Fillable Louisiana act of donation Form

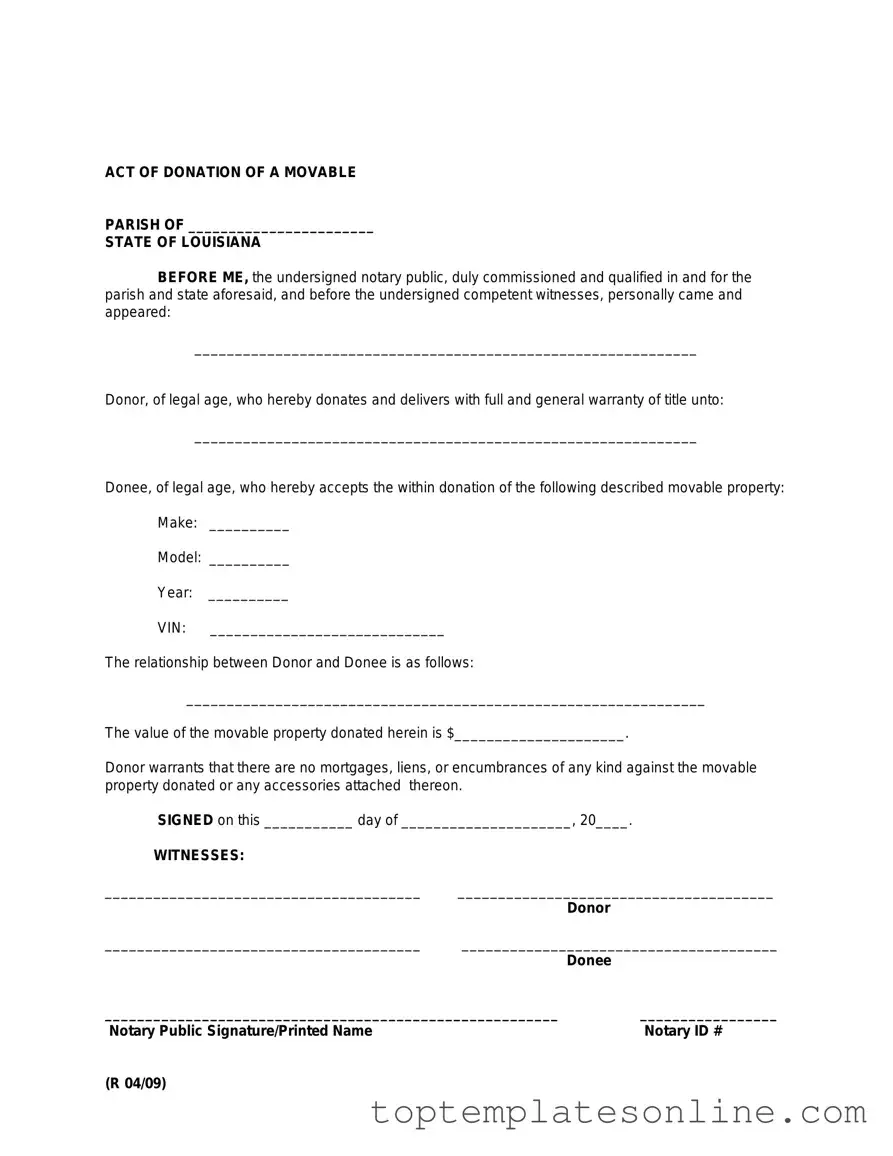

The Louisiana act of donation form serves as a crucial legal document that facilitates the transfer of property or assets from one individual to another without any expectation of compensation. This form is particularly significant in the context of estate planning and charitable giving, allowing donors to express their intent clearly and formally. Key elements of the form include the identification of both the donor and the recipient, a detailed description of the property being donated, and the terms under which the donation is made. Additionally, the form often requires the signatures of witnesses to ensure its validity, reflecting the importance of formalities in legal transactions. By utilizing this form, individuals can ensure that their intentions are honored and that the transfer of ownership is executed in accordance with Louisiana law. Understanding the nuances of this document is essential for anyone considering making a donation, whether it be to family members or charitable organizations.

Common PDF Templates

Fake Vehicle Inspection Form - Enter the year your vehicle was manufactured.

To ensure clarity and prevent disputes, it is advisable for both landlords and tenants to utilize resources such as the newyorkform.com/free-lease-agreement-template/ when drafting their lease agreements, making certain that all essential terms are properly detailed and understood by both parties.

Dd 214 - Member signatures are required on the form to ensure authenticity and acknowledgment of the information provided.

Imm1294 - An acceptance letter from the school must be attached to the application.

Common mistakes

-

Not providing complete information: Many individuals fail to fill out all required fields, which can lead to delays or rejection of the form.

-

Incorrectly identifying the property: Mislabeling or misdescribing the property being donated can cause confusion and complicate the donation process.

-

Not including a legal description: A proper legal description of the property is essential. Omitting this detail can render the donation invalid.

-

Failing to sign the form: A signature is crucial. Without it, the form cannot be processed, and the donation will not be recognized.

-

Not having witnesses: Louisiana law requires that the act of donation be witnessed. Skipping this step can invalidate the document.

-

Ignoring notary requirements: Some forms may need to be notarized. Failing to have a notary present can lead to legal complications.

-

Using outdated forms: Laws and requirements can change. Using an outdated version of the form may result in errors or omissions.

-

Not keeping copies: After submitting the form, individuals should retain a copy for their records. This can be important for future reference.

-

Overlooking tax implications: Donors should be aware of any potential tax consequences related to the donation. Ignoring this aspect can lead to unexpected liabilities.

-

Failing to consult a professional: Many people attempt to fill out the form without professional guidance. Consulting a lawyer or notary can help avoid costly mistakes.

Guide to Writing Louisiana act of donation

Once you have the Louisiana act of donation form in hand, it's important to complete it accurately to ensure that the donation is legally recognized. This process involves providing specific information about both the donor and the recipient, as well as details about the property being donated. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full name of the donor. Include any middle names or initials.

- Next, enter the donor's address, including the street, city, state, and zip code.

- Fill in the recipient's full name, ensuring it matches their legal identification.

- Input the recipient's address in the same format as the donor's.

- Describe the property being donated. Include details such as the type of property (real estate, personal items, etc.) and any identifying information like addresses or serial numbers.

- If applicable, indicate any conditions or restrictions related to the donation.

- Both the donor and the recipient should sign the form. Make sure to date the signatures.

- Consider having the document notarized to add an extra layer of authenticity.

After completing the form, review it for accuracy. Once everything is confirmed, you can proceed with the next steps of filing or recording the donation, depending on the nature of the property and local regulations.

Documents used along the form

The Louisiana Act of Donation form is a crucial document for transferring ownership of property without the exchange of money. However, several other forms and documents are often used in conjunction with this form to ensure a smooth transaction and proper legal standing. Below is a list of related documents that may be necessary or beneficial when executing an Act of Donation in Louisiana.

- Property Deed: This document officially transfers ownership of real estate from one party to another. It includes details about the property and the parties involved.

- Gift Tax Return: When a donation exceeds a certain value, the donor may need to file this form with the IRS to report the gift for tax purposes.

- Affidavit of Heirship: Used to establish the heirs of a deceased individual, this affidavit can clarify ownership rights before a donation is made.

- Power of Attorney: This document allows someone to act on behalf of another person in legal matters, including signing the Act of Donation if the donor is unable to do so.

- Title Search Report: Conducting a title search ensures that the property is free of liens or encumbrances, providing peace of mind to both the donor and the recipient.

- Living Will: While not directly related to property transfer, a living will outlines an individual's wishes regarding medical treatment and can be part of estate planning.

- Power of Attorney form: This legal document allows a principal to designate an agent for decision-making, crucial for addressing matters such as financial transactions and healthcare, making it essential to understand its implications, similar to Florida Forms.

- Last Will and Testament: This document specifies how a person's assets will be distributed upon their death, which can impact future donations.

- Gift Letter: A simple letter that states the intention of the donor to give a gift, often used to clarify the nature of the donation.

- Estate Planning Documents: These include various forms that help individuals plan for the distribution of their assets, ensuring that all legal requirements are met.

- Tax Assessment Notice: This document provides information on the assessed value of the property, which can be useful for both parties in understanding the value of the donation.

Using these documents in conjunction with the Louisiana Act of Donation form can help ensure that the transfer of property is legally sound and clearly understood by all parties involved. Proper documentation not only protects the interests of the donor and recipient but also facilitates a smoother transition of ownership.