Attorney-Approved Letter of Intent to Purchase Business Form

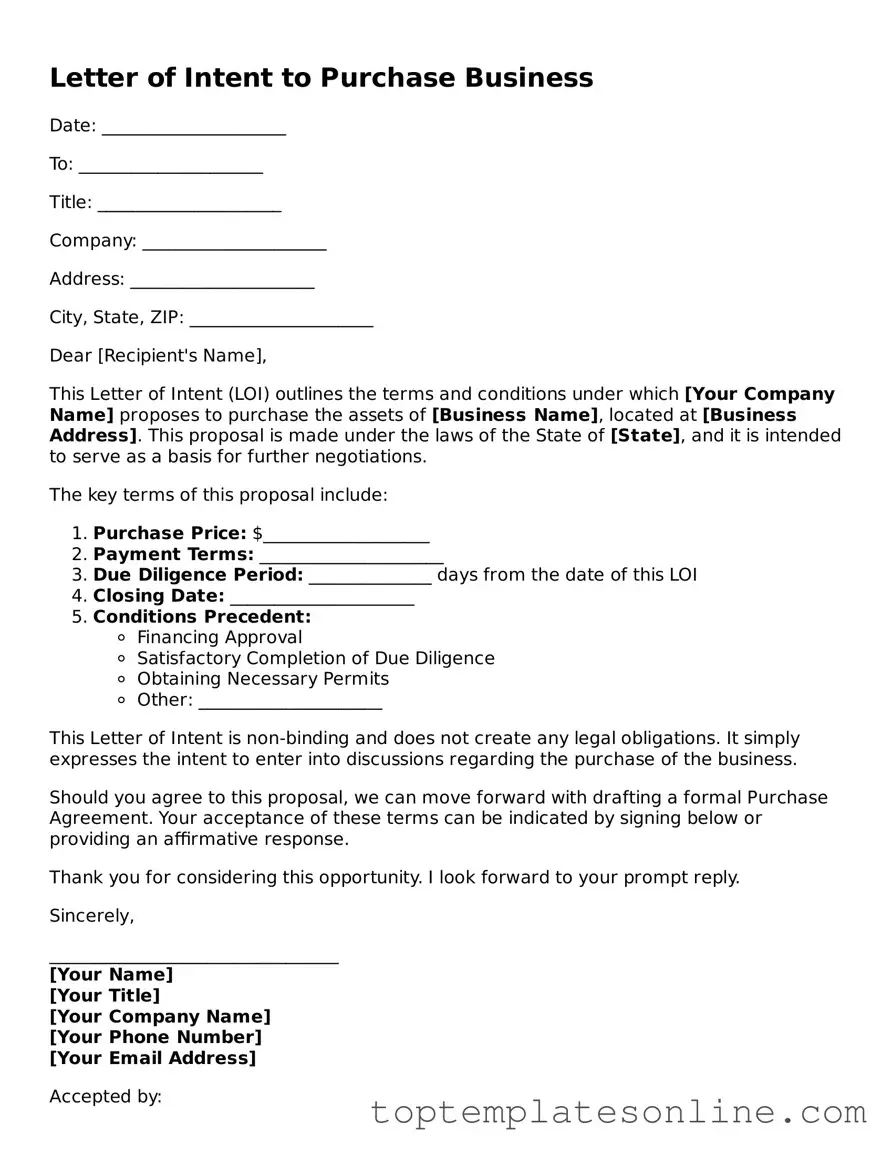

The Letter of Intent to Purchase Business form serves as a crucial preliminary document in the business acquisition process. This form outlines the key terms and conditions under which a buyer expresses their intention to purchase a business from a seller. Typically, it includes essential elements such as the purchase price, payment terms, and any contingencies that may affect the sale. Additionally, it addresses the timeline for the transaction and may specify the due diligence period, during which the buyer can evaluate the business's financial and operational status. While the letter is not legally binding, it signifies a serious commitment from the buyer and sets the stage for further negotiations and formal agreements. Clear communication of the intentions and expectations of both parties is vital, as this document can help prevent misunderstandings and facilitate a smoother transaction process. By establishing a framework for discussions, the Letter of Intent can ultimately lead to a successful business transfer, benefiting both the buyer and the seller.

Find More Types of Letter of Intent to Purchase Business Templates

Sue Letter of Intent to Take Legal Action Template - Including a summary of previous communications can be helpful.

The process of homeschooling in Alabama begins with the completion of the required paperwork, which includes the submission of the Homeschool Intent Letter. This document is crucial for parents to officially inform the state of their choice to educate their children at home, ensuring they adhere to the state's educational guidelines and regulations.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details about the buyer and seller can lead to confusion and delays.

-

Vague Terms: Using unclear language when describing the terms of the purchase can create misunderstandings later on.

-

Missing Signatures: Not signing the document or forgetting to have all required parties sign can invalidate the intent.

-

Omitting Contingencies: Neglecting to include important contingencies, such as financing or due diligence, can lead to problems.

-

Ignoring Deadlines: Failing to specify or adhere to deadlines for actions can create unnecessary complications.

-

Not Specifying Purchase Price: Leaving out the proposed purchase price can lead to misinterpretations and disputes.

-

Inaccurate Business Valuation: Relying on incorrect or outdated information for business valuation can result in unfair terms.

-

Neglecting Confidentiality: Failing to include a confidentiality clause may expose sensitive information.

-

Assuming Legal Language is Unnecessary: Using informal language instead of clear legal terms can lead to ambiguity.

-

Not Consulting Professionals: Attempting to fill out the form without legal or financial advice can result in significant errors.

Guide to Writing Letter of Intent to Purchase Business

Once you have the Letter of Intent to Purchase Business form in front of you, it's time to fill it out carefully. This document will guide the negotiation process and outline the terms of your potential business acquisition. Follow these steps to complete the form accurately.

- Provide Your Information: Start by filling in your name, address, and contact details at the top of the form.

- Seller’s Information: Enter the name and contact information of the seller or the business entity you are interested in purchasing.

- Business Description: Describe the business you wish to purchase. Include details such as its name, location, and type of business.

- Purchase Price: Clearly state the proposed purchase price for the business. Be specific and consider including terms of payment.

- Due Diligence Period: Specify the time frame you require to conduct due diligence on the business. This is critical for assessing the business's value and liabilities.

- Confidentiality Agreement: Indicate whether a confidentiality agreement is required. This protects sensitive information during negotiations.

- Sign and Date: Finally, sign and date the form. Ensure all parties involved do the same to validate the document.

After filling out the form, review it for accuracy. Once completed, you can present it to the seller to initiate the negotiation process. Be prepared for discussions and potential adjustments based on feedback from the seller.

Documents used along the form

When considering the purchase of a business, a Letter of Intent (LOI) serves as an important initial document that outlines the basic terms of the proposed transaction. However, several other forms and documents often accompany the LOI to ensure clarity and protect the interests of all parties involved. Below is a list of these essential documents, each playing a unique role in the purchasing process.

- Confidentiality Agreement: This document protects sensitive information shared between the buyer and seller. It ensures that both parties keep proprietary business details confidential during negotiations.

- Due Diligence Checklist: A comprehensive list that guides the buyer in evaluating the business's financial, legal, and operational aspects. It helps identify potential risks and liabilities associated with the purchase.

- California Homeschool Letter of Intent: For those planning to educate their children at home, the important California homeschooling letter of intent form is key to notifying the school district of the educational choice being made.

- Purchase Agreement: This legally binding contract outlines the final terms of the sale, including price, payment structure, and any contingencies. It is typically more detailed than the LOI.

- Disclosure Statement: This document provides essential information about the business being sold, including its financial statements, legal obligations, and any pending litigation. It ensures transparency in the transaction.

- Asset Purchase Agreement: If the buyer intends to purchase specific assets rather than the entire business, this agreement details which assets are included in the sale and their respective values.

- Bill of Sale: A simple document that transfers ownership of tangible assets from the seller to the buyer. It serves as proof of the transaction and can be crucial for record-keeping.

- Non-Compete Agreement: This agreement restricts the seller from starting a competing business within a specified time frame and geographic area. It protects the buyer's investment by minimizing competition.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document outlines the terms of the loan or investment, including interest rates and repayment schedules.

- Transition Plan: This plan details how the business will transition from the seller to the buyer. It may include timelines, training for the new owner, and strategies for maintaining customer relationships.

By understanding these documents, buyers and sellers can navigate the complexities of a business transaction more effectively. Each form plays a vital role in ensuring that both parties are protected and that the process runs smoothly.