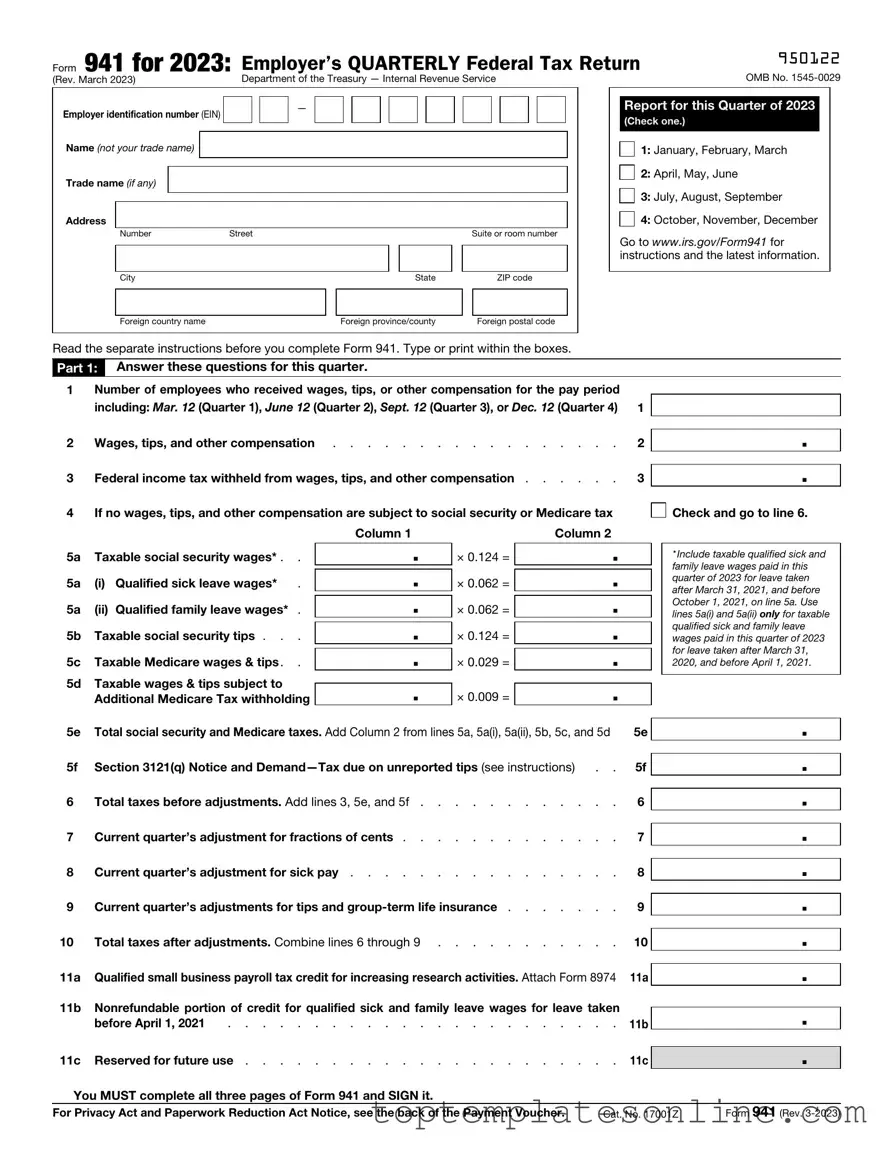

Fillable IRS 941 Form

The IRS 941 form is a crucial document for employers in the United States, as it serves as a quarterly report of payroll taxes. Each quarter, businesses must accurately report the wages paid to employees, along with the federal income tax withheld and the employer's share of Social Security and Medicare taxes. This form helps the IRS track tax liabilities and ensures compliance with federal tax laws. Employers must file Form 941 even if they did not pay any wages during the quarter, as it maintains transparency in their tax obligations. Additionally, understanding the nuances of this form can help prevent penalties and interest that may arise from late or inaccurate filings. As businesses navigate the complexities of payroll tax reporting, staying informed about the requirements and deadlines associated with Form 941 is essential for maintaining good standing with the IRS.

Common PDF Templates

What Is a Health Care Directive - Your appointed agent must follow your instructions as outlined in the directive.

Miscarriage Symptoms - The mother's signature indicates her understanding and agreement with the information provided.

For those looking to understand the nuances of the transaction, exploring the specifics of the Dirt Bike Bill of Sale process can be highly beneficial. This form streamlines the exchange by documenting the necessary details and safeguarding both parties involved.

Advance Payment Request Form - Employee advances are important for functions like training or travel-related costs.

Common mistakes

-

Incorrect Employer Identification Number (EIN): One of the most common mistakes is entering the wrong EIN. This number is crucial for identifying your business with the IRS. Double-check to ensure it matches what the IRS has on file.

-

Filing for the Wrong Quarter: Each form 941 corresponds to a specific quarter of the year. Submitting a form for the wrong quarter can lead to processing delays and potential penalties.

-

Miscalculating Tax Amounts: Accurate calculations are vital. Errors in the total taxes due, including Social Security and Medicare taxes, can result in underpayment or overpayment, leading to complications down the line.

-

Omitting Employee Information: Each employee's information must be complete and accurate. Missing names or Social Security numbers can create issues with employee records and tax reporting.

-

Failing to Sign the Form: It might seem minor, but forgetting to sign the form can render it invalid. Always ensure that the form is signed and dated before submission.

-

Not Keeping Copies: After submitting the form, it’s essential to keep a copy for your records. This can help in case of audits or discrepancies with the IRS.

-

Ignoring Deadlines: Each quarter has specific deadlines for filing. Missing these deadlines can lead to penalties. Mark your calendar to avoid late submissions.

-

Not Reviewing Before Submission: Rushing through the form can lead to mistakes. Always take a moment to review your entries for accuracy before sending it off.

Guide to Writing IRS 941

Once you have gathered all necessary information, you can proceed to fill out the IRS Form 941. This form is essential for reporting your employment taxes and ensuring compliance with federal regulations. Follow the steps below to accurately complete the form.

- Begin by entering your business name, trade name (if applicable), and address in the designated fields at the top of the form.

- Provide your Employer Identification Number (EIN) in the appropriate section. This number is crucial for identifying your business.

- Indicate the quarter for which you are filing the form. This will usually be the first, second, third, or fourth quarter of the year.

- Fill in the number of employees you had during the quarter. This information helps the IRS understand your payroll size.

- Report the total wages, tips, and other compensation you paid to employees during the quarter. Ensure that this figure is accurate and reflects all payments made.

- Calculate the total taxes withheld from employee wages, including federal income tax and Social Security and Medicare taxes.

- Complete the section for adjustments, if applicable. If you have any corrections or adjustments to previous filings, detail them here.

- Provide the total amount of tax due for the quarter. This will be the sum of the taxes withheld and any adjustments.

- If applicable, indicate any overpayment from previous quarters that you wish to apply to this quarter's taxes.

- Sign and date the form. Ensure that the person signing has the authority to do so on behalf of the business.

After completing the form, make sure to review it for accuracy. Once verified, submit the form to the IRS by the due date. Keep a copy for your records, as it may be needed for future reference or audits.

Documents used along the form

The IRS 941 form, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document for employers to report payroll taxes. However, it is often accompanied by other forms and documents that help ensure compliance with federal tax regulations. Below is a list of commonly used forms that may accompany the IRS 941 form, each serving a specific purpose in the reporting and payment process.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It is used to report and pay unemployment taxes on employee wages. Employers must file this form annually, even if they have no FUTA tax to report.

- Non-disclosure Agreement: To protect sensitive business information in Florida, consider utilizing a Florida Forms to ensure confidentiality and safeguard your proprietary details.

- Form W-2: The Wage and Tax Statement is provided to employees at the end of the year. It summarizes the total wages paid and taxes withheld, helping employees accurately report their income when filing their individual tax returns.

- Form W-3: This is the Transmittal of Wage and Tax Statements, which accompanies the W-2 forms when they are submitted to the Social Security Administration. It provides a summary of all W-2 forms issued by an employer for the year.

- Form 1099: Various types of 1099 forms are used to report income other than wages, salaries, or tips. For example, Form 1099-MISC is often issued to independent contractors, freelancers, or other non-employees who have received payments from a business.

- Form 943: This form is the Employer's Annual Federal Tax Return for Agricultural Employees. It is specifically designed for employers in the agricultural sector to report wages and taxes related to farm workers.

- Form 945: The Annual Return of Withheld Federal Income Tax is used by employers to report income tax withheld from non-payroll payments, such as pensions or annuities. This form is filed annually and is important for compliance with federal tax withholding requirements.

Understanding these forms and their purposes can help employers maintain accurate records and ensure compliance with tax regulations. Each document plays a vital role in the overall process of payroll and tax reporting, contributing to a smoother experience for both employers and employees alike.