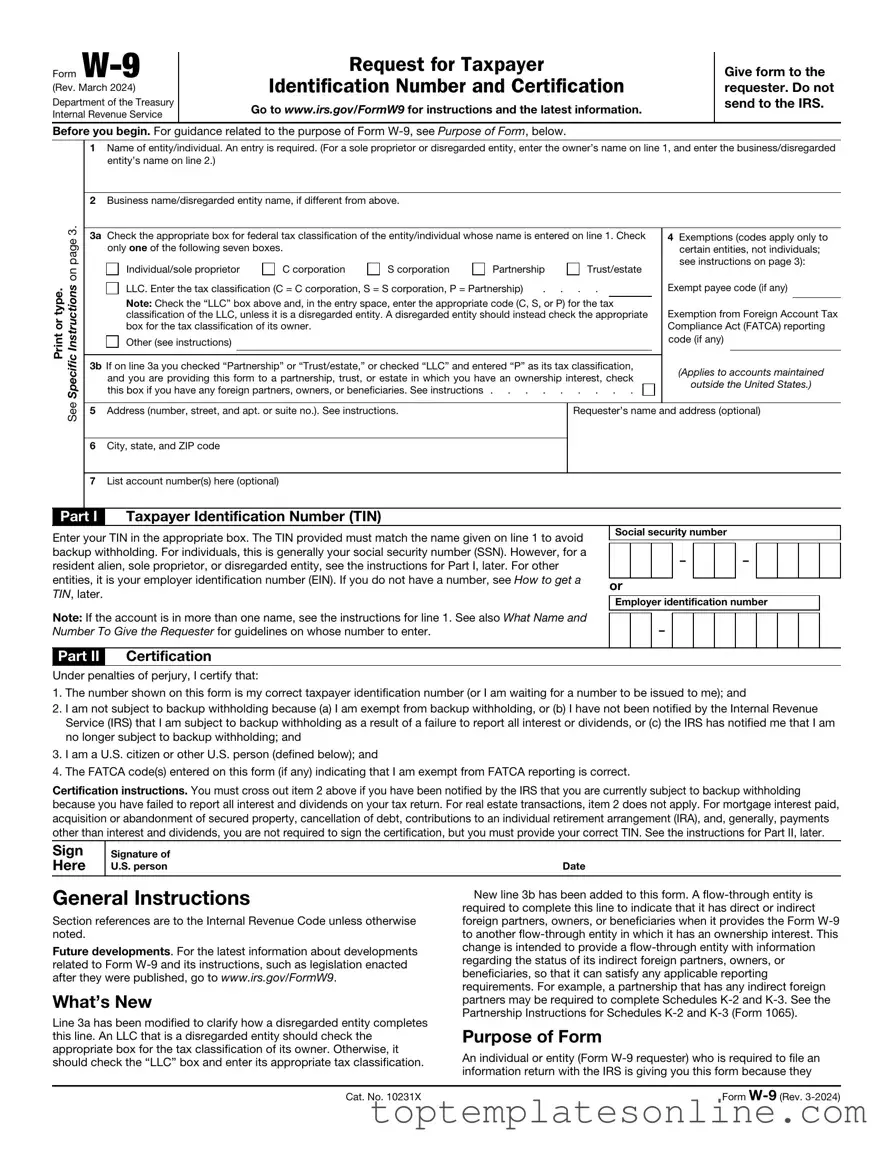

Fillable IRS W-9 Form

The IRS W-9 form plays a crucial role in the world of taxation, serving as a vital tool for individuals and businesses alike. This form is primarily used to provide your taxpayer identification number (TIN) to entities that are required to report certain types of payments to the IRS. Whether you're a freelancer receiving income from a client, a contractor working on a project, or a business entity needing to report payments, the W-9 helps ensure that the correct information is shared. By filling out this form, you not only confirm your identity but also indicate your tax classification, which can include options like individual, corporation, or partnership. Additionally, the W-9 is essential for anyone who may earn interest, dividends, or other income that requires reporting. Understanding the nuances of this form can streamline your tax reporting process and prevent potential complications down the line.

Common PDF Templates

View P60 Online - Certification of the details on the form is mandatory for employers.

The Aaa International Driving Permit Application form is a vital document that allows U.S. residents to drive legally in many foreign countries. This permit translates your driving credentials into several languages, making it easier for local authorities to recognize your right to drive. For a hassle-free process, be sure to check out the resources available at Document Templates Hub to start your journey toward obtaining your permit!

Florida Family Law Financial Affidavit Short Form - This affidavit can influence the outcome of financial disputes.

Custody Affidavit - The document captures the essence of the relinquishment and its consequences.

Common mistakes

-

Incorrect Name or Business Name: One common mistake is providing a name that does not match the taxpayer identification number (TIN). Individuals must ensure that the name on the form aligns with the name registered with the IRS. For businesses, the legal business name should be used, not a trade name or DBA (doing business as) name.

-

Missing TIN: Failing to provide a TIN is another frequent error. Individuals must include either their Social Security Number (SSN) or Employer Identification Number (EIN). Omitting this information can lead to delays in processing and potential penalties.

-

Incorrect Filing Status: Selecting the wrong tax classification can complicate matters. Individuals must accurately indicate whether they are an individual, sole proprietor, corporation, partnership, or another entity type. Misclassification can result in incorrect tax treatment.

-

Signature and Date Omission: A signature is required to validate the form. Many people forget to sign or date the W-9. Without this, the form is considered incomplete, and the recipient may not be able to process it correctly.

-

Providing Outdated Information: Using outdated or incorrect information can lead to complications. Taxpayers should ensure that their details, including address and TIN, are current. Changes in personal or business circumstances should be reflected in the form promptly.

Guide to Writing IRS W-9

After obtaining the IRS W-9 form, it is essential to complete it accurately. This form is typically used to provide your taxpayer identification information to another party, often for tax reporting purposes. Follow the steps below to ensure proper completion of the form.

- Begin by downloading the IRS W-9 form from the official IRS website or obtain a physical copy.

- At the top of the form, enter your name as it appears on your tax return in the first box.

- If applicable, provide your business name or disregarded entity name in the second box.

- In the next section, check the appropriate box that describes your federal tax classification. Options include individual/sole proprietor, corporation, partnership, etc.

- Provide your address in the designated fields, including street address, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN). This could be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the appropriate section. Otherwise, leave it blank.

- Sign and date the form at the bottom. Make sure to use the same name as in the first box.

- Review the completed form for accuracy before submitting it to the requester.

Documents used along the form

The IRS W-9 form is commonly used to provide taxpayer identification information to businesses and organizations. It is essential for ensuring accurate reporting of income and tax obligations. In addition to the W-9, several other forms and documents may be necessary to facilitate various financial and tax-related processes. Below is a list of these documents, along with a brief description of each.

- IRS 1099-MISC: This form is used to report payments made to independent contractors or freelancers. If you receive payments that total $600 or more in a year, the payer must issue a 1099-MISC to report that income to the IRS.

- IRS 1099-NEC: Similar to the 1099-MISC, this form specifically reports nonemployee compensation. It is primarily used for payments to independent contractors, freelancers, or other non-employees for services rendered.

- IRS 1040: This is the standard individual income tax return form used by U.S. citizens and residents to report their annual income. It includes various schedules and forms for specific types of income and deductions.

- IRS 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is filed quarterly and is essential for maintaining compliance with payroll tax obligations.

- Form W-4: This form is completed by employees to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- Employee Handbook: To clarify workplace policies and employee rights, you can explore our comprehensive Employee Handbook resources for effective documentation.

- Form 1098: This form is used to report mortgage interest paid by individuals. Lenders provide this form to borrowers, which can be used to claim deductions on their income tax returns.

- Form 4506-T: This is a request for a transcript of tax returns. Individuals can use this form to obtain copies of their tax documents from the IRS for various purposes, such as applying for loans or verifying income.

- Form 8821: This form allows taxpayers to authorize an individual or organization to receive and inspect their tax information. It is commonly used when seeking assistance from tax professionals.

Understanding these additional forms and documents can help individuals and businesses navigate their financial responsibilities more effectively. Each plays a crucial role in tax reporting and compliance, ensuring that all parties meet their obligations to the IRS.