form 1125-E: This document is for reporting compensation of officers. It provides transparency about how much the corporation pays its top executives, which can affect tax liabilities.

- Schedule G: This schedule is included to disclose information about the corporation's activities and ownership structure. It helps the IRS understand the business's operational framework.

- Form 4562: This form is used to claim depreciation and amortization. Corporations must detail their assets and the deductions they are taking for their wear and tear over time.

- Trailer Bill of Sale: This document assists in documenting the ownership transfer of a trailer in Florida, providing essential information for both parties involved in the transaction. For more details, visit https://floridaforms.net/blank-trailer-bill-of-sale-form.

- Form 941: This quarterly tax return reports income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is essential for corporations with employees to stay compliant with payroll tax obligations.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Corporations must issue these forms to contractors or freelancers they pay throughout the year.

- Form 7004: This is an application for an automatic extension of time to file certain business tax returns. Corporations can use this form if they need additional time to complete their Form 1120.

In conclusion, while Form 1120 is central to corporate tax reporting, these accompanying documents play vital roles in ensuring comprehensive and accurate reporting. Each form contributes to a clearer picture of a corporation's financial activities, supporting compliance and transparency in the eyes of the IRS.