Attorney-Approved LLC Share Purchase Agreement Form

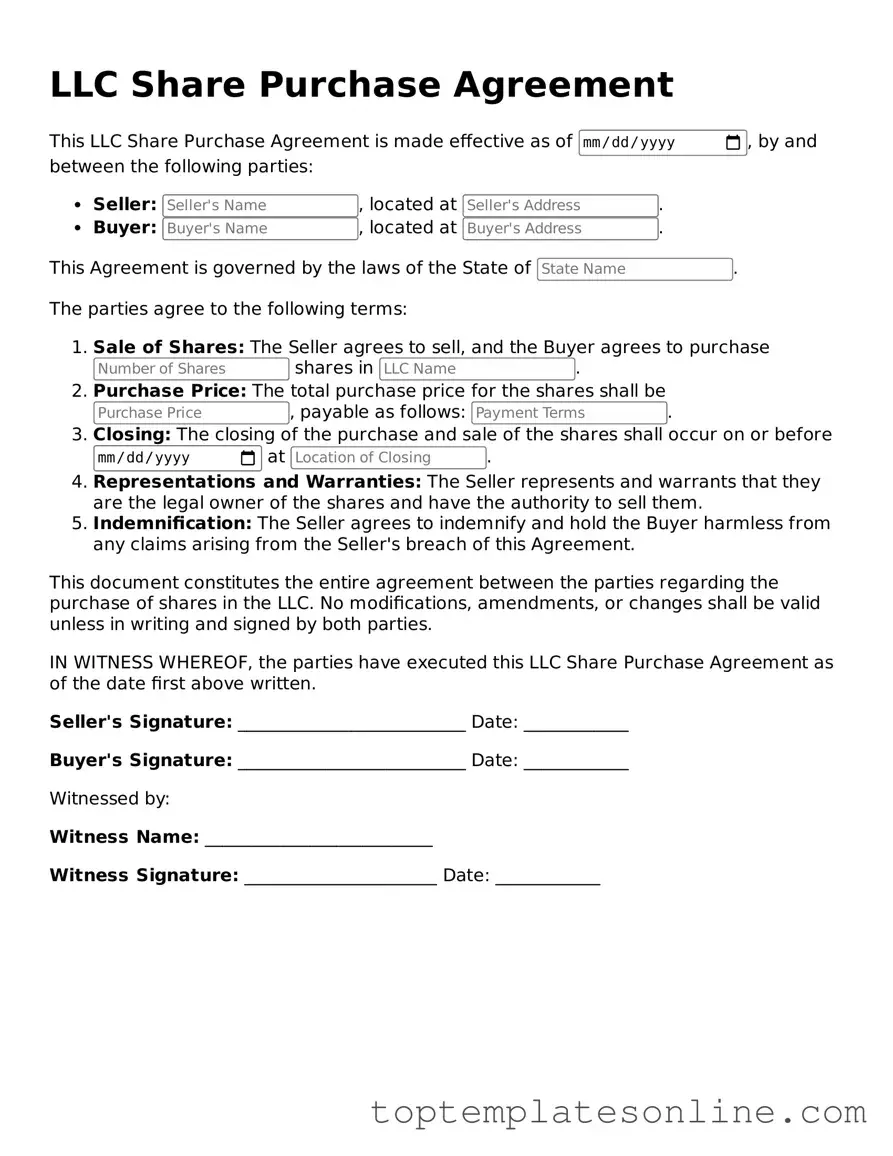

When embarking on the journey of buying or selling shares in a Limited Liability Company (LLC), a well-structured LLC Share Purchase Agreement is essential. This document serves as a formal contract between the buyer and seller, outlining the terms and conditions of the share transaction. Key components include the purchase price, payment terms, and the number of shares being transferred. Additionally, the agreement typically addresses representations and warranties, ensuring that both parties understand the status of the company and the shares involved. It may also outline any conditions that must be met before the transaction can be finalized, such as regulatory approvals or third-party consents. Importantly, the agreement often includes provisions for dispute resolution, protecting the interests of both parties in the event of a disagreement. By clearly defining the rights and obligations of each party, the LLC Share Purchase Agreement helps to facilitate a smooth and transparent transaction, fostering trust and clarity in the business relationship.

Common Templates

Types of Separation in Marriage - The Marital Separation Agreement is often a practical solution for couples with children, as it prioritizes their needs.

To effectively manage your information with the New York City Employees Retirement System, it's crucial to utilize the Address NYCERS form, which allows members to update their address details. This document helps ensure that all important communications and benefits reach you at the correct location. For more resources, you can check out NY Templates. Should you have any inquiries regarding the form or its submission, don't hesitate to reach out to the NYCERS Call Center.

Shot Records Florida - Completing this form is an integral part of a child's health and wellness journey in education.

Simple Coat of Arms - Can include tools, weapons, or significant lore figures.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details, such as the names of the buyer and seller, the date of the agreement, and the number of shares being purchased. Omitting this information can lead to confusion and disputes later on.

-

Incorrect Valuation: Buyers and sellers sometimes miscalculate the value of the shares. This mistake can stem from not considering the company’s financial health or market conditions, resulting in an unfair purchase price.

-

Ignoring State Laws: Each state has specific regulations regarding LLC transactions. Failing to adhere to these laws can invalidate the agreement or create legal complications.

-

Neglecting Tax Implications: Individuals often overlook the tax consequences of the share purchase. Understanding how the transaction affects personal and business taxes is crucial for both parties.

-

Not Seeking Legal Advice: Many people fill out the agreement without consulting a legal professional. This oversight can lead to significant errors that might have been easily avoided with proper guidance.

Guide to Writing LLC Share Purchase Agreement

Completing the LLC Share Purchase Agreement form is an essential step in formalizing the transfer of ownership in a limited liability company. This document outlines the terms and conditions under which shares are bought and sold. Ensuring accuracy in this form is crucial, as it serves as a legal record of the transaction.

- Gather Necessary Information: Collect details about the buyer and seller, including names, addresses, and contact information.

- Identify the LLC: Clearly state the name of the limited liability company involved in the share purchase.

- Specify Share Details: Indicate the number of shares being purchased and the price per share.

- Outline Payment Terms: Describe how the payment will be made, including any deposits or installment plans.

- Include Closing Date: Specify the date when the transaction will be finalized and ownership will be transferred.

- Address Representations and Warranties: Include any statements about the condition of the shares or the LLC that the seller must affirm.

- Signatures: Ensure that both the buyer and seller sign and date the agreement to make it legally binding.

After completing the form, review it carefully to ensure all information is accurate and complete. This step helps prevent misunderstandings and potential legal issues down the line.

Documents used along the form

When engaging in the purchase or sale of shares in an LLC, several other documents are commonly used alongside the LLC Share Purchase Agreement. These documents help ensure that all parties are protected and that the transaction is conducted smoothly. Below is a list of important forms and documents that may be needed.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It serves as a guide for how the company will be run and includes provisions for member roles, voting rights, and profit distribution.

- Mobile Home Bill of Sale Form: For clear ownership transfer documentation, refer to our comprehensive Mobile Home Bill of Sale resources to guide you through the process.

- Membership Interest Transfer Agreement: This form is used to formally transfer ownership of membership interests from one member to another. It details the terms of the transfer and is essential for documenting the change in ownership.

- Due Diligence Checklist: A comprehensive list of items that need to be reviewed before finalizing the purchase. This checklist helps buyers assess the financial health and legal standing of the LLC.

- Bill of Sale: This document acts as a receipt for the transaction, confirming that the seller has sold their shares and the buyer has received them. It typically includes details about the shares being sold and the sale price.

- Resolution of the Members: This document records the approval of the share purchase by the LLC members. It is often required to show that the transaction has been authorized according to the company's operating agreement.

Each of these documents plays a crucial role in the process of buying or selling shares in an LLC. They help clarify the terms of the transaction and protect the interests of all parties involved. It is advisable to ensure that each document is completed accurately and reviewed carefully.