Attorney-Approved Last Will and Testament Form

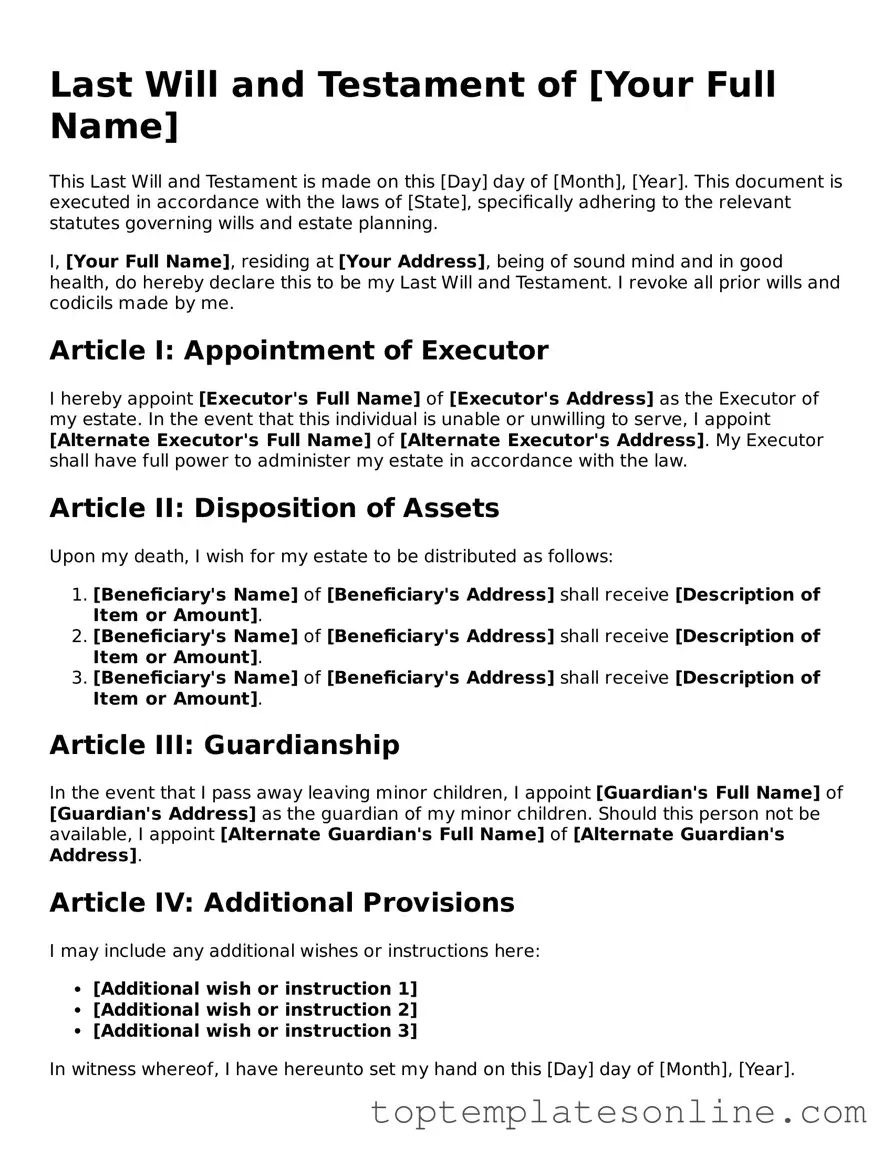

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. This legal document serves as a roadmap for the distribution of your assets, allowing you to designate beneficiaries who will inherit your property, money, and personal belongings. In addition to asset distribution, a will often includes provisions for appointing guardians for minor children, ensuring their care and upbringing align with your values. It also allows you to name an executor, a trusted individual responsible for managing your estate and ensuring that your wishes are carried out according to your instructions. The form typically requires specific information, such as your full name, address, and the date of its creation, along with the signatures of witnesses to validate its authenticity. By understanding the components of a Last Will and Testament, individuals can take significant steps toward securing peace of mind for themselves and their loved ones.

State-specific Information for Last Will and Testament Documents

Last Will and Testament Categories

Common Templates

Girlfriend Application Form Funny - In search of a match who values personal space and independence.

For those looking to simplify the transfer of personal property, understanding the Alabama bill of sale form requirements can be invaluable. This document ensures that both parties have a clear record of the transaction, providing legal protection and peace of mind. To learn more about this essential document, check out our comprehensive guide on the Alabama bill of sale.

Bill of Sale for Tractor - Useful for tracking your equipment sales and purchases over time.

Common mistakes

-

Not clearly identifying the testator. It is essential to include the full legal name and address of the person making the will. Failing to do this can lead to confusion about who the will belongs to.

-

Overlooking the requirement for witnesses. Many states require that a will be signed in the presence of at least two witnesses. Neglecting this step can render the will invalid.

-

Using vague language. Specificity is crucial when detailing how assets should be distributed. Ambiguous terms can lead to disputes among beneficiaries.

-

Failing to update the will. Life changes, such as marriage, divorce, or the birth of a child, should prompt a review and potential revision of the will. An outdated will may not reflect current wishes.

-

Not including a residuary clause. This clause addresses any assets not specifically mentioned in the will. Omitting it can lead to unintended distribution of assets.

-

Neglecting to name an executor. An executor is responsible for ensuring that the terms of the will are carried out. Failing to name one can create complications in the probate process.

-

Not considering tax implications. Some assets may be subject to taxes upon transfer. It’s important to understand how taxes can affect the inheritance.

-

Ignoring state-specific laws. Each state has its own regulations regarding wills. Not adhering to these laws can lead to the will being deemed invalid.

Guide to Writing Last Will and Testament

After obtaining the Last Will and Testament form, the next steps involve carefully filling it out to ensure that your wishes are clearly documented. This process requires attention to detail and accuracy to avoid any potential issues in the future.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your date of birth to confirm your identity.

- Designate an executor by writing their name and contact information. This person will be responsible for carrying out the terms of your will.

- List your beneficiaries. Include their names, relationships to you, and the specific assets or amounts they will receive.

- Detail any specific bequests. This includes items or amounts of money you wish to leave to particular individuals.

- Indicate how you want the remainder of your estate to be distributed after specific bequests have been made.

- Include any funeral or burial wishes, if desired.

- Sign and date the form in the presence of witnesses. Ensure that the witnesses also sign and provide their information.

- Make copies of the completed will for your records and for your executor and beneficiaries.

Documents used along the form

When preparing a Last Will and Testament, there are several other important documents that may be needed to ensure that your wishes are carried out smoothly. Each of these documents serves a specific purpose and can help clarify your intentions regarding your estate and personal matters.

- Living Will: This document outlines your preferences for medical treatment in case you become unable to communicate your wishes. It specifies what types of life-sustaining measures you want or do not want.

- Durable Power of Attorney: This form allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. It remains effective even if you are no longer able to make decisions yourself.

- Bill of Sale: This document is essential for recording the transfer of ownership of personal property in Arizona, ensuring clarity and legality in transactions. For templates, visit Legal PDF Documents.

- Healthcare Proxy: Similar to a durable power of attorney, a healthcare proxy designates someone to make medical decisions for you if you cannot do so. This ensures that your healthcare preferences are respected.

- Trust Document: A trust can hold your assets and specify how they should be managed and distributed. It can help avoid probate and provide more control over when and how your beneficiaries receive their inheritance.

- Beneficiary Designations: These are forms used for financial accounts, insurance policies, and retirement plans. They allow you to name individuals who will receive these assets directly, bypassing the probate process.

- Letter of Instruction: This informal document provides additional guidance to your loved ones about your wishes. It can include details about your funeral preferences, the location of important documents, and personal messages to family and friends.

Having these documents in place can help ensure that your wishes are honored and can ease the burden on your loved ones during a difficult time. It is wise to consult with a professional to make sure everything is completed correctly and in accordance with the law.