Attorney-Approved Lady Bird Deed Form

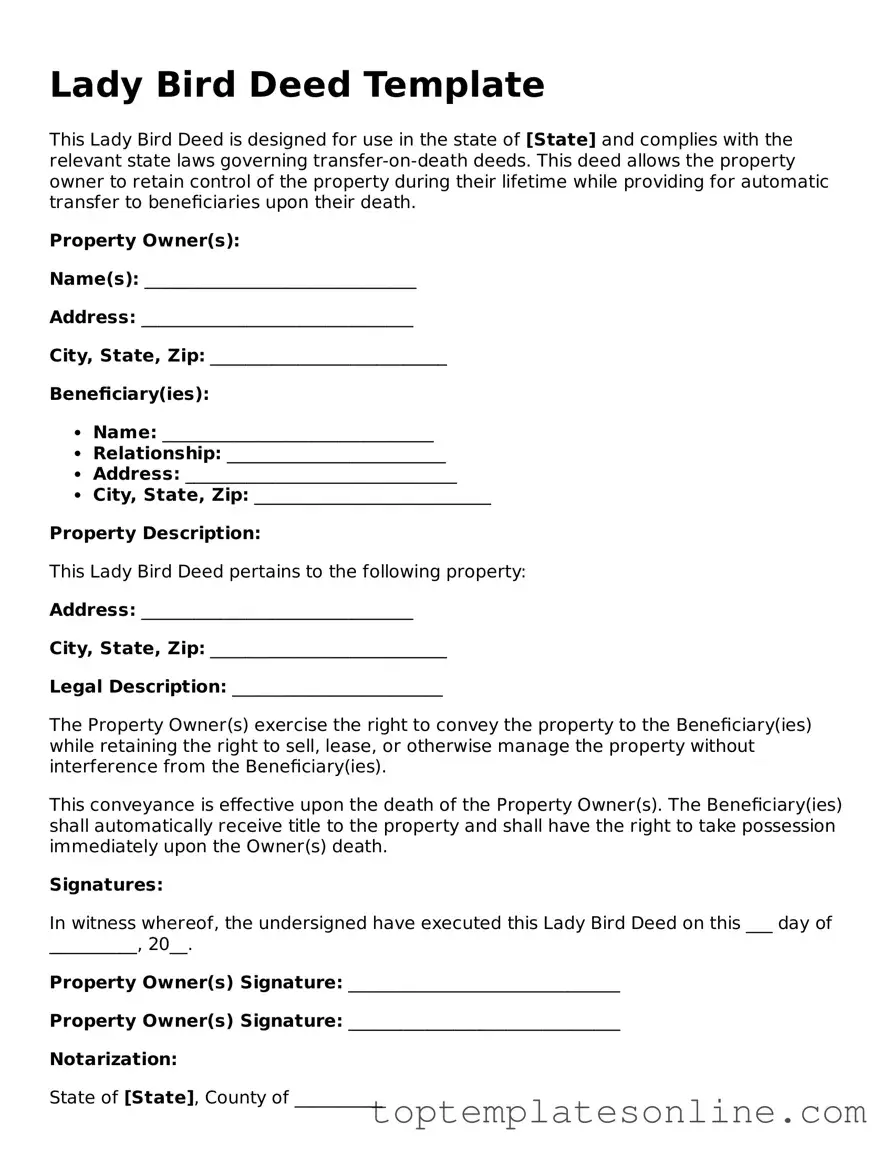

The Lady Bird Deed, also known as an enhanced life estate deed, offers a unique way for property owners to transfer their real estate while retaining certain rights during their lifetime. This form allows the owner to maintain control over the property, including the ability to sell, lease, or mortgage it without needing consent from the beneficiaries. Upon the owner's passing, the property automatically transfers to the designated beneficiaries, avoiding the lengthy and often costly probate process. This deed not only simplifies the transfer of property but also provides tax benefits and protects the property from creditors in some cases. Understanding the nuances of the Lady Bird Deed can empower property owners to make informed decisions about their estate planning and ensure a smooth transition of their assets to loved ones.

State-specific Information for Lady Bird Deed Documents

Find More Types of Lady Bird Deed Templates

Title Companies and Transfer on Death Deeds - It can serve as a valuable tool for individuals who want to pass down real estate to family members or friends directly.

Free Printable Gift Deed Form - A Gift Deed is an excellent option for those who wish to pass on assets without the complexities of a sale.

In New York, utilizing a Hold Harmless Agreement is crucial for ensuring that all parties involved can engage in various activities with reduced legal risks. This agreement not only provides clarity on liability but also fosters confidence in contractual relationships. For those looking to draft such a document, a helpful resource can be found at https://newyorkform.com/free-hold-harmless-agreement-template/, which offers a free template to facilitate the process.

Correction Deed Form California - This form addresses mistakes in property descriptions.

Common mistakes

-

Incorrect Property Description: Failing to accurately describe the property can lead to complications. It's essential to provide a complete legal description, including boundaries and any relevant identifiers.

-

Missing Signatures: All required parties must sign the form. Omitting a signature can invalidate the deed, leading to potential disputes over property ownership.

-

Improper Notarization: The deed must be notarized to be legally binding. Not obtaining a notary's signature can result in the deed being unenforceable.

-

Failure to Include a Remainder Beneficiary: Not designating a beneficiary can cause issues upon the property owner's death. It’s crucial to specify who will inherit the property.

-

Inaccurate Names: Names must match legal documents precisely. Any discrepancies can create confusion and complicate the transfer process.

-

Not Understanding the Implications: Failing to grasp the legal effects of a Lady Bird Deed can lead to unintended consequences. It’s important to understand how this deed affects property rights and taxes.

-

Neglecting State-Specific Requirements: Each state may have different rules regarding Lady Bird Deeds. Not adhering to these specific regulations can invalidate the deed.

Guide to Writing Lady Bird Deed

Filling out a Lady Bird Deed form is a straightforward process that allows you to transfer property to a beneficiary while retaining certain rights. This form can help streamline the transfer of your property upon your passing, ensuring that your wishes are honored. Below are the steps you need to follow to complete the form accurately.

- Gather Necessary Information: Collect details about the property, including the legal description, address, and any existing mortgage information.

- Identify the Grantor: Enter your full name and address as the person transferring the property.

- List the Beneficiary: Clearly state the name and address of the person or entity receiving the property. Ensure the spelling is correct.

- Include Property Description: Write a detailed description of the property. This should include the legal description, which can usually be found on your property deed.

- Specify Retained Rights: Indicate that you are retaining the right to live in the property and to sell or mortgage it during your lifetime.

- Sign the Document: As the grantor, sign the form in the designated area. Make sure to do this in front of a notary public.

- Notarization: Have the document notarized to validate your signature and ensure it is legally binding.

- Record the Deed: Finally, file the completed and notarized deed with the county clerk or recorder's office where the property is located.

After completing these steps, the Lady Bird Deed will be ready for recording. This process helps ensure that your property is transferred according to your wishes, providing peace of mind for you and your loved ones.

Documents used along the form

The Lady Bird Deed, also known as an enhanced life estate deed, serves as a valuable tool for estate planning. It allows property owners to transfer their real estate to their beneficiaries while retaining the right to live in and control the property during their lifetime. When utilizing a Lady Bird Deed, several other forms and documents may accompany it to ensure clarity and compliance with legal requirements. Below is a list of common documents often used in conjunction with a Lady Bird Deed.

- Property Title: This document establishes ownership of the property being transferred. It is essential for verifying the current owner's rights before executing a Lady Bird Deed.

- Will: A will outlines how an individual's assets, including real estate, will be distributed upon their death. It can complement a Lady Bird Deed by addressing other assets not covered by the deed.

- Power of Attorney: This legal document grants someone the authority to act on another's behalf. It may be useful if the property owner becomes incapacitated and needs someone to manage their affairs.

- Affidavit of Heirship: This sworn statement identifies the heirs of a deceased person. It can clarify ownership and help facilitate the transfer of property when the original owner passes away.

- Transfer Tax Form: In many jurisdictions, a transfer tax form must be filed when real estate changes hands. This document ensures compliance with local tax laws and regulations.

- Title Insurance Policy: This insurance protects against potential defects in the title that could arise after the property transfer. It provides peace of mind for both the grantor and the beneficiaries.

- Address NYCERS Form: This essential document is required for members of the New York City Employees Retirement System to update their address information. For more information, visit NY Templates.

- Deed of Trust: If the property is financed, a deed of trust may be involved. This document secures a loan by placing a lien on the property, and it must be considered in any transfer of ownership.

- Estate Planning Documents: These may include trusts or other legal instruments designed to manage assets during a person’s lifetime and after their death. They can work in tandem with a Lady Bird Deed to create a comprehensive estate plan.

Utilizing a Lady Bird Deed alongside these additional documents can provide a more robust framework for estate planning. Each document plays a specific role, ensuring that the property owner’s wishes are honored and that their beneficiaries are protected. Careful consideration of these forms can lead to a smoother transition of property and reduce potential legal complications in the future.