Attorney-Approved Loan Agreement Form

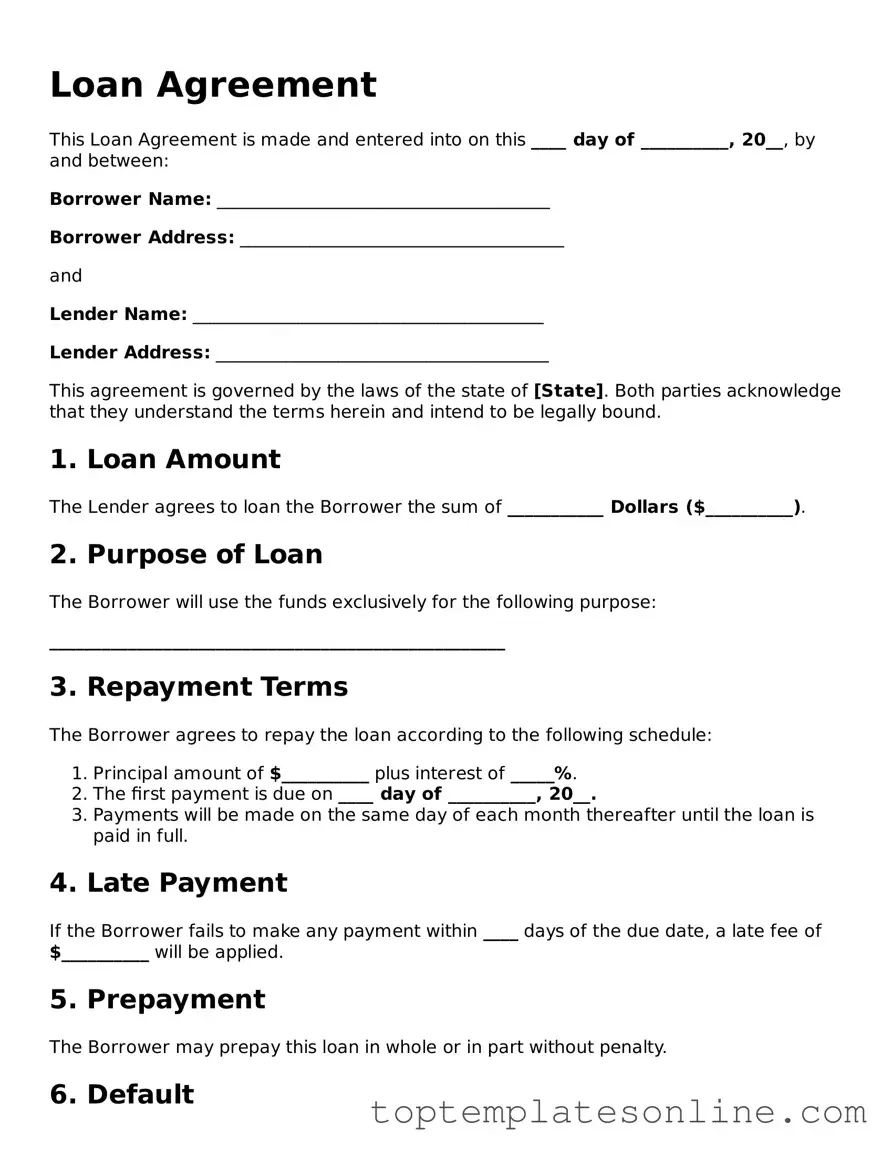

The Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions under which a borrower receives funds from a lender. This form typically includes essential details such as the principal amount, interest rate, repayment schedule, and any collateral involved. Additionally, it delineates the rights and responsibilities of both parties, ensuring clarity and reducing the potential for disputes. Borrowers must understand the implications of default and the consequences that may arise from failing to meet the agreed-upon terms. Furthermore, the Loan Agreement may include provisions for prepayment, late fees, and other contingencies that could affect the overall financial arrangement. By clearly documenting these elements, the Loan Agreement form not only protects the interests of the lender but also provides borrowers with a clear framework to manage their obligations effectively.

Loan Agreement Categories

Common Templates

Hunting Lease Agreement Template - The responsibilities for environmental conservation and ethical hunting practices are emphasized.

A Last Will and Testament form is a legal document that outlines how a person's assets and affairs should be managed after their death. In New York, this form serves as a crucial tool for individuals to express their final wishes clearly and ensure that their intentions are honored. Resources such as NY Templates can provide valuable guidance for those looking to navigate the intricacies of estate planning effectively.

Contractor Roof Certification Form - This document is key for property transactions involving roofing concerns.

Employee Availability Form - Share if you will need time off in advance for any personal reasons.

Common mistakes

-

Inaccurate Personal Information: One common mistake is providing incorrect or outdated personal details. This can include misspellings of names, wrong addresses, or incorrect Social Security numbers. Such inaccuracies can lead to delays or even denials of the loan application.

-

Neglecting to Read the Terms: Many individuals fail to thoroughly review the terms and conditions of the loan agreement. This oversight can result in misunderstandings about interest rates, repayment schedules, and potential penalties for late payments. Understanding these details is crucial for making informed financial decisions.

-

Leaving Sections Blank: It is essential to complete all required sections of the loan agreement. Leaving any section blank can raise red flags for lenders, potentially leading to the rejection of the application. Each piece of information plays a role in assessing creditworthiness.

-

Overlooking Required Documentation: Failing to attach or submit necessary documentation is another frequent error. Lenders often require proof of income, identification, and other financial documents. Without these, the application may be considered incomplete, causing delays in processing.

Guide to Writing Loan Agreement

Completing the Loan Agreement form requires careful attention to detail to ensure all necessary information is accurately provided. This process will facilitate the agreement between the lender and the borrower, establishing the terms of the loan. Below are the steps to effectively fill out the form.

- Begin by entering the date at the top of the form. This should reflect the date on which the agreement is being completed.

- Fill in the names of the parties involved. Clearly state the full name of the lender and the borrower, ensuring correct spelling.

- Provide the contact information for both parties. This includes addresses, phone numbers, and email addresses.

- Specify the loan amount. Clearly write the total amount of money being borrowed in both numeric and written form.

- Indicate the interest rate. This should be expressed as a percentage and should reflect the agreed-upon rate.

- Outline the repayment terms. Specify the duration of the loan and the schedule for repayments, including due dates.

- Detail any collateral, if applicable. Describe any assets that will secure the loan.

- Include any additional terms or conditions. This may encompass fees, penalties for late payments, or other stipulations.

- Sign and date the form. Both the lender and borrower must provide their signatures to validate the agreement.

Documents used along the form

When entering into a Loan Agreement, several additional forms and documents may be required to ensure clarity and protection for both the lender and the borrower. These documents help outline terms, conditions, and responsibilities associated with the loan. Below is a list of commonly used documents that complement a Loan Agreement.

- Promissory Note: This is a written promise from the borrower to repay the loan amount, detailing the interest rate, repayment schedule, and any penalties for late payment. It serves as a legal instrument to enforce repayment.

- Employment Verification Form: Essential for validating income, this form supports the loan application process by confirming the borrower's employment status. For more information, refer to the Proof of Employment Letter.

- Loan Application: This document collects essential information about the borrower, including financial history, income, and purpose of the loan. It helps lenders assess the borrower's creditworthiness.

- Credit Report Authorization: Borrowers may need to provide permission for lenders to access their credit reports. This document ensures that the lender can evaluate the borrower’s credit history and financial behavior.

- Collateral Agreement: If the loan is secured, this agreement outlines the assets that the borrower offers as collateral. It specifies the lender's rights to the collateral in case of default.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and total repayment amounts. It ensures transparency and helps borrowers make informed decisions.

Each of these documents plays a crucial role in the loan process, ensuring that all parties understand their rights and obligations. Being familiar with these forms can help streamline the borrowing experience and prevent misunderstandings down the line.