Fillable IRS Schedule C 1040 Form

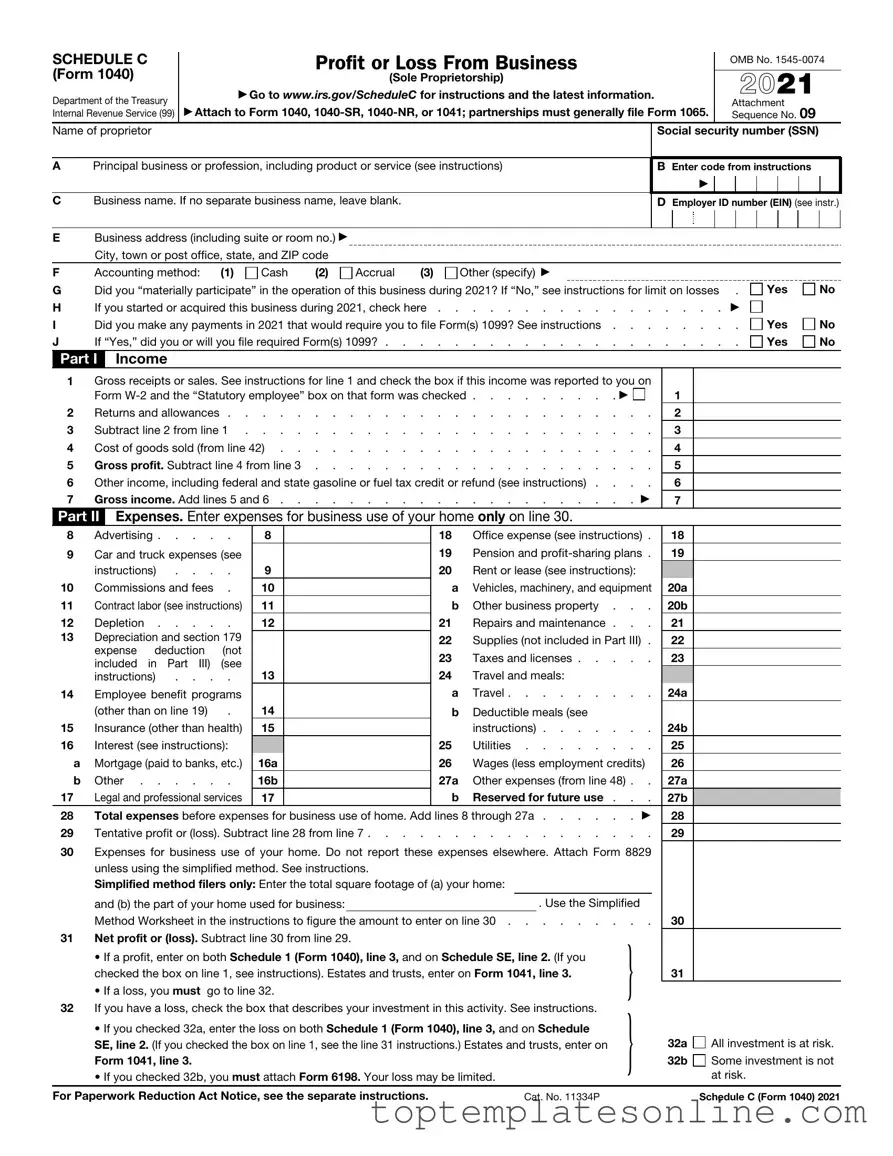

The IRS Schedule C (Form 1040) is an essential document for self-employed individuals and sole proprietors, serving as a detailed report of income and expenses from their business activities. This form allows taxpayers to calculate their net profit or loss, which ultimately impacts their overall tax liability. Key components of Schedule C include sections for reporting gross receipts, cost of goods sold, and various business expenses such as advertising, utilities, and office supplies. Additionally, it provides space for claiming deductions related to vehicle use and home office expenses, which can significantly reduce taxable income. Understanding how to accurately complete this form is crucial for ensuring compliance with tax regulations while maximizing potential deductions. As the tax landscape evolves, staying informed about the nuances of Schedule C can help business owners navigate their financial responsibilities more effectively.

Common PDF Templates

Signature Order for Ncoer - It serves as an official record of NCO performance and potential for future assignments.

U.S. Corporation Income Tax Return - This form can be filed electronically or via mail in accordance with IRS guidelines.

Properly understanding the legal implications of the eviction process is vital for landlords and tenants alike, particularly when it comes to using the Florida Notice to Quit form. This formal notification is indispensable in safeguarding the rights of both parties, and for those seeking accurate templates and guidelines, resources like Florida Forms can provide essential assistance.

How Do You Get Pay Stubs If You Are Self Employed - Simple format to keep income organized and accessible.

Common mistakes

-

Incorrect Business Name or EIN: Many individuals fail to provide the correct legal name of their business or enter the wrong Employer Identification Number (EIN). This can lead to delays or complications in processing the return.

-

Improper Classification of Expenses: A common error is misclassifying expenses. For instance, mixing personal expenses with business expenses can result in disallowed deductions and potential audits.

-

Omitting Income: Some filers neglect to report all sources of income. This oversight can arise from cash transactions or income from side jobs that are not documented properly.

-

Failure to Keep Accurate Records: Insufficient record-keeping leads to inaccuracies on the form. Without proper documentation, it becomes difficult to substantiate claimed deductions.

-

Ignoring Self-Employment Tax: Many self-employed individuals overlook the self-employment tax that applies to their net earnings. This can result in unexpected tax liabilities.

-

Not Seeking Professional Help: Some individuals attempt to complete the form without consulting a tax professional. This can lead to mistakes that could have been avoided with expert guidance.

Guide to Writing IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals. This form helps report income and expenses from a business. Follow these steps to complete it accurately.

- Gather your financial records, including income statements and expense receipts.

- Start with your personal information at the top of the form. Enter your name, Social Security number, and business name if applicable.

- In Part I, report your gross receipts or sales. This is the total income your business earned.

- Next, move to Part II to list your expenses. Common categories include advertising, car and truck expenses, and office supplies.

- Calculate your total expenses and subtract them from your gross income. This will give you your net profit or loss.

- Fill out Part III if you have a business vehicle. Provide details about the vehicle and how you use it for business purposes.

- Complete any additional sections that apply to your business, such as the cost of goods sold if you sell products.

- Review the form for accuracy. Make sure all numbers are correct and all necessary information is included.

- Sign and date the form before submitting it with your tax return.

Once you have completed the form, you can submit it along with your federal tax return. Ensure you keep a copy for your records. If you have any questions, consider reaching out to a tax professional for assistance.

Documents used along the form

When filing taxes as a sole proprietor, the IRS Schedule C (Form 1040) is essential for reporting income and expenses related to a business. However, several other forms and documents are commonly used in conjunction with Schedule C to provide a complete picture of a taxpayer's financial situation. Below is a list of these documents, along with a brief description of each.

- Form 1040: This is the main individual income tax return form used by U.S. taxpayers. It summarizes total income, deductions, and tax owed or refunded.

- Schedule SE: This form is used to calculate self-employment tax. It is necessary for individuals who earn income from self-employment, ensuring they contribute to Social Security and Medicare.

- Form 4562: If a business has depreciable assets or is claiming a Section 179 deduction, this form is required. It outlines the depreciation and amortization of business property.

- Form 8829: This form is used for claiming expenses for business use of a home. It helps calculate the portion of home expenses that can be deducted for business purposes.

- Trailer Bill of Sale: For those involved in transferring trailer ownership, the https://floridaforms.net/blank-trailer-bill-of-sale-form/ is crucial in documenting the transaction and ensuring legal compliance in Florida.

- Form 1099-NEC: If a business pays independent contractors, this form reports non-employee compensation. It is important for both the payer and the recipient for tax reporting purposes.

- Form W-2: Employees receive this form from their employers, detailing wages earned and taxes withheld. It is crucial for reporting income on the individual tax return.

- Form 1040-ES: This form is used for estimating and paying quarterly estimated taxes. Self-employed individuals often use it to avoid penalties for underpayment of taxes.

- Schedule A: If a taxpayer itemizes deductions instead of taking the standard deduction, Schedule A is used. It lists various deductions, such as medical expenses and charitable contributions.

Understanding these forms and documents is crucial for accurate tax filing. Each plays a role in ensuring that all income, deductions, and tax liabilities are properly reported, contributing to a smoother tax filing experience.