Blank Articles of Incorporation Template for Michigan State

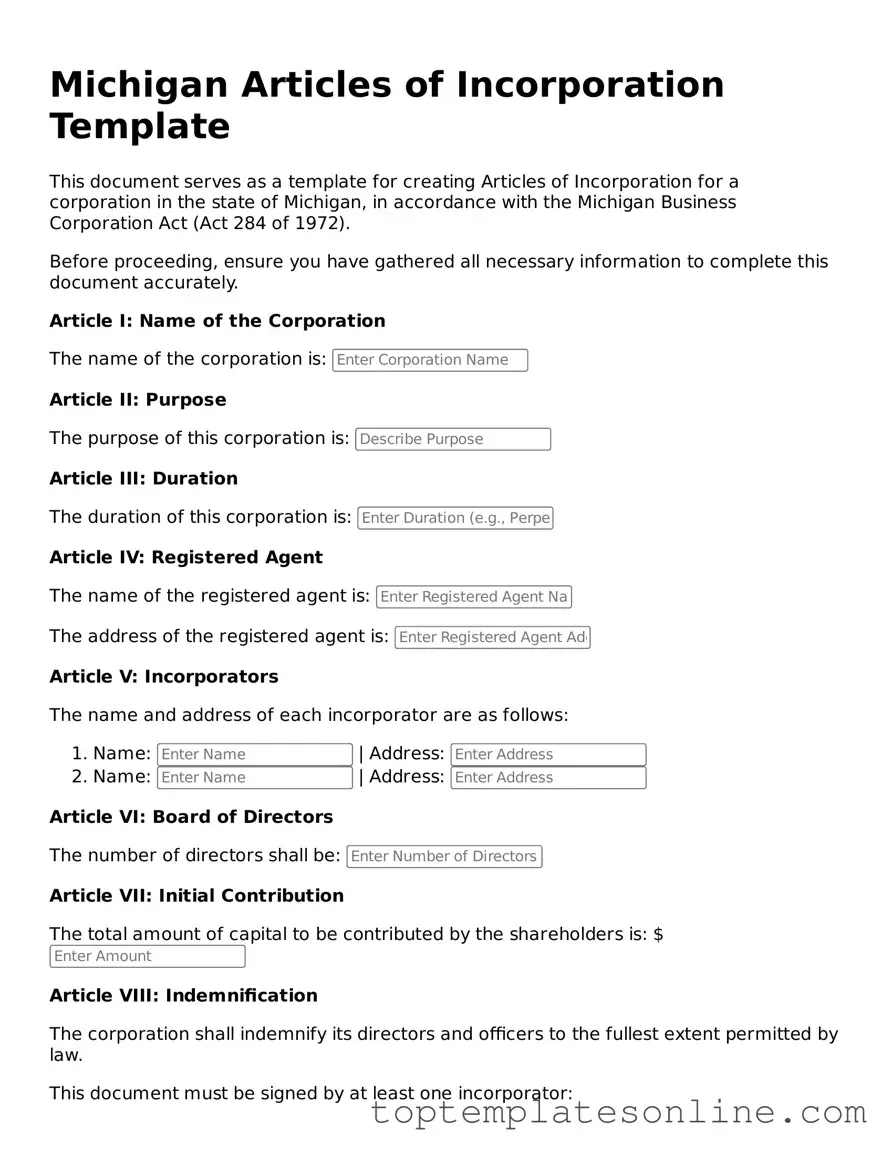

When starting a business in Michigan, one of the first and most crucial steps is filing the Articles of Incorporation. This form serves as the official document that establishes your corporation in the eyes of the state. It requires essential information, such as the corporation's name, the purpose of the business, and the registered agent's details. Additionally, the form outlines the number of shares the corporation is authorized to issue and the names and addresses of the initial directors. Completing this form accurately is vital, as it lays the groundwork for your corporation's legal structure and compliance. Ensuring that all required fields are filled out correctly can help avoid delays in processing and potential legal issues down the line. Understanding the significance of each section of the Articles of Incorporation will empower you to navigate this important step with confidence.

Some Other State-specific Articles of Incorporation Templates

Georgia Incorporation - Amending the Articles of Incorporation can be necessary for changes in structure or purpose.

When engaging in a vehicle transaction, it's important to utilize the appropriate documentation to facilitate a smooth ownership transfer. The California Motor Vehicle Bill of Sale form is a key document in this process, as it serves as an official record of the transfer and includes vital details such as the make, model, and identification number of the vehicle, along with the sale price and signatories' information. For those looking for a reliable template, the Automotive Bill of Sale is a valuable resource to ensure all necessary information is accurately captured.

Ohio Secretary of State Business Search Ohio - The form sets the stage for corporate governance procedures.

Document Retrieval Center - Details the initial board of directors or incorporators.

Common mistakes

-

Incorrect Business Name: Many people forget to check if their desired business name is already taken. The name must be unique and not too similar to existing businesses.

-

Missing Registered Agent Information: Failing to provide accurate information for the registered agent can lead to delays. This person or business must be available during business hours to receive legal documents.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly stated. Vague descriptions can cause confusion and may result in rejection of the application.

-

Improper Number of Directors: Some applicants do not specify the correct number of directors. Michigan law requires at least one director, but the number must also align with the corporation's structure.

-

Failure to Include Incorporator Information: The name and address of the incorporator must be included. Omitting this information can lead to complications during the filing process.

-

Not Signing the Form: One of the simplest mistakes is forgetting to sign the Articles of Incorporation. Without a signature, the form is considered incomplete.

Guide to Writing Michigan Articles of Incorporation

After completing the Michigan Articles of Incorporation form, you will be one step closer to establishing your business as a legal entity. The next phase involves submitting your form to the appropriate state office and paying the necessary fees. This process sets the foundation for your company’s operations and compliance with state regulations.

- Begin by visiting the Michigan Department of Licensing and Regulatory Affairs (LARA) website to access the Articles of Incorporation form.

- Choose the correct form based on your business structure (e.g., nonprofit, profit corporation).

- Provide the name of your corporation. Ensure it is unique and complies with Michigan naming requirements.

- Fill in the purpose of your corporation. This should clearly state what your business will do.

- Enter the address of the corporation’s registered office in Michigan. This is where official documents will be sent.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of your corporation.

- Indicate the number of shares the corporation is authorized to issue, if applicable.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Make sure that the person signing is authorized to do so.

- Review the completed form for accuracy and completeness before submission.

- Submit the form along with the required filing fee to the Michigan Department of Licensing and Regulatory Affairs.

Documents used along the form

When incorporating a business in Michigan, several documents may accompany the Articles of Incorporation. Each of these forms serves a specific purpose in the incorporation process and helps ensure compliance with state regulations. Below is a list of commonly used forms and documents.

- Bylaws: These are the internal rules that govern the management of the corporation. Bylaws outline the responsibilities of directors, officers, and shareholders.

- Initial Report: This document provides the state with information about the corporation's structure and operations shortly after incorporation.

- Employer Identification Number (EIN) Application: This form is required to obtain a unique tax identification number from the IRS, necessary for tax purposes and hiring employees.

- Non-disclosure Agreement: Protect your confidential information with a legal agreement. Consider using a Non-disclosure Agreement form to ensure all parties understand their obligations regarding sensitive data.

- Registered Agent Appointment: This document designates an individual or business entity to receive legal documents on behalf of the corporation.

- Operating Agreement: Although more common in LLCs, this document outlines the management structure and operating procedures for the business, ensuring clarity among members.

- Business License Application: Depending on the type of business, a local or state business license may be required to legally operate.

- State Tax Registration: This form registers the corporation with the Michigan Department of Treasury for state taxes, including sales tax and corporate income tax.

- Shareholder Agreements: This agreement outlines the rights and responsibilities of shareholders, including how shares can be transferred or sold.

- Annual Report: After incorporation, many states require an annual report that updates the state on the corporation's activities and confirms its existence.

Understanding these documents can help streamline the incorporation process in Michigan. Each form plays a vital role in establishing a solid foundation for a new business, ensuring compliance with legal requirements and protecting the interests of the owners.