Blank Deed Template for Michigan State

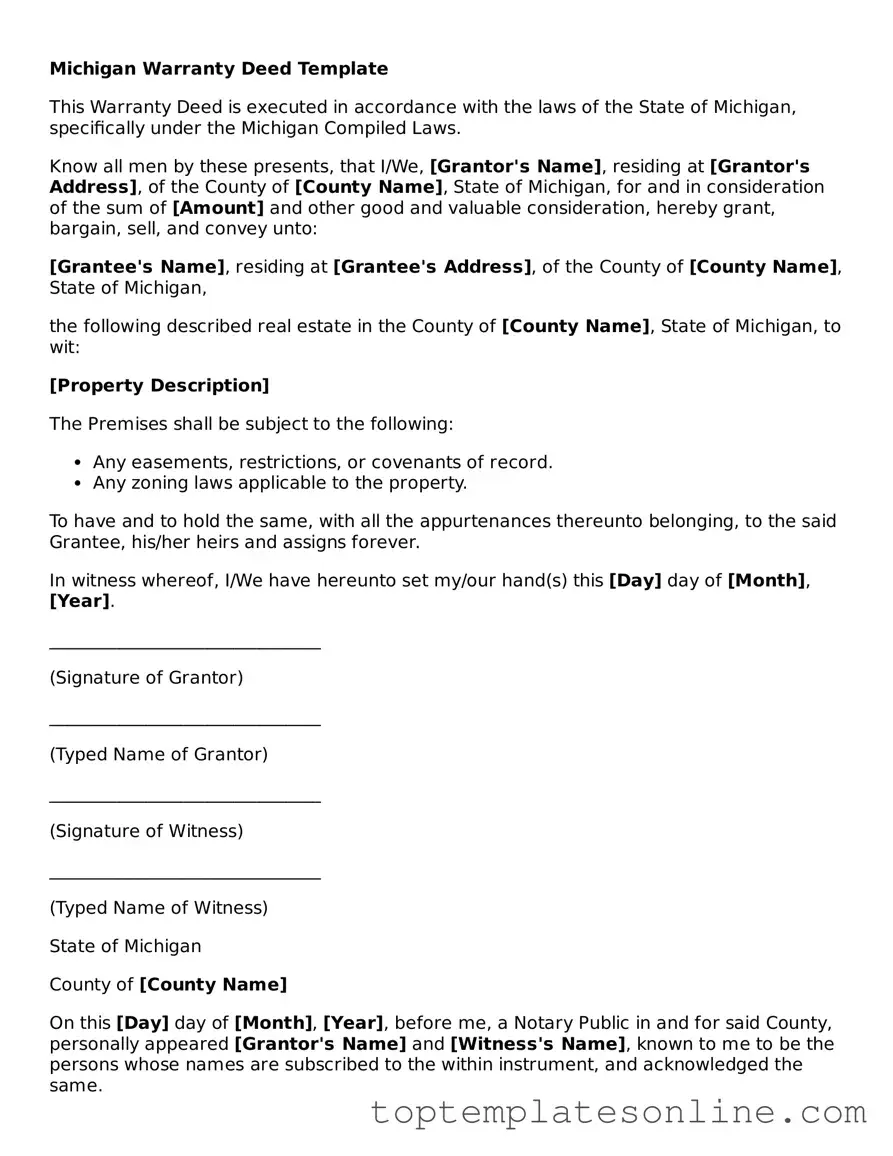

The Michigan Deed form is an essential legal document used in real estate transactions within the state. It serves to transfer ownership of property from one party to another, ensuring that the rights associated with the property are clearly conveyed. This form includes critical information such as the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), along with a detailed description of the property being transferred. Additionally, the form may specify any conditions or restrictions that apply to the transfer. It is important for both parties to understand the implications of the deed, as it can affect property rights and responsibilities. Properly executing this document requires attention to detail, including notarization and, in some cases, recording with the county register of deeds. Understanding the Michigan Deed form is vital for anyone involved in buying or selling real estate in Michigan, as it lays the groundwork for a clear and legal transfer of property ownership.

Some Other State-specific Deed Templates

Nj House Deed - Offers peace of mind for parties engaging in real estate transactions.

The Florida Operating Agreement form is a crucial document for limited liability companies (LLCs) in the state. This form outlines the management structure, responsibilities, and financial arrangements of the company, ensuring all members are on the same page. By clearly defining roles and expectations, it helps prevent misunderstandings and promotes smooth operations. For further details, you can refer to the Florida Forms.

Property Transfer Form - While a verbal agreement has no legal standing, a signed Deed is an official record.

New York Warranty Deed Form - Required for the legal recognition of property ownership changes.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion or disputes. Ensure that the legal description matches what is recorded in public records.

-

Omitting Signatures: All required parties must sign the deed. Missing signatures can invalidate the document. Ensure that all grantors and grantees have signed where necessary.

-

Improper Notarization: The deed must be notarized correctly. If the notary does not sign or stamp the document, it may not be accepted by the county clerk.

-

Incorrect Date: Failing to date the document or using an incorrect date can create legal issues. Ensure that the date reflects when the deed was executed.

-

Failure to Include Consideration: The deed should state the consideration, or payment, for the property. Omitting this information may raise questions about the transaction.

-

Not Checking Local Requirements: Different counties may have specific requirements for deeds. It is essential to check local regulations to ensure compliance with all necessary rules.

Guide to Writing Michigan Deed

After gathering the necessary information, you are ready to fill out the Michigan Deed form. Ensure that all details are accurate and complete to avoid delays in processing. Follow the steps carefully to ensure compliance with state requirements.

- Obtain a blank Michigan Deed form from a reliable source or your local county clerk's office.

- Fill in the names of the grantor(s) (the person(s) transferring the property) at the top of the form.

- Enter the names of the grantee(s) (the person(s) receiving the property) in the designated section.

- Provide the complete legal description of the property being transferred. This can usually be found in previous deeds or property tax records.

- Include the property address, including the city, county, and zip code.

- Specify the consideration amount (the value exchanged for the property) in the appropriate field.

- Sign the document in the presence of a notary public. Ensure that all grantors sign the form.

- Have the notary public complete their section by signing and sealing the document.

- Make copies of the completed and notarized deed for your records.

- Submit the original deed to the county clerk's office for recording. Check for any applicable fees.

Documents used along the form

When dealing with property transactions in Michigan, several documents often accompany the Michigan Deed form. Each of these documents serves a specific purpose and plays a crucial role in ensuring that the transfer of property rights is clear and legally binding. Below is a list of common forms and documents that you may encounter alongside the Michigan Deed form.

- Property Transfer Affidavit: This document provides information about the property being transferred, including its value and any improvements made. It is typically filed with the local tax assessor's office to ensure accurate property tax assessments.

- Title Insurance Policy: A title insurance policy protects the buyer and lender from potential issues related to the property's title. It covers any legal claims or disputes that may arise after the purchase.

- Closing Statement: Also known as a settlement statement, this document outlines all financial transactions that occurred during the closing process. It details the costs associated with the sale, including fees and adjustments.

- Access-A-Ride NYC Application: To provide individuals with transportation assistance, especially those eligible for the program, utilizing resources like NY Templates can simplify the application process and ensure all required information is included.

- Affidavit of Identity: This affidavit confirms the identity of the parties involved in the transaction. It helps to prevent fraud and ensures that the individuals signing the documents are who they claim to be.

- Power of Attorney: In some cases, a party may grant another individual the authority to act on their behalf during the property transfer. This document outlines the specific powers given and is essential for facilitating the transaction when one party cannot be present.

- Warranty Deed: A warranty deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. It offers the highest level of protection to the buyer.

- Quitclaim Deed: This type of deed transfers any interest the seller may have in the property without making any guarantees about the title. It is often used between family members or in situations where the seller is unsure of their ownership status.

- Lease Agreement: If the property is being rented out, a lease agreement outlines the terms and conditions of the rental arrangement between the landlord and tenant.

- Disclosure Statement: Sellers are often required to provide a disclosure statement that details any known issues with the property, such as structural problems or environmental hazards. This transparency helps buyers make informed decisions.

Understanding these documents can help streamline the property transfer process and ensure that all parties are well-informed. Each document has its own significance, and together they create a comprehensive framework for a successful real estate transaction in Michigan.